PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876824

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876824

Cloud Microservices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

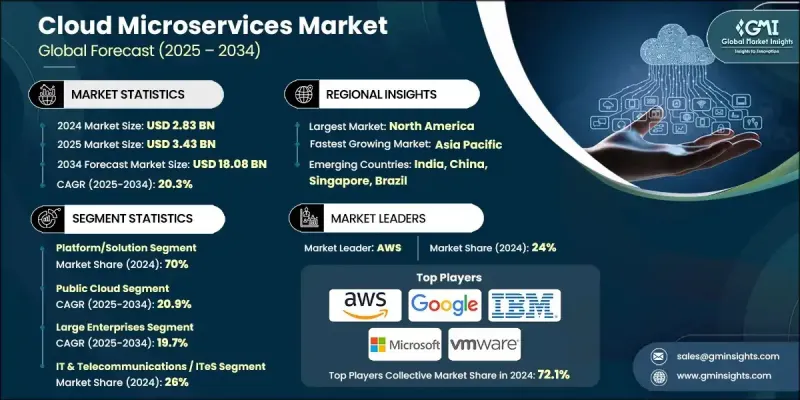

The Global Cloud Microservices Market was valued at USD 2.83 billion in 2024 and is estimated to grow at a CAGR of 20.3% to reach USD 18.08 billion by 2034.

The rapid expansion is driven by the increasing migration of enterprise applications from traditional monolithic systems to modern, cloud-native architectures. Around 62.3% of organizations have adopted microservices and container-based technologies to enhance flexibility, streamline application development, and accelerate software deployment across distributed environments. The modular design of microservices empowers development teams to scale services and deploy updates more efficiently. However, operational challenges remain; 36% of enterprises report integration difficulties, while 35% cite the complexity of applying consistent security policies across diverse service environments. The emergence of artificial intelligence for IT operations (AIOps) is expected to reshape the market, with AI-based automation improving predictive scaling, anomaly detection, and system performance. By combining machine learning with IT operations, organizations are achieving smarter, more reliable, and cost-effective management of microservices environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.83 Billion |

| Forecast Value | $18.08 Billion |

| CAGR | 20.3% |

The platform and solution segment accounted for a 70% share in 2024, establishing itself as the leading contributor to market growth. The increasing reliance on secure, interoperable, and highly scalable development frameworks has fueled this dominance. Enterprises are embracing container orchestration technologies for managing distributed applications, while integrated platforms combining automation, observability, and API management capabilities are gaining traction. These advancements enable businesses to improve efficiency, maintain scalability, and streamline complex microservice-based workflows, reinforcing the segment's substantial share in the global market.

The public cloud segment is forecast to grow at a CAGR of 20.9% through 2034. The growth of this segment is supported by the strong adoption of elastic, managed infrastructure services offered through public cloud environments. Approximately 76% of enterprises deploy their microservice applications through public cloud frameworks due to their cost-effectiveness, scalability, and operational speed. This market segment continues to gain strength due to the maturity of public cloud ecosystems, which provide enhanced DevOps integration, automated orchestration, and native container support factors that simplify deployment and performance management for enterprises worldwide.

United States Cloud Microservices Market generated USD 1.11 billion in 2024. The high rate of cloud adoption across the U.S. business landscape, particularly within information technology and manufacturing industries, is a key contributor to this leadership. More than 60% of firms in the information sector reported active use of cloud-based applications, while small and mid-sized enterprises in manufacturing continue to show fewer adoption barriers compared to earlier years. The steady expansion of cloud usage across various industries positions the U.S. as a major hub for microservices deployment and innovation.

