PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876627

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876627

Electric Vehicle Charging Load Management System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

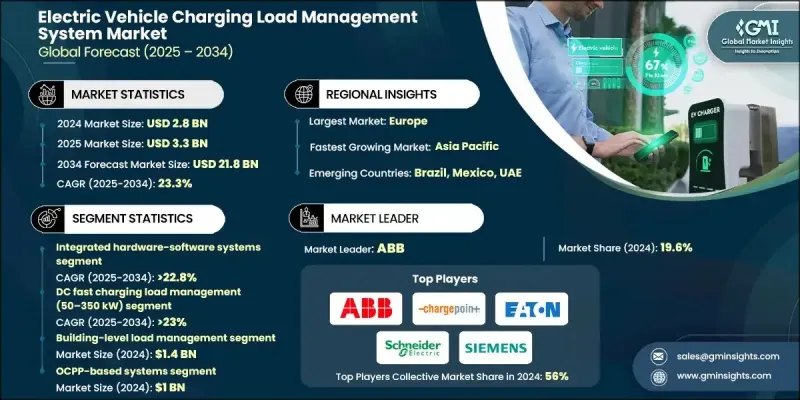

The Global Electric Vehicle Charging Load Management System Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 23.3% to reach USD 21.8 billion by 2034.

The market's growth is propelled by the rapid rise of electric vehicle adoption, expanding EV fleets, and the increasing requirement for intelligent energy management solutions. As charging infrastructure, grid connectivity, and energy storage systems advance, stakeholders are focusing on maximizing operational efficiency, integrating smart grid solutions, and optimizing load distribution to ensure reliable and cost-effective charging networks. The sector is moving toward connected, automated, and data-driven operations, transforming conventional approaches to energy management and redefining how charging networks are monitored and maintained. Rising investments in digital platforms, predictive energy scheduling, and AI-enabled control systems are creating opportunities for more scalable, resilient, and efficient EV charging ecosystems. The increasing deployment of IoT-connected charging stations, AI-based load balancing solutions, and cloud-enabled energy management platforms is reshaping the industry. These technologies facilitate real-time monitoring of grid demand, predictive load allocation, and seamless coordination between utilities, charging operators, and fleet managers. By leveraging smart meters, telematics, and AI analytics, operators can enhance energy efficiency, reduce peak load stress, and lower operational costs, enabling a smarter, more resilient charging network.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $21.8 Billion |

| CAGR | 23.3% |

The integrated hardware-software systems segment accounted for 37% share in 2024 and is expected to grow at a CAGR of 22.8% from 2025 to 2034. This segment is central to ensuring optimal EV charging, grid reliability, and energy efficiency by combining smart chargers, dynamic load controllers, energy storage interfaces, and communication modules into unified platforms. The rising complexity of high-voltage charging networks has increased demand for AI-driven control algorithms, advanced monitoring, and skilled operators to manage precise energy distribution.

The DC fast charging load management segment (50-350 kW) held 36% share in 2024 and is forecasted to grow at a CAGR of 23% through 2034. Growth in this segment is fueled by the deployment of high-capacity chargers, the need for reduced EV charging times, and the demand for grid-optimized, smart load balancing solutions. Operators are investing heavily in AI-powered load optimization, predictive scheduling, real-time monitoring, and cloud management platforms to enhance charger utilization, ease peak demand pressure, and improve operational efficiency.

Germany Electric Vehicle Charging Load Management System Market generated USD 287.8 million and held a 31% share in 2024. The country benefits from strong industrial capabilities, leadership in smart grid adoption, and advanced high-power charging technologies. Trends in Germany include AI-based load balancing, real-time fast charger monitoring, predictive energy management, and vehicle-to-grid (V2G) integration across commercial, public, and fleet charging networks.

