PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876629

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876629

North America Press Brake and Shears Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

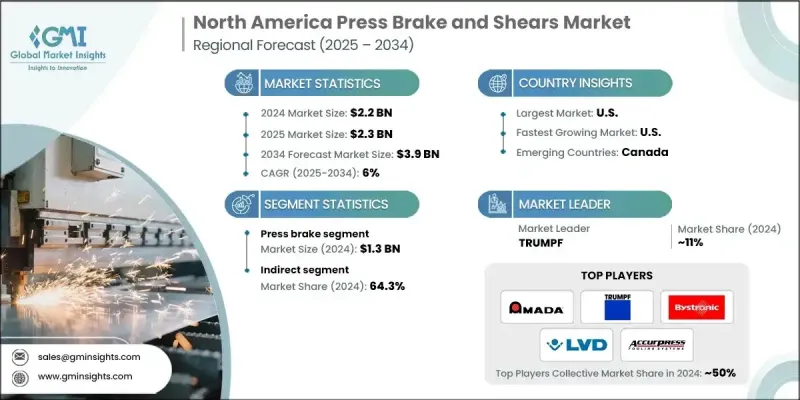

North America Press Brake and Shears Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 3.9 billion by 2034.

This market is witnessing expansion as demand for precision metal fabrication continues to rise across key industrial sectors, including electronics, automotive, and aerospace. Press brakes and shears serve as essential machinery for shaping and cutting metal components used in large-scale infrastructure, transportation, and construction projects. The ongoing boom in urban development, along with renovation and modernization efforts, is boosting the need for efficient, scalable, and high-precision metalworking systems. Moreover, the growing integration of automation and Industry 4.0 technologies is transforming the regional landscape. Smart CNC systems and IoT-enabled machines equipped with advanced sensors are enhancing productivity, minimizing downtime, and providing real-time data visibility. The move toward digital manufacturing supports greater customization and operational flexibility while improving overall manufacturing efficiency. With competitiveness becoming more technology-driven, manufacturers are increasingly investing in intelligent and automated systems to improve precision, reduce human error, and accelerate production. The market's ongoing evolution is primarily being fueled by advancements in CNC machinery, automation solutions, and digital connectivity that continue to reshape North America's metal fabrication ecosystem.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $3.9 Billion |

| CAGR | 6% |

The press brakes segment generated USD 1.3 billion in 2024 and is expected to grow at a CAGR of 6% between 2025 and 2034. These machines are critical in bending and forming metal sheets into complex and high-precision shapes, making them vital for applications in construction, aerospace, renewable energy, and automotive manufacturing. The demand for lightweight, durable, and intricately shaped components is accelerating, particularly with the rise of advanced industrial applications. Press brakes provide the precision, versatility, and efficiency needed to meet evolving industry standards and design requirements while supporting the move toward sustainable manufacturing practices.

The indirect distribution segment held a 64.3% share and is anticipated to grow at a CAGR of 5.8% through 2034. The preference for indirect distribution stems from its ability to offer wider market penetration, cost advantages, and strong after-sales support. Distributors, dealers, and digital platforms help manufacturers reach regional markets more effectively, particularly among small and medium-sized enterprises (SMEs) that lack direct access to OEM networks. These partners often bundle additional services such as installation, operator training, financing, and technical support, creating value-added solutions that enhance customer satisfaction and promote long-term business relationships.

United States Press Brake and Shears Market generated USD 1.47 billion in 2024 and is expected to grow at a CAGR of 5.4% from 2025 to 2034. The U.S. benefits from a highly advanced manufacturing infrastructure supported by strong investments in automation, robotics, and CNC systems. This enables the adoption of cutting-edge press brake technologies featuring IoT integration, predictive maintenance, and real-time operational analytics. American producers employ these solutions extensively in high-value manufacturing sectors where precision, repeatability, and speed are essential. These technological advancements help reduce labor dependency, minimize material waste, and improve production efficiency, keeping the U.S. market at the forefront of industrial innovation.

Major companies operating in the North America Press Brake and Shears Market include TRUMPF, Cincinnati Incorporated, Accurl, Yawei, AMADA, Prima Power, Baykal, YANGLI, Salvagnini, LVD, Accurpress, Durma, Pacific Machine Tool, Bystronic, and Haco. Leading manufacturers in the North America Press Brake and Shears Market are employing multiple strategies to strengthen their market position. A major focus is on technological innovation, with companies integrating IoT, CNC automation, and AI-based systems to enhance precision and performance. Firms are also expanding their production capabilities and establishing regional partnerships with distributors and service providers to improve market reach and customer access. Strategic collaborations, mergers, and acquisitions are being leveraged to enhance product portfolios and develop advanced solutions that meet evolving industrial requirements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Product

- 2.2.3 Capacity

- 2.2.4 Application

- 2.2.5 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for precision metal fabrication

- 3.2.1.2 Infrastructure and construction boom

- 3.2.1.3 Automation and industry 4.0 integration

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Maintenance and operational costs

- 3.2.2.2 Competition from alternative technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 North America

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Country

- 4.2.1.1 U.S.

- 4.2.1.2 Canada

- 4.2.1 By Country

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Press brake

- 5.2.1 Hydraulic

- 5.2.2 Servo-electric

- 5.2.3 Mechanical press brakes

- 5.3 Shears

- 5.3.1 Guillotine shears

- 5.3.2 Power shears

- 5.3.3 Plate shears

- 5.3.4 Swing beam shears

Chapter 6 Market Estimates & Forecast, By Capacity, 2021 - 2034, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Press brake

- 6.2.1 Light duty press brakes (<100T)

- 6.2.2 Medium duty press brakes (100-300T)

- 6.2.3 Heavy duty press brakes (300T+)

- 6.3 Shears

- 6.3.1 Light duty shears market (<1/4" Capacity)

- 6.3.2 Medium duty shears market (1/4"-1/2" Capacity)

- 6.3.3 Heavy duty shears market (>1/2" Capacity)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Aerospace

- 7.4 Building and construction

- 7.5 Electric and electronics

- 7.6 Industrial machinery

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Country, 2021 - 2034, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 U.S.

- 9.3 Canada

Chapter 10 Company Profiles

- 10.1 Accurl

- 10.2 Accurpress

- 10.3 AMADA

- 10.4 Baykal

- 10.5 Bystronic

- 10.6 Cincinnati Incorporated

- 10.7 Durma

- 10.8 Haco

- 10.9 LVD

- 10.10 Pacific Machine Tool

- 10.11 Prima Power

- 10.12 Salvagnini

- 10.13 TRUMPF

- 10.14 YANGLI

- 10.15 Yawei