PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876657

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876657

Solvent Recovery Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

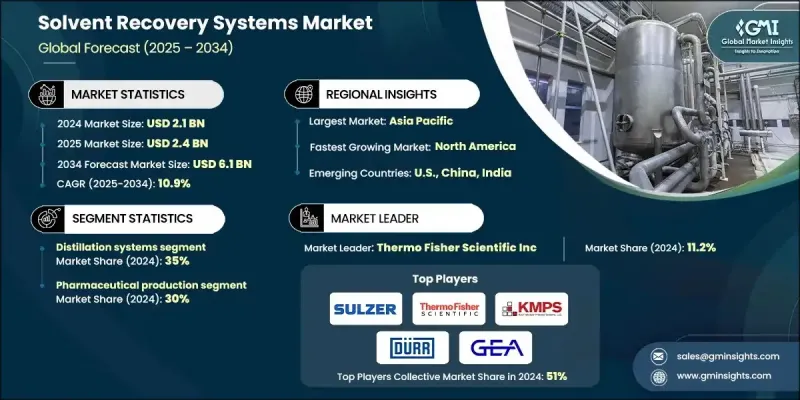

The Global Solvent Recovery Systems Market was valued at USD 2.1 billion in 2024 and is estimated to grow at a CAGR of 10.9% to reach USD 6.1 billion by 2034.

The strong growth outlook shows how quickly industries are moving toward sustainable operations, stricter environmental management, and improved production efficiency. Regulatory bodies worldwide continue enforcing aggressive limits on VOC emissions and hazardous waste, encouraging companies to adopt solutions that recover solvents rather than dispose of them. Increasing compliance demands under regional and national environmental frameworks have pushed manufacturers to invest in high-performance recovery systems. At the same time, these solutions deliver major cost advantages, enabling companies to reduce their solvent purchasing and waste management spending by up to 50%, with typical payback times often occurring within two years. More advanced recovery technologies using membranes now offer additional benefits, cutting energy use and capital expenses by as much as 40% compared with traditional distillation. As industries place greater emphasis on circular resource usage, solvent recovery systems are becoming an essential part of operational planning and long-term sustainability goals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $6.1 Billion |

| CAGR | 10.9% |

The vacuum distillation technologies segment accounted for a 25% share in 2024, as they are effective for solvents that degrade under high heat. These systems operate under reduced pressure, allowing separation at lower temperatures while protecting solvent quality. Their efficiency ratings commonly reach 90-95%, providing purity levels suited for applications that require stringent control standards.

The pharmaceutical manufacturing segment held a 30% share in 2024, driven by demanding purity expectations and unwavering adherence to Good Manufacturing Practice guidelines. Many facilities require recovery systems capable of achieving purity levels above 99% to support active ingredient production, which fuels the adoption of vacuum distillation and organic solvent nanofiltration technologies. These systems safeguard product integrity while maximizing solvent reuse. Automated equipment with built-in documentation capabilities is also becoming essential as companies follow strict regulatory mandates that require comprehensive process tracking.

U.S. Solvent Recovery Systems Market generated USD 323.2 million in 2024 and is projected to reach USD 930 million by 2034. North America held a 19.8% share in 2024, supported by tougher EPA directives and a growing commitment to industrial sustainability. Federal regulations designed to reduce VOC emissions continue to accelerate system installations across many manufacturing segments. As the pharmaceutical sector expands in key regions, demand for recovery solutions that align with GMP and FDA expectations remains high, strengthening overall market growth.

Key companies participating in the Solvent Recovery Systems Market include Maratek Environmental, Thermo Fisher Scientific, Durr Group, Spooner AMCEC, Sulzer, Hydrite Chemical, HongYi Environmental Equipment, CBG Biotech, Koch Modular Process Systems, OFRU Recycling, and GEA Group. Companies in the Solvent Recovery Systems Market rely on several core strategies to expand their competitive standing. Many invest heavily in advanced separation technologies that improve energy efficiency, reduce operating costs, and support high-purity recovery for sensitive applications. Firms also focus on modular and customizable system designs to meet the needs of diverse industries. Expanding global manufacturing capability and building regional service networks help shorten lead times and strengthen customer support.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Process type

- 2.2.2 Application

- 2.2.3 Installation type

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Process Type, 2021-2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Distillation systems

- 5.3 Vacuum distillation systems

- 5.4 Membrane separation systems

- 5.5 Microwave-enhanced recovery systems

- 5.6 Adsorption systems

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Automotive manufacturing

- 6.2.1 Paint shop & coating operations

- 6.2.2 Parts cleaning & degreasing

- 6.2.3 Solvent blending & recycling in assembly

- 6.2.4 Battery manufacturing (EVs & hybrids)

- 6.2.5 Others

- 6.3 Pharmaceutical production

- 6.3.1 Active pharmaceutical ingredient (API) manufacturing

- 6.3.2 Laboratory solvent recovery

- 6.3.3 Others

- 6.4 Printing & packaging

- 6.4.1 Flexographic printing

- 6.4.2 Gravure printing

- 6.4.3 Lithographic printing

- 6.4.4 Others

- 6.5 Electronics manufacturing

- 6.5.1 PCB manufacturing & cleaning

- 6.5.2 Semiconductor wafer processing

- 6.5.3 Others

- 6.6 Aerospace & defense

- 6.6.1 Composite material fabrication

- 6.6.2 Surface treatment & preparation

- 6.6.3 Maintenance, repair & overhaul (MRO)

- 6.6.4 Others

- 6.7 Chemical processing

- 6.7.1 Others

Chapter 7 Market Size and Forecast, By Installation Type, 2021-2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 On-site systems

- 7.3 Off-site systems

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Sulzer

- 9.2 Thermo Fisher Scientific

- 9.3 Koch Modular Process Systems

- 9.4 Durr Group

- 9.5 GEA Group

- 9.6 Hydrite Chemical

- 9.7 Maratek Environmental

- 9.8 OFRU Recycling

- 9.9 HongYi Environmental Equipment

- 9.10 Spooner AMCEC

- 9.11 CBG Biotech

- 9.12 NexGen Enviro Systems

- 9.13 TruSteel

- 9.14 CleanPlanet Chemical

- 9.15 Progressive Recovery