Key players in the Electric Vehicle Charging Load Management System Market include Wallbox N.V., Enel X, ABB, EV Connect, Eaton Corporation, Tesla, Schneider Electric SE, ChargePoint Holdings, Siemens AG, and Shell Recharge Solutions. Companies in the Electric Vehicle Charging Load Management System Market are focusing on technological innovation, strategic partnerships, and geographic expansion to strengthen their market presence. They invest in R&D to develop AI-driven, cloud-based, and IoT-enabled solutions that optimize energy use and load distribution. Collaborations with utilities, fleet operators, and government programs allow faster market penetration and compliance with evolving regulations. Firms are expanding infrastructure and service networks to improve accessibility and operational efficiency. Mergers, acquisitions, and alliances help diversify product portfolios, enhance technological capabilities, and consolidate market share.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology Architecture

- 2.2.3 Power Management Level

- 2.2.4 Communication Protocol

- 2.2.5 Power Rating

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising EV adoption & fleet expansion

- 3.2.1.2 Advanced charging infrastructure

- 3.2.1.3 IoT & AI integration

- 3.2.1.4 Grid reliability & energy efficiency

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High infrastructure investment

- 3.2.2.2 Complexity of integration

- 3.2.3 Market opportunities

- 3.2.3.1 Predictive & remote management services

- 3.2.3.2 Sustainability & circular economy initiatives

- 3.2.3.3 Software-driven and AI-enabled solutions

- 3.2.3.4 Public-private infrastructure expansion

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Government policies promoting EV adoption

- 3.4.2 Grid codes and energy management standards

- 3.4.3 Emission reduction and sustainability regulations

- 3.4.4 Safety and high-voltage system compliance

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 AI-powered load optimization

- 3.7.2 IoT-enabled monitoring and connectivity

- 3.7.3 Cloud-integrated management platforms

- 3.7.4 Standards-based communication protocols

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Best case scenarios

- 3.14 Future Outlook & Strategic Recommendations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Technology Architecture, 2021 - 2034 ($ Bn)

- 5.1 Key trends

- 5.2 Integrated hardware-software system

- 5.3 Hardware-based load management system

- 5.4 Software-based load management system

Chapter 6 Market Estimates & Forecast, By Power Management Level, 2021 - 2034 ($ Bn)

- 6.1 Key trends

- 6.2 Building-level load management

- 6.3 Panel-level load management

- 6.4 Circuit-level load management

- 6.5 Grid-level load management

Chapter 7 Market Estimates & Forecast, By Communication Protocol, 2021 - 2034 ($ Bn)

- 7.1 Key trends

- 7.2 OCPP-based system

- 7.3 ISO 15118-based system

- 7.4 Proprietary protocol system

- 7.5 IEEE 2030.5-based system

Chapter 8 Market Estimates & Forecast, By Power Rating, 2021 - 2034 ($ Bn)

- 8.1 Key trends

- 8.2 DC fast charging load management (50-350 kW)

- 8.3 Level 2 ac load management (3.3-22 kW)

- 8.4 Level 1 ac load management (≤1.9 kW)

- 8.5 Megawatt charging system load management (>1 MW)

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($ Bn)

- 9.1 Key trends

- 9.2 Public charging

- 9.3 Fleet charging

- 9.4 Residential charging

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Belgium

- 10.3.7 Netherlands

- 10.3.8 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 Singapore

- 10.4.6 South Korea

- 10.4.7 Vietnam

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Global Player

- 11.1.1 ABB

- 11.1.2 BP Pulse

- 11.1.3 ChargePoint Holdings

- 11.1.4 Eaton Corporation

- 11.1.5 Schneider Electric SE

- 11.1.6 Shell Recharge Solutions

- 11.1.7 Siemens AG

- 11.1.8 Tesla

- 11.2 Regional Player

- 11.2.1 Allego N.V.

- 11.2.2 EV Connect

- 11.2.3 EVBox (ENGIE)

- 11.2.4 Gridserve Holdings

- 11.2.5 gridX GmbH

- 11.2.6 InstaVolt Limited

- 11.2.7 SWTCH Energy

- 11.2.8 Virta

- 11.2.9 Wallbox

- 11.3 Emerging Players

- 11.3.1 Ampcontrol Pty

- 11.3.2 Bolt.Earth

- 11.3.3 CyberSwitching

- 11.3.4 Enphase Energy

- 11.3.5 Wevo Energy