PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876797

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876797

Stretchable Electronics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

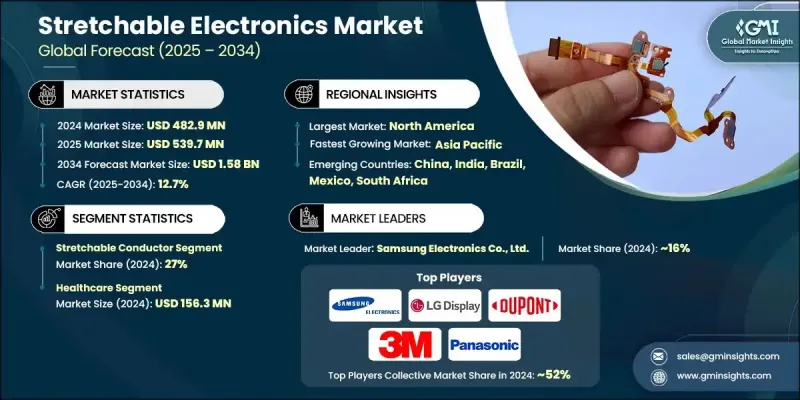

The Global Stretchable Electronics Market was valued at USD 482.9 million in 2024 and is estimated to grow at a CAGR of 12.7% to reach USD 1.58 billion by 2034.

Market growth is fueled by the increasing demand for flexible, wearable, and skin-conformable devices across healthcare, consumer electronics, and automotive industries. Stretchable electronics provide unmatched comfort, adaptability, and durability, making them ideal for smart textiles, soft robotics, and biomedical sensors. Innovations in materials science, including stretchable conductive polymers and nanomaterials, are enabling more scalable and reliable production processes. Rising adoption of IoT devices and personalized health monitoring is accelerating the demand for stretchable electronics, which are essential for next-generation connected technologies. The growing popularity of wearable devices and health-monitoring tools is driving demand, as their skin-like flexibility supports continuous biometric tracking and real-time health insights. Stretchable electronics also enable miniaturization and adaptability, allowing seamless integration in smart homes, industrial systems, and connected devices, while improving healthcare diagnostics and treatments through implantable and skin-mounted sensors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $482.9 Million |

| Forecast Value | $1.58 Billion |

| CAGR | 12.7% |

The stretchable conductor segment held a 27% share in 2024, leading the industry due to its essential role in maintaining electrical performance under bending, twisting, or stretching. These conductors are critical for wearables, medical devices, and soft robotics. Advances in materials such as graphene and silver nanowires have further enhanced conductivity and stretchability, promoting widespread adoption across multiple sectors.

The healthcare segment generated USD 156.3 million in 2024, driven by increasing demand for wearable medical devices, implantable sensors, and remote monitoring solutions. Stretchable electronics offer high biocompatibility, flexibility, and comfort, enabling continuous patient monitoring and accurate data collection. Growing emphasis on personalized healthcare and an aging population further boost adoption in this sector.

North America Stretchable Electronics Market accounted for a 35.9% share in 2024, driven by strong demand for advanced medical technologies, smart consumer electronics, and wearable devices. The region benefits from robust research infrastructure, leading tech companies, and early adoption of innovative materials. Applications in remote health monitoring, fitness tracking, and biomedical devices are expanding rapidly. Supportive government initiatives and the presence of major automotive and aerospace industries further strengthen North America's market leadership.

Key players in the Global Stretchable Electronics Market include Samsung Electronics Co., Ltd., 3M Company, DuPont de Nemours, Inc., LG Display Co., Ltd., Panasonic Corporation, Rogers Corporation, MC10, Inc., StretchSense Ltd, Royole Corporation, Enfucell Flexible Electronics Co., Ltd., Pragmatic Semiconductor Ltd, Toyobo Co., Ltd., Heraeus Holding GmbH, Advanced Nano Products Co., Ltd., Dycotec Materials Ltd, PowerFilm, Inc., Sekisui Polymatech Co., Ltd., Sensing Tex, S.L., and Imprint Energy, Inc. Companies in the Stretchable Electronics Market strengthen their position by investing heavily in R&D to develop next-generation conductive and flexible materials. Strategic partnerships, joint ventures, and acquisitions help expand global presence and production capabilities. Firms focus on diversifying product offerings for healthcare, consumer electronics, and industrial applications while enhancing manufacturing scalability.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Component Trends

- 2.2.2 Application Trends

- 2.2.3 Regional Trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing Demand for Wearable Health Devices

- 3.2.1.2 Advancements in Flexible and Conductive Materials

- 3.2.1.3 Expansion of IoT and Smart Textiles

- 3.2.1.4 Increasing Adoption in Automotive and Aerospace

- 3.2.1.5 Rising Interest in Soft Robotics and Human-Machine Interfaces

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High Manufacturing Costs and Scalability Issues

- 3.2.2.2 Limited Durability Under Repeated Stretching

- 3.2.3 Market opportunities

- 3.2.3.1 Development of Biocompatible Medical Implants

- 3.2.3.2 Smart Clothing for Sports and Military Applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 U.S.

- 3.4.1.2 Canada

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.4.1 North America

- 3.5 Technology landscape

- 3.5.1 Current trends

- 3.5.2 Emerging technologies

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 Global

- 4.2.2 North America

- 4.2.3 Europe

- 4.2.4 Asia Pacific

- 4.2.5 Latin America

- 4.2.6 Middle East and Africa

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Component, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Electroactive polymer

- 5.3 Stretchable batteries

- 5.4 Stretchable conductor

- 5.5 Photovoltaic

- 5.6 Stretchable circuit

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Healthcare

- 6.3 Consumer electronics

- 6.4 Automotive electronics

- 6.5 Aerospace & defense

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 DuPont de Nemours, Inc.

- 8.2 3M Company

- 8.3 Samsung Electronics Co., Ltd.

- 8.4 LG Display Co., Ltd.

- 8.5 Panasonic Corporation

- 8.6 Rogers Corporation

- 8.7 StretchSense Ltd

- 8.8 MC10, Inc.

- 8.9 FlexEnable Ltd

- 8.10 Royole Corporation

- 8.11 Enfucell Flexible Electronics Co., Ltd.

- 8.12 Pragmatic Semiconductor Ltd

- 8.13 Toyobo Co., Ltd.

- 8.14 Heraeus Holding GmbH

- 8.15 Advanced Nano Products Co., Ltd.

- 8.16 Dycotec Materials Ltd

- 8.17 PowerFilm, Inc.

- 8.18 Sekisui Polymatech Co., Ltd.

- 8.19 Sensing Tex, S.L.

- 8.20 Imprint Energy, Inc.