PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876659

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876659

Thermochromic Materials for Smart Windows Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

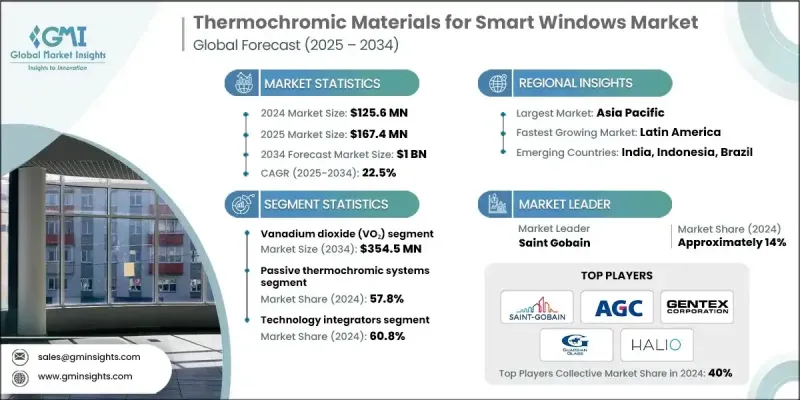

The Global Thermochromic Materials for Smart Windows Market was valued at USD 125.6 million in 2024 and is estimated to grow at a CAGR of 22.5% to reach USD 1 billion by 2034.

The rapid rise reflects stricter building-energy rules, accelerating advances in thermochromic chemistry, and expanding deployment of intelligent building technologies. Smart windows that shift tint based on temperature are increasingly paired with automated building platforms to regulate indoor conditions more efficiently, a major advantage given that HVAC systems can account for 40-60% of commercial facility energy consumption. Programs promoting net-zero energy buildings continue to encourage thermochromic glazing because it functions without external power and can significantly lower total energy use compared with standard window systems. Material platforms integrating multiple layers, such as perovskite blends, VO2 coatings, and other tunable films, are progressing, offering high visible light transmission and enhanced solar control. Strong year-over-year momentum is tied to updated building codes, continuous material breakthroughs, and emerging hybrid technologies. Research efforts remain intensive, with improved durability and faster switching speeds positioning modern thermochromic films for broader commercial acceptance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $125.6 Million |

| Forecast Value | $1 Billion |

| CAGR | 22.5% |

The vanadium dioxide segment generated USD 43.7 million in 2024 and is expected to reach USD 354.5 million by 2034 at a 22.3% CAGR. The natural metal-insulator shift near 68°C can be re-engineered to activate at lower temperatures through selective doping, with scalable production now achieving transitions near 22°C. Advances in sputtering approaches are enhancing coating stability and extending long-term performance across different climates.

The passive thermochromic solutions segment accounted for a 57.8% share in 2024 and is anticipated to maintain a 22.4% CAGR through 2034. Their appeal is rooted in zero-power functionality and minimal upkeep, aligning with net-zero construction priorities. When designed correctly, these systems have demonstrated 15-25% HVAC savings, making them increasingly attractive for owners facing rising operational costs.

North America Thermochromic Materials for Smart Windows Market held a significant share in 2024. The smart window adoption, as regulatory updates such as IECC 2021 and ASHRAE 90.1 reinforce high-efficiency building envelopes. State-level initiatives, including evolving requirements across major construction markets, accelerate usage in the United States, while coordinated Canadian policies support long-term carbon-reduction goals. The region benefits from strong integration of IoT-enabled building management platforms and a mature installation network experienced with next-generation glazing.

Key companies in the Thermochromic Materials for Smart Windows Market include ChromoGenics AB, Guardian Glass LLC, View Inc., PPG Industries Inc., Kinestral Technologies, Saint-Gobain S.A., AGC Inc., Nippon Sheet Glass Co. Ltd., Gentex Corporation, and Halio Inc. Companies competing in the Thermochromic Materials for Smart Windows Market focus on several strategic pillars to reinforce their market standing. Many emphasize sustained R&D investment to enhance transition temperatures, material durability, and optical clarity, ensuring greater compatibility with modern building requirements. Firms increasingly streamline production technologies to reduce manufacturing costs and support large-scale deployment. Strategic partnerships with glazing manufacturers and smart-building solution providers help expand access to commercial projects.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material type

- 2.2.3 Product form

- 2.2.4 Technology & control

- 2.2.5 Manufacturing process

- 2.2.6 End use industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product form

- 3.8 Future market trends

- 3.9 Patent Landscape

- 3.10 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.10.1 Major importing countries

- 3.10.2 Major exporting countries

- 3.11 Sustainability and Environmental Aspects

- 3.11.1 Sustainable Practices

- 3.11.2 Waste Reduction Strategies

- 3.11.3 Energy Efficiency in Production

- 3.11.4 Eco-friendly Initiatives

- 3.12 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.7 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Vanadium dioxide (vo2) systems

