PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876799

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876799

Food Truck Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

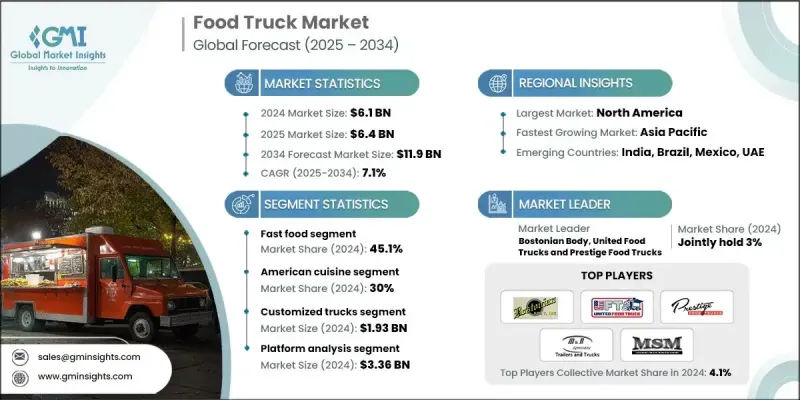

The Global Food Truck Market was valued at USD 6.1 billion in 2024 and is estimated to grow at a CAGR of 7.1% to reach USD 11.9 billion by 2034.

Technology plays a key role in this growth, with operators increasingly using GPS tracking, mobile payment solutions, and social media marketing to enhance visibility and improve operational efficiency. Digital tools allow food trucks to share their location, streamline service, and build brand loyalty while optimizing revenue opportunities across diverse metropolitan areas. Changing consumer preferences toward portable, experiential, and diverse food options are also driving market expansion. Operators are offering a mix of gourmet, fusion, and healthy menu options to cater to Millennials, Gen X, and tourists, reflecting a broader global trend toward casual and open-air dining experiences. Food trucks are redefining convenience and culinary exploration while balancing operational efficiency and customer engagement.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.1 Billion |

| Forecast Value | $11.9 Billion |

| CAGR | 7.1% |

The fast food segment held 45.1% share in 2024, valued at approximately USD 2.8 billion. This segment thrives on the same attributes that food trucks provide, including speed, convenience, and affordability. Innovative offerings, such as gourmet sandwiches and fusion dishes, elevate traditional fast food through premium ingredients and creative preparation. Chinese cuisine represents a 15.3% market share with a CAGR of 7.3%, driven by demand for authentic flavors and versatile ingredients. Mobile Chinese food operations focus on a concise menu of staple dishes that maintain quality, texture, and temperature while being easily served on the go.

US Food Truck Market held an 85% share in 2024, supported by over 48,400 active units generating average annual revenues of USD 346,000 per truck. The US market was valued at USD 2.1 million in 2024 and is expected to experience robust growth between 2025 and 2034. Pilot zones and park-based programs are expanding operating opportunities beyond traditional urban areas, fostering entrepreneurship while requiring clear municipal health and zoning frameworks to ensure safety and equitable access for vendors.

Leading players in the Global Food Truck Market include Bostonian Body, Futuristo Trailers, Food Truck Company, M&R Trailers, MRA, MSM Catering Trucks Manufacturing, Prestige Food Trucks, The Fud Trailer Company, United Food Trucks, and VS Veicoli Speciali. Companies in the Food Truck Market are strengthening their presence by adopting multi-faceted strategies, including investing in advanced, customizable truck designs, integrating digital payment and tracking systems, and leveraging social media for targeted marketing. Many are diversifying menus with gourmet and fusion options to appeal to wider audiences. Strategic partnerships with municipal programs and event organizers help expand operational locations, while collaborations with suppliers ensure efficient supply chains. Companies are also focusing on brand differentiation, customer experience, and loyalty programs to maintain a competitive advantage and capture larger market shares in growing urban and recreational segments.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Offering

- 2.2.2 Cuisine

- 2.2.3 Vehicle

- 2.2.4 Platform

- 2.2.5 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urbanization & busy lifestyles

- 3.2.1.2 Low startup & operational costs

- 3.2.1.3 Technological integration

- 3.2.1.4 Evolving consumer preferences

- 3.2.1.5 Growth of events & festivals

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory & licensing barriers

- 3.2.2.2 Operational limitations & weather dependency

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion into emerging markets

- 3.2.3.2 Eco-friendly & sustainable operations

- 3.2.3.3 Technological innovation & smart operations

- 3.2.3.4 Menu diversification & health-focused offerings

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle east and Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technology

- 3.7.2 Emerging technology

- 3.8 Patent analysis

- 3.9 Price Trends Analysis

- 3.9.1 By component

- 3.9.2 By region

- 3.10 Cost Breakdown Analysis

- 3.11 Production statistics

- 3.11.1 Production hubs

- 3.11.2 Consumption hubs

- 3.11.3 Export and import

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

- 3.14 Consumer Behavior & Demographics

- 3.15 Seasonal Demand Patterns

- 3.16 Urban vs Rural Market Dynamics

- 3.17 Digital Transformation Impact

- 3.18 Social Media & Marketing Evolution

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key news and initiatives

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Offering, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Fast Food

- 5.3 Beverages

- 5.4 Bakery & confectionary

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Cuisine, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 American

- 6.3 Mexican

- 6.4 Chinese

- 6.5 Japanese

- 6.6 Italian

- 6.7 Asian

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Vehicle 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Expandable

- 7.3 Boxes

- 7.4 Buses & vans

- 7.5 Customized trucks

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Platform, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 On-the-Go service

- 8.3 Catering services

- 8.4 Online delivery

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Netherlands

- 9.3.8 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 ANZ

- 9.4.5 Singapore

- 9.4.6 Thailand

- 9.4.7 Vietnam

- 9.4.8 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 AMOBOX

- 10.1.2 Bostonian Body

- 10.1.3 Concession Nation

- 10.1.4 Cousins Maine Lobster

- 10.1.5 Custom Concessions

- 10.1.6 Deliverect

- 10.1.7 Elite Mobile Kitchens

- 10.1.8 Food Truck Builder

- 10.1.9 Food Truck Company

- 10.1.10 Futuristo Trailers

- 10.1.11 Hoshizaki America

- 10.1.12 Kona Ice

- 10.1.13 M&R Trailers

- 10.1.14 MRA

- 10.1.15 MSM Catering Trucks Manufacturing

- 10.1.16 Pacific Food Truck Manufacturing

- 10.1.17 Prestige Food Trucks

- 10.1.18 Revel Systems

- 10.1.19 The Fud Trailer Company

- 10.1.20 The Grilled Cheese Truck

- 10.1.21 Toast

- 10.1.22 True Manufacturing

- 10.1.23 United Food Trucks

- 10.1.24 VS Veicoli Speciali

- 10.2 Regional players

- 10.2.1 Roy Choi Enterprises

- 10.2.2 The Halal Guys

- 10.3 Emerging Players / Startups

- 10.3.1 Electric Food Truck Conversions