PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876625

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876625

Automotive Image Signal Processor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

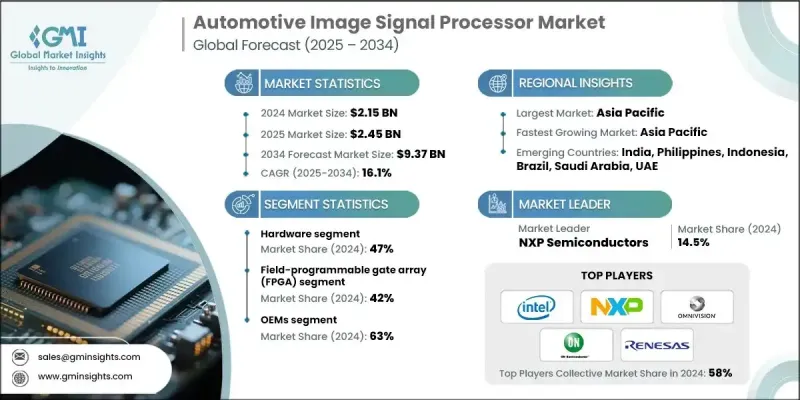

The Global Automotive Image Signal Processor Market was valued at USD 2.15 billion in 2024 and is estimated to grow at a CAGR of 16.1% to reach USD 9.37 billion by 2034.

The rising use of intelligent imaging technologies in modern vehicles is transforming the landscape of automotive ISPs. Advanced ISPs now enable real-time image processing from multiple cameras, supporting key functions such as object detection, lane tracking, and 360-degree view systems. These processors deliver ultra-low latency, high dynamic range, and dependable performance even in challenging lighting and weather conditions, fostering safer and more energy-efficient vehicle operations. The ongoing evolution toward automated and software-defined vehicle architectures is strengthening the integration of high-performance ISPs. Strategic collaborations between semiconductor manufacturers, automakers, and AI software companies are also advancing AI-driven image processing for enhanced driver-assistance and perception systems. Partnerships with chipmakers and camera module suppliers are optimizing thermal management, image quality, and system integration in centralized electronic designs, helping automakers improve safety, comfort, and autonomy levels. As vehicles transition toward intelligent mobility ecosystems, ISPs are becoming critical components in next-generation ADAS and autonomous driving platforms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.15 Billion |

| Forecast Value | $9.37 Billion |

| CAGR | 16.1% |

The field-programmable gate array (FPGA) segment held a 42% share in 2024 and is anticipated to grow at a CAGR of 14.9% through 2034. FPGA-based processors dominate the automotive ISP market due to their reconfigurable architecture, scalability, and superior parallel computing performance. They enable vehicle manufacturers to integrate advanced image-processing algorithms for applications such as driver monitoring, object detection, and lane-keeping without extensive hardware redesign. Their adaptability to changing camera and perception requirements also reduces time-to-market, making them essential for next-generation ADAS and autonomous vehicle development.

In 2024, the OEMs segment held a 63% share. Original equipment manufacturers are the leading adopters of automotive ISPs because they directly integrate these processors into new vehicle models during production. This ensures that imaging systems perform optimally, meet safety regulations, and deliver reliable operation. The preference for factory-installed ISPs is increasing as automakers deploy high-resolution cameras, sensor-fusion technologies, and real-time image analysis to enhance ADAS capabilities and improve driver safety. The growing use of multi-camera configurations and advanced perception features further supports ISP adoption among global OEMs.

China Automotive Image Signal Processor Market held a 39% share in 2024, generating USD 324.9 million. The country maintains a dominant position in the region due to its strong automotive electronics and semiconductor manufacturing ecosystem. Rapid implementation of ADAS and semi-autonomous technologies by major domestic automakers has fueled significant demand for ISPs. Supportive government programs encouraging innovation in smart vehicles and chip design are further accelerating market growth. China's commitment to advancing local semiconductor production and intelligent mobility solutions continues to reinforce its leadership in the automotive ISP space.

