PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876637

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876637

Germany Flexible Endoscopic Surgery Robot Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

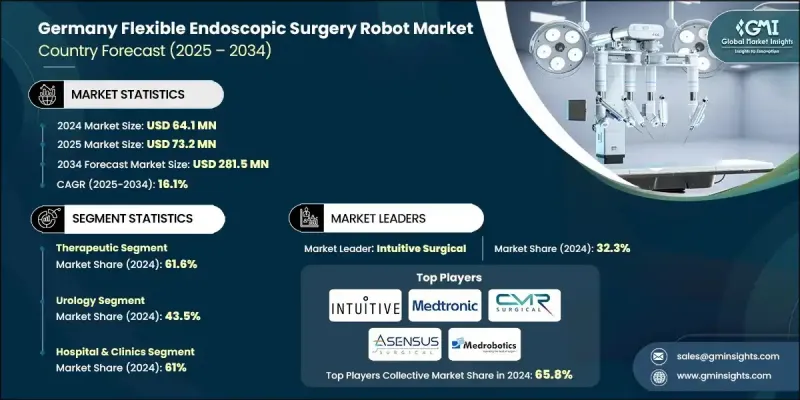

Germany Flexible Endoscopic Surgery Robot Market was valued at USD 64.1 million in 2024 and is estimated to grow at a CAGR of 16.1% to reach USD 281.5 million by 2034.

The strong growth of this market is attributed to the rising preference for minimally invasive surgical techniques, ongoing advancements in robotic-assisted endoscopy, and the increasing incidence of gastrointestinal and respiratory diseases. Hospitals, clinics, and ambulatory surgical centers across Germany are increasingly adopting flexible robotic systems that allow surgeons to perform complex procedures with enhanced precision, flexibility, and control. These systems are widely used in gastrointestinal, pulmonary, urological, and gynecological surgeries, utilizing advanced imaging, robotic articulation, and AI-assisted guidance to improve diagnostic and therapeutic outcomes. The demand for robotic-assisted endoscopic surgery continues to grow as both patients and healthcare providers prioritize reduced physical trauma, shorter recovery periods, and lower postoperative complications. Developments in 3D visualization, surgeon console ergonomics, and real-time data analytics further improve procedural accuracy and decision-making. These technological upgrades are transforming endoscopic surgeries into safer, more efficient, and patient-friendly interventions, setting new benchmarks for surgical precision in modern healthcare systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $64.1 Million |

| Forecast Value | $281.5 Million |

| CAGR | 16.1% |

The therapeutic segment held a 61.6% share in 2024, driven by the rapid adoption of robotic-assisted systems for complex surgical procedures. The preference for minimally invasive and scarless surgeries continues to strengthen this segment, as robotic technologies enhance surgeon control, dexterity, and visualization in delicate operations. The ability of these systems to provide superior precision during gastrointestinal, pulmonary, urological, and gynecological interventions significantly contributes to their widespread utilization in advanced medical facilities.

The urology segment accounted for a 43.5% share in 2024 and is projected to reach USD 124.2 million during 2025-2034. The segment's dominance is largely due to the rising prevalence of urological conditions, including kidney stones, benign prostatic hyperplasia, and bladder-related disorders. Surgeons and patients are increasingly gravitating toward minimally invasive robotic systems that minimize discomfort, reduce complications, and accelerate recovery. Enhanced visualization and greater control in confined anatomical regions enable precise surgical maneuvers, establishing robotic-assisted urological surgery as a preferred treatment option across German healthcare facilities.

The hospitals and clinics segment held a 61% share in 2024 and is estimated to reach USD 179.9 million by 2034. The growing implementation of flexible endoscopic robotic systems in hospital settings is primarily driven by the need to improve clinical efficiency, reduce postoperative risks, and optimize patient recovery outcomes. The shift toward minimally invasive procedures continues to expand hospital investments in robotic technologies that deliver consistent surgical performance. With innovations such as flexible robotic arms, 3D imaging systems, and AI-powered navigation tools, hospitals are enhancing their ability to perform highly precise surgeries in challenging anatomical areas, further reinforcing their dominance in this market segment.

Leading companies in the Germany Flexible Endoscopic Surgery Robot Market include Medtronic, Avateramedical, Intuitive Surgical, CMR Surgical, Asensus Surgical, Karl Storz, Medrobotics, and Johnson & Johnson. Major companies in the Germany Flexible Endoscopic Surgery Robot Market are pursuing innovation-focused strategies to strengthen their competitive positioning. They are heavily investing in R&D to develop next-generation robotic platforms with enhanced flexibility, AI-driven guidance, and real-time imaging integration. Strategic collaborations between medical device firms, hospitals, and research institutions are expediting clinical validation and product adoption. Companies are also focusing on expanding their product portfolios by introducing modular systems suitable for diverse surgical specialties, from gastrointestinal to urological applications.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Category trends

- 2.2.2 Application trends

- 2.2.3 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing preference for minimally invasive and scar-less surgeries

- 3.2.1.2 Advancements in robotic-assisted endoscopic technologies

- 3.2.1.3 Rising prevalence of gastrointestinal and respiratory diseases

- 3.2.1.4 Adoption of AI and data analytics for improved surgical precision

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High purchase and maintenance costs of robotic systems

- 3.2.2.2 Complex technology requiring specialized surgeon training

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into outpatient and ambulatory surgical centers

- 3.2.3.2 Strategic collaborations and partnerships for R&D and innovation

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Pricing analysis, 2024

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.1.1 High-definition endoscopic cameras for superior visualization in complex procedures

- 3.6.1.2 Enhanced instrument articulation for precise navigation in confined anatomical spaces

- 3.6.1.3 Real-time intraoperative imaging for better procedural decision-making

- 3.6.2 Emerging technologies

- 3.6.2.1 Predictive analytics for personalized surgical planning and risk assessment

- 3.6.2.2 Tele-mentoring and remote proctoring for surgeon training and guidance

- 3.6.2.3 Modular robotic platforms for multi-specialty surgical applications

- 3.6.1 Current technological trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Category, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Therapeutic

- 5.3 Diagnostic

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Urology

- 6.3 Respiratory applications

- 6.4 Gastrointestinal applications

- 6.5 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital & clinics

- 7.3 Ambulatory surgical centers

- 7.4 Other End use

Chapter 8 Company Profiles

- 8.1 Asensus Surgical

- 8.2 Avateramedical

- 8.3 CMR Surgical

- 8.4 Intuitive Surgical

- 8.5 Johnson & Johnson

- 8.6 Karl Storz

- 8.7 Medrobotics

- 8.8 Medtronic