PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876814

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876814

Ski Gear and Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

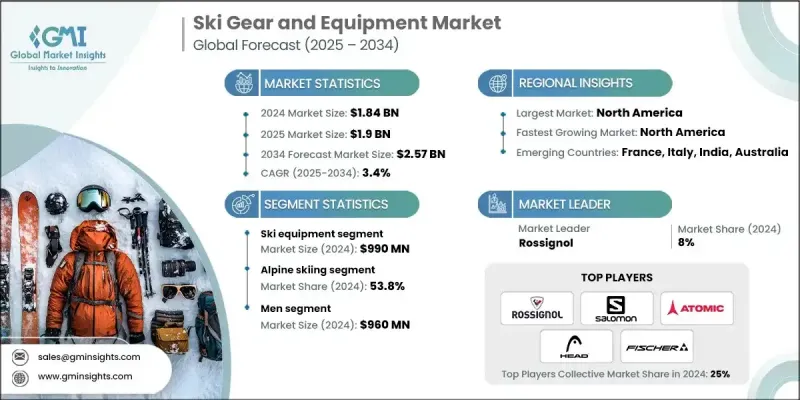

The Global Ski Gear and Equipment Market was valued at USD 1.84 billion in 2024 and is estimated to grow at a CAGR of 3.4% to reach USD 2.57 billion by 2034.

Growing enthusiasm for winter recreation is playing a key role in expanding the market as skiing, snowshoeing, and other cold-weather activities gain traction across broader demographics. Youth participation continues to rise, and an increasing number of women and families are engaging with winter sports due to heightened visibility across digital platforms and evolving lifestyle trends. Governments promoting these activities through training programs and upgraded facilities are further contributing to stronger consumer engagement. The shift toward active, outdoor-focused lifestyles, combined with a booming interest in adventure travel, has strengthened skiing's appeal among travelers looking for unique experiences. Resort development and modernization across both established and emerging ski destinations are also accelerating equipment demand. As more consumers prioritize safety, performance, and comfort, ski manufacturers are responding with advanced gear, materials, and technologies. With these dynamics in place, the ski gear market continues to expand its influence across recreational and competitive sports communities worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.84 Billion |

| Forecast Value | $2.57 Billion |

| CAGR | 3.4% |

In 2024, the ski equipment segment generated USD 990 million. Product innovation continues to evolve as brands prioritize design improvements centered around enhanced safety, ergonomic fit, and consistent performance. Helmets, goggles, and other protective gear now feature integrated technology, upgraded coatings, and improved ventilation systems to support user comfort. Advancements in bindings and boots, including precision release mechanisms and adjustable fit components, are being adopted widely by both dedicated enthusiasts and professional athletes seeking elevated control and stability on the slopes.

Alpine skiing accounted for a 53.8% share in 2024, representing the leading category within the industry. This segment remains influential because it resonates with a large global audience and supports numerous recreational and competitive formats. Alpine skiing holds a deep cultural connection in many mountainous regions and frequently serves as an entry point for newcomers exploring winter sport activities. Its long-standing popularity continues to sustain consistent demand for alpine-specific equipment, making it a vital focus area for major brands and retailers.

U.S. Ski Gear and Equipment Market held 84.7% share and generated USD 590 million in 2024. This strong position reflects the country's established winter sports community and widespread access to well-developed ski destinations. Consumer segments range from casual participants to high-performance athletes, all placing emphasis on durability, safety enhancements, and premium technology. Ongoing interest in sustainable gear materials and tech-driven equipment features is helping support industry growth, while indoor skiing facilities are introducing the sport to urban populations and broadening overall market participation.

Major companies competing in the Ski Gear and Equipment Market include Blizzard, Nordica, Salomon Group, Atomic Austria, Black Crows Skis, Burton Snowboards, Dynastar, Rossignol Group, Elan, Scott Sports, Fischer Sports, K2 Sports, Head Sport, Marker Volkl (part of Tecnica Group), and Tecnica Group. Companies in the ski gear and equipment market are strengthening their foothold by investing in advanced materials, improved safety features, and performance-enhancing technologies. Many are expanding product customization options, offering tailored fits and adjustable equipment to appeal to broader user groups. Partnerships with ski schools, athletes, and resort operators help brands boost visibility and accelerate product adoption. Sustainability is another focal point, with firms integrating recycled inputs and eco-focused manufacturing practices to attract environmentally conscious consumers.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Sport type

- 2.2.4 Price

- 2.2.5 End Use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising popularity of winter sports

- 3.2.1.2 Expansion of ski tourism and infrastructure

- 3.2.1.3 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Seasonality and climate dependency

- 3.2.2.2 High cost of equipment and travel

- 3.2.3 Opportunities

- 3.2.3.1 Rental and subscription models

- 3.2.3.2 Product innovation and customization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Ski equipment

- 5.2.1 Ski bindings

- 5.2.2 Ski boots

- 5.2.3 Ski poles

- 5.2.4 Ski helmets

- 5.2.5 Ski goggles

- 5.2.6 Ski gloves & mittens

- 5.2.7 Others (ski bags & carriers, etc)

- 5.3 Protective gear

- 5.3.1 Helmets

- 5.3.2 Face guards

- 5.3.3 Knee pads

- 5.3.4 Others (back protectors, etc)

- 5.4 Ski apparel

- 5.4.1 Jackets

- 5.4.2 Pants

- 5.4.3 Base layers

- 5.4.4 Ski socks

- 5.4.5 Others (insulated gloves and mittens, etc)

Chapter 6 Market Estimates and Forecast, By Sport Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Alpine skiing

- 6.3 Cross-country skiing

- 6.4 Freestyle skiing

- 6.5 Ski touring

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Price, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Men

- 8.3 Women

- 8.4 Kids

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-commerce platform

- 9.2.2 Company websites

- 9.3 Offline

- 9.3.1 Department stores

- 9.3.2 Specialty sports stores

- 9.3.3 Sporting good retailers

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Atomic Austria

- 11.2 Black Crows Skis

- 11.3 Blizzard

- 11.4 Burton Snowboards

- 11.5 Dynastar

- 11.6 Elan

- 11.7 Fischer Sports

- 11.8 Head Sport

- 11.9 K2 Sports

- 11.10 Marker Volkl (part of Tecnica Group)

- 11.11 Nordica

- 11.12 Rossignol

- 11.13 Salomon

- 11.14 Scott Sports

- 11.15 Tecnica