PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876633

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876633

Specialty Chemicals Recycling Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

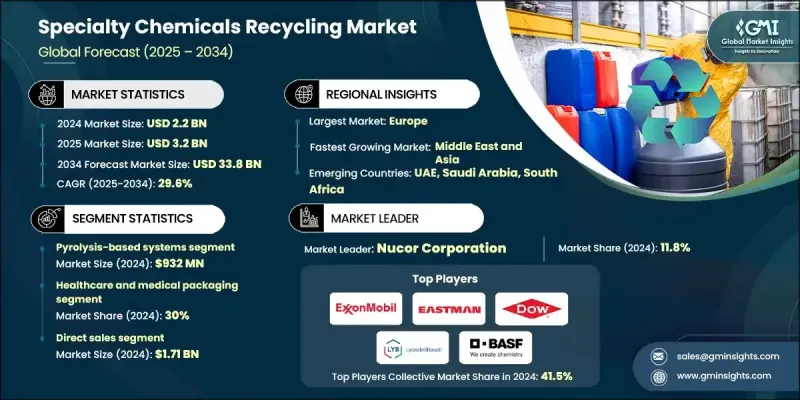

The Global Specialty Chemicals Recycling Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 29.6% to reach USD 33.8 billion by 2034.

The market is gaining traction as industries increasingly focus on recovering valuable materials such as solvents, catalysts, pigments, and other specialty chemical by-products that would otherwise become waste. Recycling these materials into reusable feedstocks or intermediate chemicals significantly reduces raw material consumption and manufacturing costs while promoting environmental sustainability and circular economy goals. Technological advancements are transforming the recycling landscape through innovations in distillation, membrane separation, depolymerization, and purification methods, enabling greater efficiency and purity in recovered materials. Automation, digital monitoring, and process optimization software are further improving consistency, reducing energy usage, and enhancing cost-effectiveness. These factors make specialty chemical recycling a more commercially viable and environmentally responsible solution across industries, including pharmaceuticals, water treatment, adhesives, coatings, and electronics. Developed economies are taking the lead with stringent sustainability regulations, while emerging markets are steadily adopting these recycling systems to minimize waste, lower production costs, and meet environmental targets. The shift toward closed-loop production systems is positioning specialty chemical recycling as a key enabler of global industrial sustainability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $33.8 Billion |

| CAGR | 29.6% |

The pyrolysis-based systems generated USD 932 million in 2024. These systems are leading the market due to their capability to process complex and contaminated waste streams that conventional recycling methods cannot manage. Pyrolysis technology converts mixed chemical materials into reusable feedstocks, supporting industries striving for circular production models and material recovery efficiency. Depolymerization technologies closely follow, offering the advantage of recovering high-purity monomers that can be used to manufacture recycled materials with identical performance to their virgin counterparts. The rising focus on sustainable raw materials and the drive to reduce dependency on fossil-based inputs are key factors encouraging the widespread adoption of both pyrolysis and depolymerization processes across multiple industrial sectors.

The healthcare and medical packaging segment held a 30% share in 2024. This segment's growth is fueled by increasing demand for sterile, durable, and easy-to-handle packaging solutions for pharmaceuticals, medical devices, and disposable products. The expanding aging population, along with rising healthcare expenditure and stricter hygiene regulations, has strengthened the need for advanced recyclable packaging materials in the healthcare ecosystem. The automotive sector is also witnessing significant progress due to technological evolution in electric and autonomous vehicles, which require innovative and sustainable packaging and chemical solutions for intricate electronic and sensor systems.

U.S. Specialty Chemicals Recycling Market accounted for USD 569.4 million in 2024. In North America, the specialty chemicals recycling industry continues to expand due to strong demand from the construction and automotive sectors. In the U.S., the rapid adoption of electric vehicles and energy-efficient building practices is increasing the need for recycled materials such as steel and aluminum. Canada is advancing in metal and chemical recovery from both industrial and obsolete waste, driven by its national commitment to sustainability and circular economy practices. Together, these factors are propelling the region's transition toward resource-efficient manufacturing and sustainable industrial operations.

Prominent players active in the Global Specialty Chemicals Recycling Market include Covestro, Chevron Phillips Chemical, BASF SE, Eastman Chemical, Dow Inc., DSM-Firmenich, Arkema, Evonik Industries, ExxonMobil, LyondellBasell, Jiangsu Eastern Shenghong, Indorama Ventures, PETRONAS Chemical Group, Mitsubishi Chemical, and SABIC. Leading companies in the Specialty Chemicals Recycling Market are focusing on innovation, collaboration, and capacity expansion to strengthen their market foothold. Many are investing in advanced recycling technologies such as pyrolysis, depolymerization, and solvent recovery to enhance process efficiency and material quality. Strategic alliances and joint ventures with industrial manufacturers and research organizations are being formed to accelerate the commercialization of high-purity recycled chemicals. Firms are also adopting digitalization and automation to optimize recycling operations, reduce costs, and improve traceability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Technology type

- 2.2.2 Application

- 2.2.3 Distribution channel

- 2.2.4 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising raw material costs

- 3.2.1.2 Technological advancements in recycling processes

- 3.2.1.3 Growing demand from End use industries

- 3.2.1 Growth drivers

- 3.3 Industry pitfalls and challenges

- 3.3.1 High initial investment

- 3.3.2 Fluctuating market demand for recycled chemicals

- 3.4 Market opportunities

- 3.4.1 Development of advanced recycling technologies

- 3.4.2 Digital platforms for chemical waste trading

- 3.4.3 Product innovation using recycled chemicals

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 Middle East & Africa

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By technology type

- 3.11 Future market trends

- 3.12 Technology and innovation landscape

- 3.12.1 Current technological trends

- 3.12.2 Emerging technologies

- 3.13 Patent landscape

- 3.14 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.14.1 Major importing countries

- 3.14.2 Major exporting countries

- 3.15 Sustainability and environmental aspects

- 3.15.1 Sustainable practices

- 3.15.2 Waste reduction strategies

- 3.15.3 Energy efficiency in production

- 3.15.4 Eco-friendly initiatives

- 3.16 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Technology Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Pyrolysis-based systems

- 5.3 Depolymerization technologies

- 5.4 Dissolution and purification

- 5.5 Gasification and thermal processing

- 5.6 Emerging and hybrid technologies

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Healthcare and medical packaging

- 6.3 Automotive applications

- 6.4 Electronics and semiconductors

- 6.5 Packaging industries

- 6.6 Construction and building materials

- 6.7 Other industrial applications

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Direct sales

- 7.3 Online

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Arkema

- 9.2 BASF SE

- 9.3 Chevron Phillips Chemical

- 9.4 Covestro

- 9.5 DSM-Firmenich

- 9.6 Dow Inc.

- 9.7 Eastman Chemical

- 9.8 Evonik Industrie

- 9.9 ExxonMobil

- 9.10 Indorama Ventures

- 9.11 Jiangsu Eastern Shenghong

- 9.12 LyondellBasell

- 9.13 Mitsubishi Chemical

- 9.14 PETRONAS Chemical Group

- 9.15 SABIC