PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876803

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876803

Cold Plates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

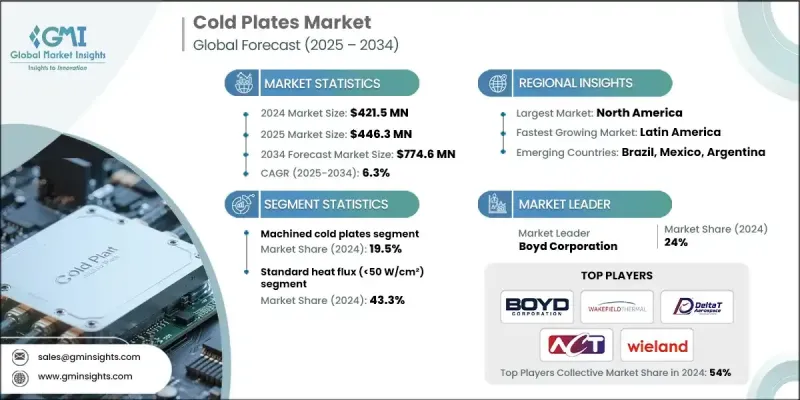

The Global Cold Plates Market was valued at USD 421.5 million in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 774.6 million by 2034.

The growth is driven by the rising adoption of electric vehicles (EVs), renewable energy systems, and advanced computing applications that require efficient thermal management solutions. Cold plates are essential for removing excess heat from power electronics, batteries, and semiconductor components, ensuring system reliability and performance. Increasing investments in high-performance computing, 5G infrastructure, and energy storage are boosting demand for innovative liquid-cooled technologies. Manufacturers are focusing on developing compact, lightweight, and high-efficiency cooling systems using materials such as aluminum and copper to meet the needs of automotive, aerospace, and industrial sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $421.5 Million |

| Forecast Value | $774.6 Million |

| CAGR | 6.3% |

In 2024, the standard heat flux capacity segment, requiring a heat transfer rating below 50 W/cm2, held a 43.3% share. This category primarily serves industrial electronics, automotive systems, and a range of general thermal management applications. Owing to its well-established large-scale manufacturing, this segment delivers cost-effective solutions tailored for everyday use across diverse industries.

The machined cold plates segment captured a 19.5% share in 2024 and is projected to grow at a CAGR of 6.4%. These solutions offer superior customization capabilities through precision CNC machining and specialized brazing processes. They are ideal for intricate flow path designs, precise mounting requirements, and the integration of fin inserts that enhance heat transfer efficiency in demanding environments such as advanced semiconductors, cloud computing, and AI-based systems.

North America Cold Plates Market held 33.4% share in 2024 with a CAGR of 5.6% through 2034. The region's dominance is supported by its advanced technological infrastructure and widespread adoption of thermal management solutions across key sectors, including aerospace, data centers, and medical equipment. The presence of leading industry players, strong R&D activities, and the growing need for high-efficiency cooling systems to support high-performance electronics are driving innovation and continued market expansion in the region.

Leading players in the Global Cold Plates Market, such as Boyd Corporation, Dana Incorporated, TE Technology, Inc., Kawaso Texcel, Mersen, Pantronics India, Wakefield Thermal Solutions, Wieland Thermal Solutions, Tesio, QATS, KenFa Tech., DeltaT Aerospace, Advanced Cooling Technologies (ACT), are focusing on technological innovation, strategic partnerships, and capacity expansion to strengthen their market position. These companies are investing in advanced manufacturing processes like additive manufacturing and precision machining to enhance design flexibility and thermal performance. Strategic collaborations with EV manufacturers, aerospace firms, and data center operators are enabling customized solutions tailored to high-performance cooling requirements. Firms are emphasizing sustainability, developing lightweight recyclable materials, and eco-friendly coolants to reduce environmental impact.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material type

- 2.2.3 Technology

- 2.2.4 Heat flux capacity

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By material type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021-2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Copper

- 5.3 Aluminum

- 5.4 Stainless steel

- 5.5 Hybrid

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Technology, 2021-2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Stamped cold plates

- 6.3 Machined cold plates

- 6.4 Microchannel cold plates

- 6.5 Formed tube cold plates

- 6.6 Flat tube cold plates

- 6.7 Deep drilled cold plates

Chapter 7 Market Estimates and Forecast, By Heat Flux Capacity, 2021-2034 (USD Million & Kilo Tons)

- 7.1 Key trend

- 7.2 Standard heat flux (<50 W/cm²)

- 7.3 High heat flux (50-200 W/cm²)

- 7.4 Very high heat flux (200-500 W/cm²)

- 7.5 Ultra-high heat flux (>500 W/cm²)

Chapter 8 Market Estimates and Forecast, By Application, 2021-2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 Data centres

- 8.3 Electric vehicles

- 8.4 Aerospace & defense

- 8.5 Industrial electronics

- 8.6 Medical equipment

- 8.7 Telecommunication equipment

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Advanced Cooling Technologies (ACT)

- 10.2 Boyd Corporation

- 10.3 Dana Incorporated

- 10.4 DeltaT Aerospace

- 10.5 Kawaso Texcel

- 10.6 KenFa Tech.

- 10.7 Mersen

- 10.8 Pantronics India

- 10.9 QATS

- 10.10 TE Technology, Inc

- 10.11 Tesio

- 10.12 Wakefield Thermal Solutions

- 10.13 Wieland Thermal Solutions