- 5.2.1 Pure vo2 systems

- 5.2.2 Tungsten-doped vo2

- 5.2.3 Molybdenum-doped vo2

- 5.2.4 Co-doped vo2 systems

- 5.2.5 Core-shell vo2 nanostructures

- 5.3 Hydrogel-based systems

- 5.3.1 PNIPAM hydrogels

- 5.3.2 HPC (hydroxypropyl cellulose) systems

- 5.3.3 Composite hydrogels

- 5.3.4 Physically cross-linked systems

- 5.3.5 Chemically cross-linked systems

- 5.4 Perovskite materials

- 5.4.1 Halide perovskites

- 5.4.2 Methylamine-switchable systems

- 5.4.3 Hydration-responsive materials

- 5.5 Liquid crystal systems

- 5.5.1 Thermotropic liquid crystals

- 5.5.2 Cholesteric liquid crystals

- 5.5.3 Lc-polymer composites

- 5.6 Organic dye systems

- 5.6.1 LEUCO dyes

- 5.6.2 SPIROPYRAN systems

- 5.6.3 LETC (ligand exchange thermochromism) systems

Chapter 6 Market Estimates and Forecast, By Product Form, 2021 - 2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Thin film coatings

- 6.2.1 Sputtered films

- 6.2.2 Solution-processed films

- 6.2.3 CVD films

- 6.2.4 Multilayer stacks & fabry-perot cavities

- 6.3 Laminated interlayers

- 6.3.1 PVB (polyvinyl butyral) interlayers

- 6.3.2 EVA (ethylene vinyl acetate) interlayers

- 6.3.3 TPU (thermoplastic polyurethane) interlayers

- 6.4 Retrofit films

- 6.4.1 Self-adhesive films

- 6.4.2 Static-cling films

- 6.4.3 Liquid-applied films

- 6.5 Complete window systems

- 6.5.1 Single-glazed units

- 6.5.2 Double-glazed igus

- 6.5.3 Triple-glazed igus

- 6.5.4 Vacuum-glazed units

Chapter 7 Market Estimates and Forecast, By Technology & Control, 2021 - 2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 Passive thermochromic systems

- 7.2.1 Fixed transition temperature

- 7.2.2 Broad-range switching

- 7.2.3 Multi-stage switching

- 7.3 Active thermochromic systems

- 7.3.1 Electrically assisted systems

- 7.3.2 IoT-enabled smart windows

- 7.3.3 Sensor-controlled systems

- 7.4 Hybrid systems

- 7.4.1 Thermochromic-electrochromic

- 7.4.2 Thermochromic-photovoltaic

- 7.4.3 Thermochromic-photochromic

Chapter 8 Market Estimates and Forecast, By Manufacturing Process, 2021 - 2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 Vacuum-based methods

- 8.2.1 Magnetron sputtering

- 8.2.2 Hipims (high-power impulse magnetron sputtering)

- 8.2.3 Pulsed laser deposition (PLD)

- 8.2.4 Chemical vapor deposition (CVD)

- 8.2.5 Atomic layer deposition (ALD)

- 8.3 Solution-based methods

- 8.3.1 Sol-gel processing

- 8.3.2 Hydrothermal synthesis

- 8.3.3 Spin coating

- 8.3.4 Roll-to-roll coating

- 8.4 Additive manufacturing

- 8.4.1 Inkjet printing

- 8.4.2 Screen printing

- 8.4.3 3d printing technologies

Chapter 9 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Million) (Tons)

- 9.1 Key trends

- 9.2 Construction & architecture

- 9.2.1 General contractors

- 9.2.2 Glazing contractors

- 9.2.3 Architects & design firms

- 9.2.4 Facility management companies

- 9.3 Automotive manufacturing

- 9.3.1 Original equipment manufacturers (OEMs)

- 9.3.2 Tier 1 component suppliers

- 9.3.3 Aftermarket & retrofit services

- 9.4 Glass manufacturing

- 9.4.1 Float glass manufacturers

- 9.4.2 Coated glass manufacturers

- 9.4.3 Laminated glass manufacturers

- 9.5 Technology integrators

- 9.5.1 Building automation system providers

- 9.5.2 Smart home technology companies

- 9.5.3 Iot platform providers

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million) (Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 AGC Inc.

- 11.2 ChromoGenics AB

- 11.3 Gentex Corporation

- 11.4 Guardian Glass LLC

- 11.5 Halio Inc.

- 11.6 Heliotrope Technologies

- 11.7 Innovative Glass Corporation

- 11.8 Kinestral Technologies

- 11.9 Miru Smart Technologies

- 11.10 NEXT Energy Technologies

- 11.11 Nippon Sheet Glass Co. Ltd.

- 11.12 Pleotint LLC

- 11.13 Polytronix Inc.

- 11.14 PPG Industries Inc.

- 11.15 RavenWindow

- 11.16 Research Frontiers Inc.

- 11.17 Saint-Gobain S.A.

- 11.18 Scienstry Inc.

- 11.19 Smartglass International Ltd.

- 11.20 View Inc.

- 11.21 Others