PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876791

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876791

Gene Synthesis Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

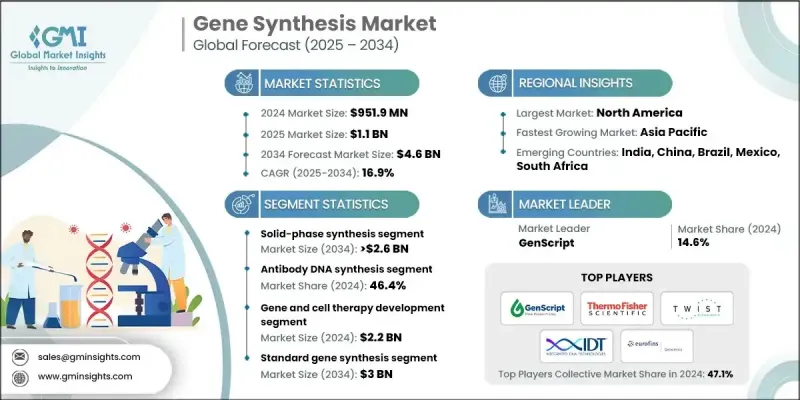

The Global Gene Synthesis Market was valued at USD 951.9 million in 2024 and is estimated to grow at a CAGR of 16.9% to reach USD 4.6 billion by 2034.

Market expansion is propelled by the rise of synthetic biology, continual progress in DNA synthesis technologies, and growing investments in genomics research worldwide. The expanding use of personalized medicine and biomarker development is also increasing the demand for high-precision gene construction tools. The gene synthesis industry provides essential solutions for pharmaceutical companies, biotechnology firms, academic research centers, and healthcare technology developers by offering custom gene synthesis, DNA library creation, and advanced cloning services. These solutions improve the efficiency of genetic engineering workflows, drug discovery studies, and molecular diagnostics. Automated synthesis platforms and sophisticated error-correction technologies have enhanced accuracy while reducing cost and turnaround time, making gene synthesis widely accessible. Increased government and private funding for large-scale genomics initiatives supports applications in disease modeling, agriculture, and industrial biotechnology. Growing utilization of synthetic genes in antibody engineering, vaccine development, and therapeutic design continues to push the industry forward. The post-pandemic landscape has further reinforced the importance of rapid synthetic gene production for accelerated therapeutic innovation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $951.9 Million |

| Forecast Value | $4.6 Billion |

| CAGR | 16.9% |

The solid-phase synthesis segment held 58.6% share in 2024, driven by its scalability, high precision, and suitability for generating long DNA sequences for both research and commercial use. Its stepwise nucleotide addition method enhances reliability and purification efficiency, making it a preferred synthesis technique.

The antibody DNA synthesis segment accounted for a 46.4% share in 2024 and is projected to reach USD 2.2 billion during the forecast period. Growth is driven by rising demand for monoclonal antibody therapies used across cancer treatment, immune system disorders, infectious diseases, and various rare conditions. This surge has increased the need for custom-designed antibody genes to accelerate therapeutic development pipelines.

North America Gene Synthesis Market held a 40.3% share in 2024. The region's leadership is supported by major biotechnology and pharmaceutical companies, strong research ecosystems, and significant investment in genomics and synthetic biology. Supportive regulatory structures and advanced clinical research capabilities continue to elevate the adoption of gene synthesis technologies.

Prominent companies participating in the Global Gene Synthesis Market include Azenta, Inc. (GENEWIZ), BIOMATIK, Bio Basic Inc., BIONEER CORPORATION, Gene Universal Inc., Eurofins Scientific SE, Integrated DNA Technologies, Inc., GenScript, Macrogen, Inc., ProMab Biotechnologies, Inc., OriGene Technologies, Inc., ProteoGenix, Synbio Technologies, Thermo Fisher Scientific Inc., and Twist Bioscience Corporation. Companies in the Gene Synthesis Market are strengthening their competitive position by scaling up automated synthesis platforms, improving error-correction capabilities, and expanding their custom gene design services. Many firms are forming strategic partnerships with pharmaceutical and biotechnology companies to integrate synthesis technologies directly into drug discovery and antibody engineering workflows. Investments in high-throughput systems and cloud-based sequence design tools are enabling faster project turnaround and greater volume capacity.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Method trends

- 2.2.3 Services trends

- 2.2.4 Application trends

- 2.2.5 Complexity trends

- 2.2.6 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid advancements in DNA synthesis technology

- 3.2.1.2 Growing investments in gene synthesis projects and synthetic biology R&D

- 3.2.1.3 Increased prevalence of genetic disorders and chronic disease

- 3.2.1.4 Rising adoption of gene therapy

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of skilled professionals

- 3.2.2.2 Complex gene synthesis techniques and high process cost

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of CRISPR-based gene editing applications

- 3.2.3.2 RNA-based vaccines and therapeutics development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies and their impacts

- 3.6 Future market trends

- 3.7 Pricing analysis

- 3.8 Investment and funding landscape

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New service launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Method, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Solid-phase synthesis

- 5.3 PCR-based enzyme synthesis

- 5.4 Chip-based synthesis

Chapter 6 Market Estimates and Forecast, By Services, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Antibody DNA synthesis

- 6.3 Viral DNA synthesis

- 6.4 Other services

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Gene and cell therapy development

- 7.3 Disease diagnosis

- 7.4 Vaccine development

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By Complexity, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Standard gene synthesis

- 8.3 Complex gene synthesis

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Biopharmaceutical companies

- 9.3 Academic and research institutes

- 9.4 Contract research organizations

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Azenta, Inc. (GENEWIZ)

- 11.2 Bio Basic Inc.

- 11.3 BIOMATIK

- 11.4 BIONEER CORPORATION

- 11.5 Eurofins Scientific SE

- 11.6 Gene Universal Inc.

- 11.7 GenScript

- 11.8 Integrated DNA Technologies, Inc.

- 11.9 Macrogen, Inc.

- 11.10 OriGene Technologies, Inc.

- 11.11 ProMab Biotechnologies, Inc.

- 11.12 ProteoGenix

- 11.13 Synbio Technologies

- 11.14 Thermo Fisher Scientific Inc.

- 11.15 Twist Bioscience Corporation