PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876788

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876788

Digital Pathology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

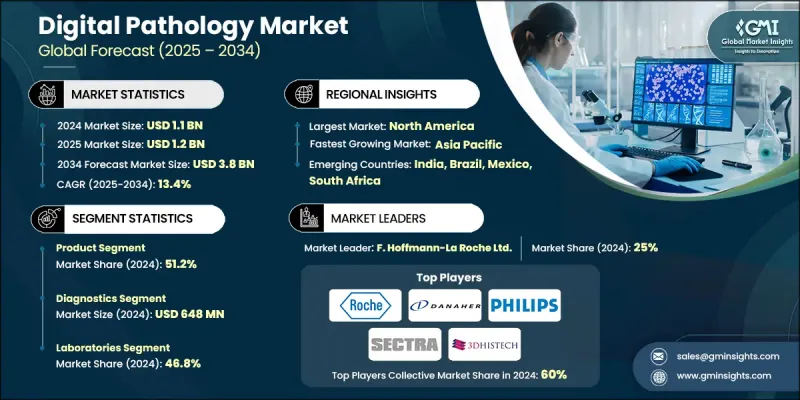

The Global Digital Pathology Market was valued at USD 1.1 billion in 2024 and is estimated to grow at a CAGR of 13.4% to reach USD 3.8 billion by 2034.

The growth is fueled by the rising adoption of digital solutions, modernization of diagnostic infrastructure, integration with electronic health records (EHRs), and increasing utilization in drug discovery and companion diagnostics. Digital pathology involves using digital imaging technologies to scan, analyze, and manage pathology slides and related data. It enables remote diagnostics, AI-assisted interpretations, and seamless EHR integration. Digitizing tissue samples enhances diagnostic accuracy, accelerates workflow efficiency for pathologists, and supports research and development. The market encompasses both hardware and software solutions for acquiring, storing, retrieving, sharing, and analyzing pathology slide data. Continuous technological innovations, particularly in oncology diagnostics, are driving the market forward, as pharmaceutical and research institutions increasingly leverage digital pathology to streamline drug development and improve precision medicine approaches.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.1 Billion |

| Forecast Value | $3.8 Billion |

| CAGR | 13.4% |

The product segment held a 51.2% share in 2024 owing to its ability to optimize workflow and enhance diagnostic precision. Scanners enable remote diagnostics and telepathology, reducing the need to transport physical slides. Slide management systems simplify data handling, improve collaboration across locations, and increase overall efficiency. Other product offerings automate routine tasks, minimize human error, and accelerate diagnosis, which is crucial in high-volume clinical environments.

The diagnostics segment was valued at USD 648 million in 2024. This segment focuses on interpreting digitized tissue slides for disease detection within clinical workflows. Pathologists rely on digital images, often enhanced with AI-based analysis tools, to identify abnormalities such as tumors, infections, or inflammatory conditions, replacing traditional microscope-based workflows.

North America Digital Pathology Market held a 33.4% share in 2024. Growth in the U.S. is driven by increased adoption in drug discovery, companion diagnostics, and research institutions seeking faster, more accurate tissue analysis methods. Federal investment in biomedical research and drug development further supports the expansion of digital pathology technologies across the region.

Key players in the Global Digital Pathology Market include 3DHISTECH, Dedalus, CellaVision, Danaher Corporation, F. Hoffmann-La Roche Ltd, Fujifilm Holdings Corporation, Glencoe Software Inc., Hamamatsu Photonics K.K., Huron Digital Pathology, Ibex Medical Analytics, Indica Labs Inc., Koninklijke Philips N.V., Mikroscan Technologies Inc., Olympus Corporation (Evident Scientific, Inc.), Paige AI, PathAI, PHC Holding Corporation (Epredia), Proscia, Inc., Sectra AB, and Visiopharm A/S. Companies in the Global Digital Pathology Market are strengthening their foothold by implementing several strategic initiatives. They are investing in advanced, high-resolution imaging devices and AI-powered analysis software to improve diagnostic accuracy. Many are forming partnerships with hospitals, research institutions, and pharmaceutical firms to expand adoption in clinical and drug development workflows. Mergers and acquisitions are being used to consolidate technologies and broaden product portfolios.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Component trends

- 2.2.3 Application trend

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of digital solutions

- 3.2.1.2 Growing modernization in diagnostic infrastructure in digital pathology

- 3.2.1.3 Integration of digital pathology systems with electronic health records (EHRs)

- 3.2.1.4 Increasing application in drug discovery and companion diagnostics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of standard guidelines for digital pathology

- 3.2.2.2 High cost associated with the implementation and integration of hardware or software

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for remote pathology and telepathology solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Product

- 5.2.1 Scanners

- 5.2.2 Slide management systems

- 5.2.3 Other products

- 5.3 Software

- 5.3.1 Type

- 5.3.1.1 AI enhanced image analysis software

- 5.3.1.2 Data management software

- 5.3.1.3 Other software

- 5.3.2 Deployment mode

- 5.3.2.1 Cloud-based

- 5.3.2.2 On-premises

- 5.3.1 Type

- 5.4 Services

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Diagnostics

- 6.3 Research

- 6.4 Education and training

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Research institutes

- 7.3 Laboratories

- 7.3.1 Pathology labs

- 7.3.2 Cytology labs

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3DHISTECH

- 9.2 CellaVision

- 9.3 Danaher Corporation

- 9.4 Dedalus

- 9.5 F. Hoffmann-La Roche Ltd

- 9.6 Fujifilm Holdings Corporation

- 9.7 Glencoe Software Inc.

- 9.8 Hamamatsu Photonics K.K.

- 9.9 Huron Digital Pathology

- 9.10 Ibex Medical Analytics

- 9.11 Indica Labs Inc.

- 9.12 Koninklijke Philips N.V.

- 9.13 Mikroscan Technologies Inc.

- 9.14 Olympus Corporation

- 9.15 Paige AI

- 9.16 PathAI

- 9.17 PHC Holding Corporation

- 9.18 Proscia, Inc.

- 9.19 Sectra AB

- 9.20 Visiopharm A/S