PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876812

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876812

Microencapsulation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

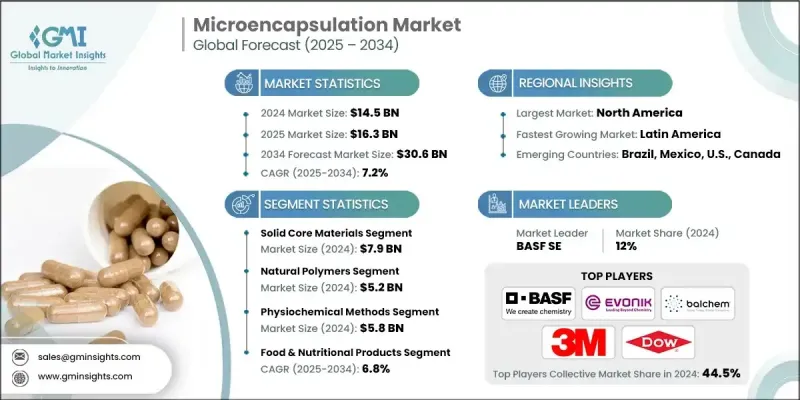

The Global Microencapsulation Market was valued at USD 14.5 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 30.6 billion by 2034.

The increasing adoption of controlled drug delivery systems is driving demand for microencapsulation, as it offers precise protection and controlled release of active compounds. Rising focus on nutritional enhancement and food fortification has further fueled market growth, with countries implementing programs to address nutrient deficiencies. The growing need for improved stability, bioavailability, and shelf life of functional ingredients in foods, nutraceuticals, and pharmaceuticals has boosted the importance of this technology. Moreover, global sustainability initiatives are accelerating the use of biodegradable and bio-based coating materials, such as alginates and lignin derivatives, which align with environmental and regulatory standards. As industries shift toward health-conscious and eco-friendly formulations, microencapsulation technologies are becoming vital in enhancing ingredient efficiency and consumer appeal. Strong regulatory support, rising wellness trends, and advancements in encapsulation techniques are shaping this market's steady expansion worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.5 Billion |

| Forecast Value | $30.6 Billion |

| CAGR | 7.2% |

The solid core materials segment accounted for USD 7.9 billion in 2024, holding the largest share of the global market. This dominance is attributed to their extensive application in pharmaceuticals, nutraceuticals, and food products. Solid actives like minerals, enzymes, probiotics, and vitamins are widely encapsulated to prevent oxidation, enhance stability, and ensure slow release of nutrients. These materials work efficiently with multiple coating technologies such as spray drying and fluidized bed coating, delivering uniform particle formation and extended product shelf life.

The natural polymers segment was valued at USD 5.2 billion in 2024, representing the leading share of coating materials. The preference for natural polymers is growing due to their biodegradable, safe, and food-grade characteristics. Substances such as starch, gelatin, alginate, gum Arabic, and cellulose derivatives are increasingly utilized in food, pharmaceutical, and cosmetic applications because of their film-forming capabilities and excellent compatibility with active ingredients. The surge in demand for sustainable and clean-label materials continues to strengthen the adoption of natural polymer-based coatings across industries.

North America Microencapsulation Market reached USD 4.9 billion in 2024, representing 34% share. The region is expected to witness strong growth through 2034, led by the United States, which benefits from a well-established pharmaceutical and nutraceutical sector. The increasing need for fortified foods, advanced drug delivery technologies, and personalized nutrition products continues to boost market demand. Regulatory support from the FDA and the region's investment in R&D are encouraging innovation in encapsulation processes. The growing focus on wellness, coupled with access to advanced encapsulation materials, has positioned North America as a major contributor to global market development.

Major players operating in the Microencapsulation Market include Coating Place Inc., Aveka Inc., Syngenta AG, DOW Corning, DSM N.V., Ashland Global Holdings Inc., BASF SE, 3M Company, Evonik Industries AG, Balchem Corporation, and Capsugel (Lonza Group). Leading companies in the Microencapsulation Market are focusing on product innovation, partnerships, and sustainable technology development to strengthen their market foothold. Many are investing heavily in R&D to develop new encapsulation materials that improve bioavailability, stability, and controlled release properties. Strategic collaborations with food, pharmaceutical, and cosmetic manufacturers are helping expand application areas.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Core Material Type

- 2.2.3 Coating Material

- 2.2.4 Technology

- 2.2.5 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for controlled drug delivery systems

