PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876807

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876807

Medical Drone Delivery Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

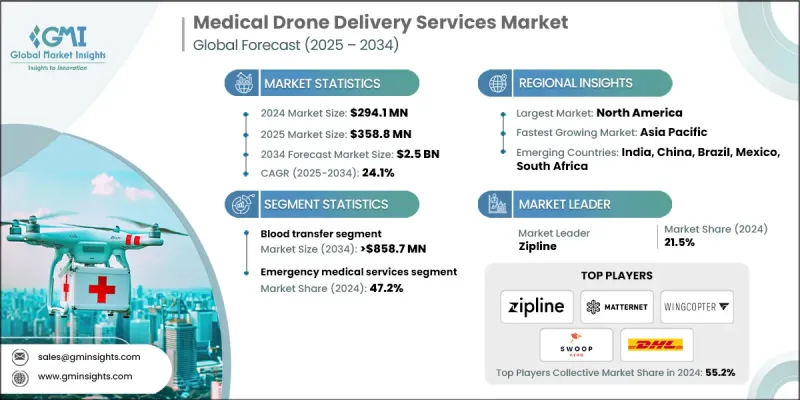

The Global Medical Drone Delivery Services Market was valued at USD 294.1 million in 2024 and is estimated to grow at a CAGR of 24.1% to reach USD 2.5 billion by 2034.

The market is driven by the growing need for rapid medical deliveries, favorable government regulations, technological advancements, and increasing adoption of drones in healthcare logistics. Medical drone delivery services offer innovative solutions to hospitals, blood banks, pharmaceutical companies, and healthcare providers, improving delivery speed, operational efficiency, and patient outcomes. These solutions include autonomous drones, hybrid VTOL aircraft, and integrated delivery platforms capable of transporting blood, vaccines, laboratory samples, and medications. By drastically reducing delivery times, these services help healthcare providers enhance patient care. Supportive regulatory frameworks and government pilot programs are also fueling growth by streamlining airspace management and providing funding for commercial medical drone operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $294.1 Million |

| Forecast Value | $2.5 Billion |

| CAGR | 24.1% |

Technological progress in drone design, including autonomous navigation, hybrid VTOL capabilities, expanded payload capacity, and cold-chain integration, allows sensitive medical supplies to be transported safely and efficiently. Medical drone delivery services rely on unmanned aerial vehicles to move blood, vaccines, lab specimens, and pharmaceuticals quickly, supporting hospitals, emergency services, and healthcare providers while improving patient outcomes and operational logistics.

The blood transfer segment held a 35.9% share in 2024, owing to the critical demand for rapid blood delivery in emergencies and remote regions. Quick, reliable blood transport between hospitals, blood banks, and emergency medical centers is essential for surgeries, trauma care, and urgent transfusions, where delays can be life-threatening. Combined with the emergency medical services segment, the two largest categories accounted for over 81.4% of the total market value. Drones significantly reduce response times compared to traditional road transport, while features like AI-based route optimization, autonomous navigation, and real-time monitoring ensure secure and precise deliveries, even in crowded urban areas or remote locations.

North America Medical Drone Delivery Services Market held a 33.2% share in 2024, benefiting from technological, economic, and regulatory advantages. The region features advanced drone innovations such as autonomous navigation, hybrid VTOL aircraft, AI-powered route planning, and IoT-enabled payload monitoring, ensuring the rapid and safe delivery of blood, vaccines, laboratory specimens, and medications.

Key players operating in the Global Medical Drone Delivery Services Market include Matternet, Volansi, Wingcopter, DHL, Apian, Air Taurus, MightyFly, Wing (Alphabet), Flirtey/SkyDrop, Draganfly, and Zipline. Companies in the Medical Drone Delivery Services Market are strengthening their presence through several strategies. They are investing in advanced drone technologies, including AI navigation, hybrid VTOL, and payload monitoring systems, to enhance efficiency and reliability. Strategic partnerships with hospitals, blood banks, and pharmaceutical firms help expand service coverage and build trust. Firms are also participating in government pilot programs to secure regulatory support and gain early market adoption. Mergers and acquisitions are used to integrate technologies and scale operations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Application trends

- 2.2.3 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing application of medical drone in the healthcare industry

- 3.2.1.2 Rising number of government initiatives

- 3.2.1.3 Technological advancements

- 3.2.1.4 Growing public acceptance

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complications associated with medical drone

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in remote and rural healthcare access

- 3.2.3.2 Integration with smart healthcare infrastructure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Technology landscape

- 3.5.1 Current technological trends

- 3.5.1.1 Autonomous drone navigation systems enabling precise delivery of medical supplies

- 3.5.1.2 Hybrid VTOL (vertical take-off and landing) drones for flexible urban and rural operations

- 3.5.1.3 IoT-enabled tracking and monitoring for real-time delivery updates

- 3.5.2 Emerging technologies

- 3.5.2.1 Integration of blockchain for secure, transparent, and traceable medical supply logistics.

- 3.5.2.2 Swarm drone technology for simultaneous deliveries to multiple locations.

- 3.5.2.3 Advanced sensors for obstacle detection and automated collision avoidance

- 3.5.1 Current technological trends

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.9.1 Expansion of drone networks integrated with smart hospitals and healthcare infrastructure

- 3.9.2 Increased adoption in emergency medical services and remote healthcare delivery

- 3.9.3 Regulatory harmonization and airspace management to support large-scale operations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New service type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Blood transfer

- 5.3 Drugs/pharmaceutical transfer

- 5.4 Vaccination program

- 5.5 Lab sample

- 5.6 Other applications

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Emergency medical services

- 6.3 Blood banks

- 6.4 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Air Taurus

- 8.2 Apian

- 8.3 DHL

- 8.4 Draganfly

- 8.5 Flirtey /SkyDrop

- 8.6 Matternet

- 8.7 MightyFly

- 8.8 Swoop Aero

- 8.9 Volansi

- 8.10 Wing (Alphabet)

- 8.11 Wingcopter

- 8.12 Zipline