Key industry participants in the Global Automotive Image Signal Processor Market include Texas Instruments, ON Semiconductor, Renesas Electronics, Analog Devices, STMicroelectronics, Arm Limited, NXP Semiconductors, Microchip Technology, Intel (Mobileye), and OmniVision Technologies. Leading players in the Automotive Image Signal Processor Market are adopting multi-faceted strategies to strengthen their competitive positioning. Many are focusing on integrating AI-driven imaging capabilities, edge processing, and real-time computer vision enhancements into their ISP architectures. Companies are forming partnerships with automakers and software firms to co-develop customized ISP platforms optimized for ADAS, autonomous driving, and in-cabin monitoring. R&D investments are being directed toward low-power designs, advanced thermal solutions, and enhanced camera synchronization to support multi-sensor fusion.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Type

- 2.2.4 Technology

- 2.2.5 End Use

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Surge in ADAS and autonomous vehicle development

- 3.2.1.2 Expansion of high-resolution automotive cameras

- 3.2.1.3 Rise in vehicle safety regulations

- 3.2.1.4 Growing EV adoption and smart cockpit features

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and integration costs

- 3.2.2.2 Complexity in software and sensor calibration

- 3.2.3 Market opportunities

- 3.2.3.1 Emergence of software-defined vehicles

- 3.2.3.2 Growth in fleet and commercial vehicle analytics

- 3.2.3.3 Adoption in two-wheelers and entry-level vehicles

- 3.2.3.4 Collaborations between OEMs and semiconductor firms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By component

- 3.10 Cost breakdown analysis

- 3.11 Business Case & ROI Analysis

- 3.11.1 Total cost of ownership framework

- 3.11.2 ROI calculation methodologies

- 3.11.3 Implementation timeline & milestones

- 3.11.4 Risk assessment & mitigation strategies

- 3.12 Sustainability and environmental impact analysis

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

- 3.14 Future outlook & opportunities

- 3.14.1 Technology evolution & next-generation ISP architectures

- 3.14.2 AI & machine learning integration trends

- 3.14.3 Edge computing & distributed processing models

3.14.4. 5G connectivity & vehicle-to-everything (V2X) integration

- 3.14.5 Sustainability & environmental impact considerations

- 3.14.6 Regulatory evolution & global harmonization trends

- 3.14.7 Market consolidation & industry structure changes

- 3.14.8 Emerging applications & use case development

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LAMEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Analog Front-End

- 5.2.2 Image Sensor

- 5.2.3 Signal Processing Core

- 5.2.4 Memory

- 5.2.5 Output Interface

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 ADAS Systems

- 6.3 Autonomous Vehicles

- 6.4 Parking Assistance / Rear-View / Surround View

- 6.5 Night Vision Systems

- 6.6 Driver Monitoring Systems

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Digital signal processing (DSP)

- 7.3 Field-programmable gate array (FPGA)

- 7.4 Application-specific integrated circuits (ASIC)

Chapter 8 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Standalone image signal processors

- 8.3 Integrated image signal processors

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Philippines

- 10.4.7 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 ARM

- 11.1.2 Broadcom

- 11.1.3 Cirrus Logic

- 11.1.4 Fujitsu

- 11.1.5 Infineon Technologies

- 11.1.6 Intel (Mobileye)

- 11.1.7 Microchip Technology

- 11.1.8 Nikon

- 11.1.9 NVIDIA

- 11.1.10 NXP Semiconductors

- 11.1.11 Olympus

- 11.1.12 OmniVision Technologies

- 11.1.13 Qualcomm Technologies

- 11.1.14 Renesas Electronics

- 11.1.15 Sony Semiconductor Solutions

- 11.1.16 STMicroelectronics

- 11.1.17 Texas Instruments

- 11.1.18 ON Semiconductor

- 11.1.19 Analog Devices

- 11.2 Regional Players

- 11.2.1 Allwinner Technology

- 11.2.2 Amlogic

- 11.2.3 HiSilicon Technologies

- 11.2.4 MediaTek

- 11.2.5 Rockchip Electronics

- 11.3 Emerging Players

11.3.1. 10xEngineers

- 11.3.2 Cadence Design Systems

- 11.3.3 e-con Systems

- 11.3.4 Image Quality Labs

- 11.3.5 Indie Semiconductor

- 11.3.6 Innodisk

- 11.3.7 Lattice Semiconductor

- 11.3.8 Leopard Imaging