PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876821

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876821

Animal Feed Protein Hydrolysate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

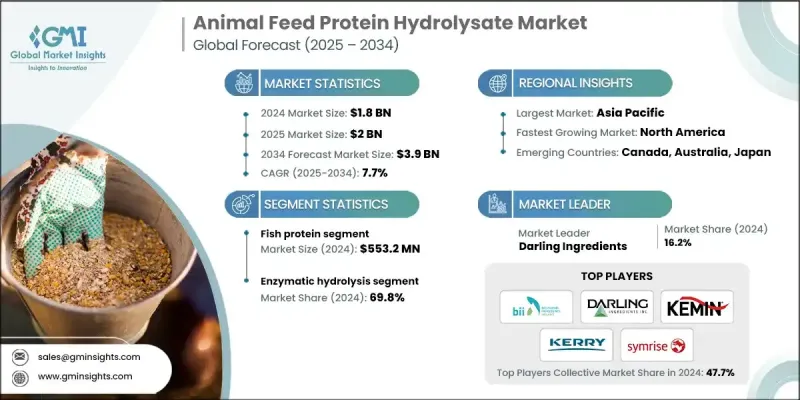

The Global Animal Feed Protein Hydrolysate Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 7.7% to reach USD 3.9 billion by 2034.

The market expansion is influenced by the increasing need for high-quality protein supplements in livestock, aquaculture, and poultry feed to boost growth performance, immunity, and overall health. Animal feed protein hydrolysates are derived from the enzymatic or chemical breakdown of animal proteins and are known for their superior digestibility and bioactivity. As the livestock and aquaculture industries continue to focus on performance enhancement and disease resistance, feed manufacturers are increasingly turning to these hydrolysates as functional additives. This transition toward more nutrient-dense and health-focused animal nutrition is shaping the future of feed formulation. The adoption of advanced enzymatic hydrolysis technologies has further strengthened the market by improving production efficiency, ensuring consistency in peptide structure, and reducing manufacturing costs. These innovations have made it possible to produce hydrolysates with specific functional benefits, promoting better animal health and growth. The continuous drive toward sustainable, nutrient-rich, and performance-boosting feed ingredients will keep fueling demand for animal feed protein hydrolysates globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $3.9 Billion |

| CAGR | 7.7% |

Fish protein generated USD 553.2 million in 2024. Its strong nutritional value, high amino acid profile, and abundance of bioactive compounds make it an ideal ingredient for supporting optimal growth and health in animals. The seafood industry's extensive supply of fish by-products offers a sustainable and cost-effective raw material source for manufacturers. In addition, fish-derived nutrients exhibit excellent digestibility and palatability, making them a preferred choice among feed producers seeking efficient and eco-friendly solutions.

The enzymatic hydrolysis segment accounted for a 69.8% share in 2024, maintaining its position as the most efficient and environmentally sustainable production method. This process allows for precise control of hydrolysis, enabling the development of peptides with specific bioactive properties while preserving nutritional quality. The mild operational conditions of enzymatic hydrolysis ensure high product stability and uniformity. Moreover, it is a greener alternative compared to chemical processes, aligning with the industry's growing focus on sustainable and high-performance animal nutrition ingredients.

North America Animal Feed Protein Hydrolysate Market is projected to grow at a CAGR of 7.8% between 2025 and 2034. The region's market growth is driven by the increasing focus on animal wellness, gut health, and immunity. With a rising preference for sustainable and natural ingredients in animal feed, U.S. feed producers are actively adopting hydrolysate-based formulations. Advancements in enzymatic processes have enhanced digestibility and stability, allowing manufacturers to create high-quality, environmentally friendly products. This aligns with North America's ongoing trend toward organic and eco-conscious feed production.

Prominent players in the Global Animal Feed Protein Hydrolysate Market include Symrise AG, Kerry Group, BioMarine Ingredients Ireland, Kemin Industries, SAMPI, Darling Ingredients, Titan Biotech, Copalis, Janatha Fish Meal, Empro Europe, and Proliver. Key companies in the Animal Feed Protein Hydrolysate Market are focusing on multiple strategies to reinforce their global market position. Many are investing in advanced hydrolysis technologies to improve yield, peptide functionality, and nutritional efficacy. Strategic collaborations and mergers are being pursued to expand product portfolios and regional presence. Firms are also emphasizing sustainable sourcing and circular economy practices to utilize fish and meat by-products efficiently.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Source trends

- 2.2.2 Technology trends

- 2.2.3 Livestock trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for high-quality animal protein

- 3.2.1.2 Growing focus on animal health & nutrition

- 3.2.1.3 Increasing adoption of functional feed additives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs

- 3.2.2.2 Competition from synthetic alternatives

- 3.2.3 Market opportunities

- 3.2.3.1 Emerging protein sources development

- 3.2.3.2 Bioactive peptide applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By source

- 3.9 Future market trends

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries( Note: the trade statistics will be provided for key countries only)

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Fish protein

- 5.2.1 Salmon

- 5.2.2 Tuna

- 5.2.3 Sardine & anchovy

- 5.3 Animal protein

- 5.3.1 Poultry by-product

- 5.3.2 Pork by-product

- 5.3.3 Beef by-product

- 5.3.4 Blood & plasma

- 5.4 Plant protein

- 5.4.1 Soy

- 5.4.2 Rice

- 5.4.3 Pea

- 5.4.4 Others

- 5.5 Milk

- 5.5.1 Whey

- 5.5.2 Casein

- 5.5.3 Milk processing by-products

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Technology, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Enzymatic hydrolysis

- 6.2.1 Alcalase-based processing

- 6.2.2 Protamex-based processing

- 6.2.3 Others

- 6.3 Acid hydrolysis

- 6.3.1 Hydrochloric acid processing

- 6.3.2 Sulfuric acid processing

- 6.3.3 Others

- 6.4 Advanced processing technologies

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Livestock, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Poultry

- 7.2.1 Broiler

- 7.2.2 Layer

- 7.2.3 Turkey

- 7.2.4 Others

- 7.3 Swine

- 7.3.1 Piglet

- 7.3.2 Grower

- 7.3.3 Finisher

- 7.4 Ruminant

- 7.4.1 Cattle

- 7.4.2 Dairy

- 7.4.3 Small ruminants

- 7.5 Aquaculture

- 7.5.1 Finfish

- 7.5.2 Crustacean

- 7.5.3 Mollusk

- 7.6 Companion animal

- 7.6.1 Dog food

- 7.6.2 Cat food

- 7.6.3 Specialty pet foods

- 7.7 Other livestock

- 7.7.1 Equine

- 7.7.2 Exotic & game animals

- 7.7.3 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 BioMarine Ingredients Ireland

- 9.2 Copalis

- 9.3 Darling Ingredients

- 9.4 Empro Europe

- 9.5 Janatha Fish Meal

- 9.6 Kemin Industries

- 9.7 Kerry Group

- 9.8 Proliver

- 9.9 SAMPI

- 9.10 Symrise AG

- 9.11 Titan Biotech