- 3.2.1.2 Growing food fortification & nutraceutical applications

- 3.2.1.3 Increasing adoption of biodegradable coating materials

- 3.2.1.4 Expanding applications in textiles & functional coating

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing costs & equipment investment

- 3.2.2.2 Complex regulatory approval processes

- 3.2.2.3 Technical challenges in scale-up operations

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging applications in self-healing materials

- 3.2.3.2 Growing demand for personalized medicine

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation Landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 Core Material Type

- 3.7.3 Coating Material

- 3.7.4 Technology

- 3.7.5 Application

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Core Material, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Solid core materials

- 5.2.1 Pharmaceutical APIs

- 5.2.2 Vitamins & minerals

- 5.2.3 Enzymes & probiotics

- 5.3 Liquid core materials

- 5.3.1 Essential oils & fragrances

- 5.3.2 Flavoring agents

- 5.3.3 Liquid pharmaceuticals

- 5.4 Gas core materials

- 5.4.1 Oxygen & medical gases

- 5.4.2 Propellants

- 5.5 Specialized core materials

- 5.5.1 Hydrophobic actives

- 5.5.2 Biological materials (vaccines, bacteriophages)

- 5.5.3 Phase change materials (PCMs)

Chapter 6 Market Estimates and Forecast, By Coating Material, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Natural polymers

- 6.2.1 Gelatin

- 6.2.2 Chitosan-alginate composites

- 6.2.3 Silk fibroin

- 6.2.4 Plant-based materials

- 6.3 Synthetic polymers

- 6.3.1 Polyvinyl alcohol (PVA)

- 6.3.2 Ethyl cellulose

- 6.3.3 Cellulose acetate phthalate (CAP)

- 6.3.4 PLGA (Poly Lactic-co-Glycolic Acid)

- 6.3.5 Carbopol polymers

- 6.4 Composite materials

- 6.4.1 Protein-carbohydrate combinations

- 6.4.2 Silica-based materials

- 6.4.3 Formaldehyde-melamine resins

- 6.5 Others

- 6.5.1 Biodegradable polymer blends

- 6.5.2 Smart responsive polymers

- 6.5.3 Inorganic-organic hybrids

Chapter 7 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Chemical methods

- 7.2.1 In-situ polymerization

- 7.2.2 Interfacial polymerization

- 7.2.3 Complex coacervation

- 7.2.4 Simple coacervation

- 7.3 Physiochemical methods

- 7.3.1 Spray drying

- 7.3.2 Fluid bed coating

- 7.3.3 Solvent evaporation

- 7.4 Electrostatic methods

- 7.4.1 Electro spraying

- 7.4.2 Electrohydrodynamic processing

- 7.5 Mechanical methods

- 7.5.1 Air suspension coating

- 7.5.2 Pan coating

- 7.5.3 Centrifugal extrusion

- 7.6 Advanced technology methods

- 7.6.1 Supercritical fluid methods (RESS, SAS, GSSP)

- 7.6.2 Three-fluid nozzle spray drying

- 7.6.3 Pickering emulsion-based encapsulation

- 7.6.4 Ionic gelation

- 7.6.5 Membrane emulsification

- 7.6.6 Sol-gel methods

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Pharmaceuticals & drug delivery

- 8.2.1 Oral drug delivery systems

- 8.2.2 Parenteral formulations

- 8.2.3 Topical & transdermal applications

- 8.2.4 Vaccine & biological delivery

- 8.3 Food & nutritional products

- 8.3.1 Functional foods & nutraceuticals

- 8.3.2 Food additives & preservatives

- 8.3.3 Probiotic delivery systems

- 8.4 Agrochemicals & pesticides

- 8.4.1 Controlled release fertilizers

- 8.4.2 Pesticide formulations

- 8.4.3 Seed coating applications

- 8.5 Industrial applications

- 8.5.1 Textiles & functional coatings

- 8.5.2 Construction & self-healing materials

- 8.5.3 Oil & gas applications

- 8.5.4 Weather modification

- 8.6 Consumer products

- 8.6.1 Cosmetics & dermo cosmetics

- 8.6.2 Household & personal care

- 8.6.3 Fragrance & aromatherapy

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 DOW Corning

- 10.2 BASF SE

- 10.3 Evonik Industries AG

- 10.4 DSM N.V.

- 10.5 Syngenta AG

- 10.6 3M Company

- 10.7 Ashland Global Holdings Inc.

- 10.8 Coating Place Inc.

- 10.9 Capsugel (Lonza Group)

- 10.10 Balchem Corporation

- 10.11 Aveka Inc.