Leading companies in the Global Cloud Microservices Market include Microsoft, Oracle, VMware, Salesforce, Dell Technologies, Google, Alibaba, AWS (Amazon), SAP, and IBM. To strengthen their position in the Global Cloud Microservices Market, major companies are implementing strategies focused on innovation, partnerships, and service expansion. Firms are heavily investing in developing integrated platforms that combine automation, analytics, and AI-driven orchestration to optimize cloud-native operations. Strategic collaborations with software developers, enterprises, and cloud service providers are enabling enhanced interoperability and faster product deployment.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Deployment model

- 2.2.4 Organization Size

- 2.2.5 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing adoption of microservices for cloud-native applications

- 3.2.1.2 Rise of containerization and Kubernetes orchestration

- 3.2.1.3 Demand for continuous integration and continuous delivery (CI/CD)

- 3.2.1.4 Need for resilient and fault-tolerant architectures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complexity in managing distributed services

- 3.2.2.2 Security vulnerabilities in microservices architectures

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of microservices in edge computing

- 3.2.3.2 Integration with AI/ML for intelligent service orchestration

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Cost breakdown analysis

- 3.9 Patent analysis

- 3.10 Sustainability & environmental aspects

- 3.10.1 Carbon Footprint Assessment

- 3.10.2 Circular Economy Integration

- 3.10.3 E-Waste Management Requirements

- 3.10.4 Green Manufacturing Initiatives

- 3.11 Use cases and applications

- 3.12 Best-case scenario

- 3.13 Industry-specific growth opportunities

- 3.13.1 Autonomous vehicle & transportation systems

- 3.13.2 Smart manufacturing & industrial iot

- 3.13.3 Renewable energy & grid management

- 3.13.4 Supply chain & logistics optimization

- 3.13.5 Retail & e-commerce platform evolution

- 3.13.6 Digital health & personalized medicine

- 3.14 Technology convergence & integration trends

- 3.14.1 Multi-cloud & hybrid architecture standardization

- 3.14.2 Zero trust security model implementation

- 3.14.3 Observability & AIops platform integration

- 3.14.4 Gitops & infrastructure-as-code adoption

- 3.14.5 Sustainable computing & green technology

- 3.14.6 Quantum-safe cryptography & security preparation

- 3.15 Open source vs proprietary solution analysis

- 3.16 Data management & analytics platform evolution

- 3.17 Investment & funding landscape analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Platform/Solution

- 5.2.1 Container Orchestration Platforms

- 5.2.2 API Management Platforms

- 5.2.3 DevOps & CI/CD Integration Tools

- 5.2.4 Others

- 5.3 Services

- 5.3.1 Deployment & Integration Services

- 5.3.2 Consulting & Advisory Services

- 5.3.3 Maintenance & Support Services

- 5.3.4 Training & Certification Services

Chapter 6 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Public cloud

- 6.3 Private cloud

- 6.4 Hybrid cloud

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Large Enterprises

- 7.3 Small & Medium Enterprises (SMEs)

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 IT & Telecommunications / ITeS

- 8.3 Retail & e-Commerce

- 8.4 Healthcare

- 8.5 BFSI (Banking, Financial Services & Insurance)

- 8.6 Manufacturing

- 8.7 Media & Entertainment

- 8.8 Government & Public Sector

- 8.9 Transportation & Logistics

- 8.10 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Nordics

- 9.3.7 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 AWS (Amazon)

- 10.1.2 Microsoft

- 10.1.3 Google

- 10.1.4 IBM / Red Hat

- 10.1.5 VMware

- 10.1.6 Oracle

- 10.1.7 Alibaba

- 10.1.8 SAP

- 10.1.9 Salesforce

- 10.1.10 Dell Technologies

- 10.1.11 Hewlett Packard Enterprise (HPE)

- 10.1.12 Cisco Systems

- 10.1.13 Adobe

- 10.1.14 Intel

- 10.1.15 Tencent Cloud

- 10.2 Regional Players

- 10.2.1 Huawei Cloud

- 10.2.2 Baidu Cloud

- 10.2.3 NTT Communications

- 10.2.4 Fujitsu

- 10.2.5 T-Systems

- 10.2.6 Orange Business Services

- 10.2.7 Capgemini

- 10.2.8 Atos

- 10.2.9 Rackspace Technology

- 10.2.10 DigitalOcean

- 10.3 Emerging Players / Disruptors

- 10.3.1 Snowflake

- 10.3.2 Databricks

- 10.3.3 HashiCorp

- 10.3.4 Pulumi

- 10.3.5 Cloudify