PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876628

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876628

Packaging Equipment for Agricultural Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

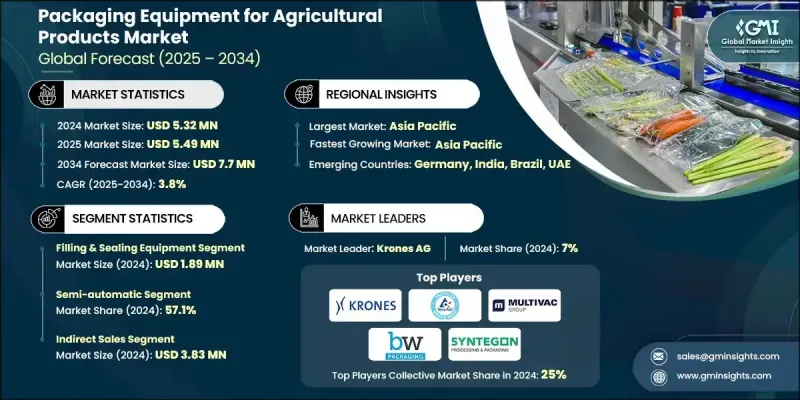

The Global Packaging Equipment for Agricultural Products Market was valued at USD 5.32 million in 2024 and is estimated to grow at a CAGR of 3.8% to reach USD 7.7 million by 2034.

The market's expansion is driven by the increasing adoption of automated packaging systems that enhance operational efficiency, accuracy, and productivity. Automated equipment simplifies processes such as filling, sealing, and labeling, helping producers reduce dependence on manual labor, minimize human error, and accelerate throughput for large-scale agricultural operations. The integration of smart packaging technologies, including features that enable real-time tracking and data collection, is adding significant value. These technologies enhance traceability, support food safety compliance, and optimize inventory management for exporters and suppliers dealing with premium agricultural goods. Rising consumer expectations for quality assurance and transparency are also fueling the adoption of automated and intelligent packaging solutions. As food safety regulations continue to tighten globally, producers are increasingly investing in machinery that offers digital monitoring and predictive maintenance capabilities. This shift enables greater operational reliability, improves data-driven decision-making, and reduces packaging waste. Companies developing modular and IoT-enabled packaging systems are well-positioned to gain a competitive edge in this evolving industry landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.32 Million |

| Forecast Value | $7.7 Million |

| CAGR | 3.8% |

In 2024, the semi-automatic packaging machines segment held a 57.1% share. Semi-automatic systems remain a preferred choice among small and medium agricultural producers due to their affordability and flexibility. These configurations strike a balance between manual and fully automated operations, helping businesses reduce labor costs while maintaining adaptability in production. They allow producers to expand output capacity without requiring major capital investment, offering a cost-efficient approach for scaling production.

The indirect sales channels generated USD 3.83 million in 2024, capturing a substantial portion of the market. Indirect sales models enable manufacturers to collaborate with regional distributors and dealers, making it easier to reach markets that are challenging to access directly. This approach is especially valuable in emerging regions where established distributor networks provide better market penetration and understanding of local agricultural practices. Such distribution partnerships allow companies to grow their customer base efficiently without building independent sales infrastructures.

United States Packaging Equipment for Agricultural Products Market held a 78.2% share and generated USD 0.89 million in 2024. The U.S. market demonstrates high sophistication due to advanced agricultural operations and supportive government regulations promoting sustainability and food safety. Automation is widely implemented across the industry, with farms and processing facilities investing heavily in advanced filling, sealing, and palletizing equipment to meet growing demand for speed, consistency, and compliance.

Key players in the Global Packaging Equipment for Agricultural Products Market include BW Packaging, Combi Packaging Systems, Concetti Group, General Packer, Haver & Boecker, IMA Group, Krones AG, Landpack, MULTIVAC Group, Paglierani, Premier Tech Systems & Automation, STATEC BINDER, Syntegon Technology, Tetra Pak, and WOLF Packaging. Leading companies in the Packaging Equipment for Agricultural Products Market are focusing on several strategic initiatives to strengthen their market position. Many are prioritizing product innovation by developing modular, IoT-enabled, and energy-efficient systems to cater to the growing demand for smart and automated packaging solutions. Partnerships with local distributors and regional dealers are being expanded to enhance market reach and customer accessibility, especially in emerging economies. Firms are also investing in digital monitoring capabilities and predictive maintenance features to boost operational reliability and reduce downtime.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment type

- 2.2.3 Operation

- 2.2.4 Application

- 2.2.5 End Use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Automation & smart packaging integration

- 3.2.1.2 Diversification into agrochemicals & specialty products

- 3.2.1.3 Sustainability-driven equipment demand

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital costs & ROI pressure

- 3.2.2.2 Supply chain volatility

- 3.2.3 Opportunities

- 3.2.3.1 Smart packaging equipment

- 3.2.3.2 Eco-friendly packaging lines

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By equipment type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Equipment Type, 2021 - 2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Filling & sealing equipment

- 5.2.1 Vertical form-fill-seal (VFFS)

- 5.2.2 Horizontal form-fill-seal (HFFS) systems

- 5.2.3 Others

- 5.3 Sorting & grading equipment

- 5.4 Bagging & packaging lines

- 5.5 Weighing and portioning systems

- 5.6 Palletizing and wrapping equipment

Chapter 6 Market Estimates and Forecast, By Operation, 2021 - 2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automatic

- 6.4 Automatic

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Fresh produce packaging

- 7.3 Grain & seed processing

- 7.4 Animal feed & agricultural inputs

- 7.5 Others (eggs, dairy pack, etc.)

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Primary agricultural producers

- 8.3 Agro & food processing facilities

- 8.4 Others (agricultural cooperatives & associations, farmer-owned processing facilities, etc.)

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 BW Packaging

- 11.2 Combi Packaging Systems

- 11.3 Concetti Group

- 11.4 General Packer

- 11.5 Haver & Boecker

- 11.6 IMA Group

- 11.7 Krones AG

- 11.8 Landpack

- 11.9 MULTIVAC Group

- 11.10 Paglierani

- 11.11 Premier Tech Systems & Automation

- 11.12 STATEC BINDER

- 11.13 Syntegon Technology

- 11.14 Tetra Pak

- 11.15 WOLF Packaging