PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876826

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1876826

Organoids and Spheroids Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

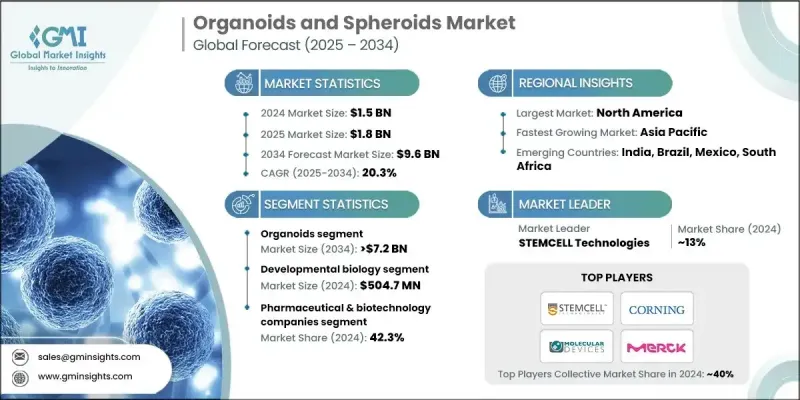

The Global Organoids and Spheroids Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 20.3% to reach USD 9.6 billion by 2034.

Market expansion is accelerating as researchers and developers increasingly depend on advanced 3D cell culture models that mirror human physiology better than traditional 2D systems. This transition is largely fueled by the need for more accurate, scalable, and ethically acceptable preclinical solutions across areas such as regenerative medicine, oncology, and neurology. Growing adoption of patient-derived organoids and spheroids is also contributing to industry momentum, as these models deliver valuable insights into individual treatment responses and biomarker identification. These platforms are transforming targeted therapy development by giving scientists a realistic view of how disease-specific mutations behave and how patient cells react to drugs. Their growing use provides stronger predictability and decreases the inefficiencies often seen in trial-and-error testing. The organoids and spheroids market covers a broad spectrum of applications, including drug discovery, toxicity evaluation, regenerative medicine, disease modelling, and personalized therapeutic strategies, driving strong demand across academic, clinical, and commercial sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $9.6 Billion |

| CAGR | 20.3% |

The organoids segment held a 76.2% share in 2024. Its dominance stems from the ability of organoids to recreate functional and structural features of human tissues, resulting in more reliable modelling of disease mechanisms and drug responses. Demand continues to rise as researchers increasingly integrate organoids into personalized medicine workflows, particularly in oncology, where patient-specific tissue helps guide more precise therapy selection. Their expanding role in regenerative medicine is also spurring adoption across liver, neural, and intestinal tissue engineering initiatives.

The pharmaceutical and biotechnology companies segment held 42.3% share in 2024 due to growing reliance on 3D systems for drug discovery, toxicity evaluation, and personalized therapy development. These organizations are incorporating organoid- and spheroid-based platforms to enhance prediction accuracy during early development and reduce clinical trial failures. Companies are making sizable investments in high-throughput screening systems that allow simultaneous testing of multiple compounds using 3D cultures.

North America Organoids and Spheroids Market accounted for a 42.7% share in 2024. Regional growth is supported by strong biomedical research capabilities, rapid adoption of breakthrough technologies, and significant participation from leading pharmaceutical and biotech developers. The rising prevalence of cancer, neurological disorders, and gastrointestinal diseases is leading to deeper integration of human-relevant preclinical models. The U.S. and Canada are also witnessing increased activity in organoid-based research because of robust research funding, expanding patient-derived biobanks, and widespread use of organoids in precision medicine programs.

Key Organoids and Spheroids Market participants include ACROBiosystems, AMSBIO, ATCC, Corning, Lonza, DefiniGEN, Molecular Devices, Merck KGaA, Prellis Biologics, and STEMCELL Technologies. Companies in the Organoids and Spheroids Market are strengthening their competitive position by expanding their 3D culture platforms, increasing partnerships with pharmaceutical and biotech firms, and investing in automated screening technologies. Many are developing specialized, disease-focused organoid models to support precision medicine initiatives and create differentiated product portfolios. Firms are also enhancing their manufacturing processes to ensure scalability, reproducibility, and regulatory compliance, which is essential for broader adoption in drug discovery and clinical research. Strategic collaborations with academic institutes and healthcare providers help companies access diverse patient-derived samples, allowing them to refine personalized therapy tools. Additionally, technological upgrades in imaging, culture media, and bioprinting systems are enabling companies to deliver more advanced and commercially viable 3D cell culture solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumption and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Type trends

- 2.2.3 Application trends

- 2.2.4 End Use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Advancement in cell culture technologies

- 3.2.1.2 Increase in demand for personalized medicine

- 3.2.1.3 Rise in prevalence of chronic diseases

- 3.2.1.4 Technological advancement in 3D spheroid systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of robust disease models

- 3.2.2.2 High cost of development and maintenance

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of organoid biobanks and rare disease modeling

- 3.2.3.2 Integration of AI and digital platforms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East and Africa

- 3.5 Future market trends

- 3.6 Technological landscape

- 3.6.1 Current technologies

- 3.6.2 Emerging technologies

- 3.7 Patent analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Merger and acquisition

- 4.6.2 Partnership and collaboration

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Organoids

- 5.2.1 By Type

- 5.2.1.1 Neural organoids

- 5.2.1.2 Hepatic organoids

- 5.2.1.3 Intestinal organoids

- 5.2.1.4 Other organoid types

- 5.2.2 By Method

- 5.2.2.1 General submerged method for organoid culture

- 5.2.2.2 Crypt organoid culture techniques

- 5.2.2.3 Air Liquid Interface (ALI) method

- 5.2.2.4 Other organoid culture methods

- 5.2.3 By Source

- 5.2.3.1 Primary tissues

- 5.2.3.2 Stem cells

- 5.2.1 By Type

- 5.3 Spheroids

- 5.3.1 By Type

- 5.3.1.1 Multicellular tumor spheroids

- 5.3.1.2 Neurospheres

- 5.3.1.3 Mammospheres

- 5.3.1.4 Hepatospheres

- 5.3.2 By Method

- 5.3.2.1 Micropatterned plates

- 5.3.2.2 Low cell attachment plates

- 5.3.2.3 Hanging drop method

- 5.3.2.4 Other spheroid culture methods

- 5.3.3 By Source

- 5.3.3.1 Cell line

- 5.3.3.2 iPSCs derived cells

- 5.3.1 By Type

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Developmental biology

- 6.3 Personalized medicine

- 6.4 Regenerative medicine

- 6.5 Disease pathology studies

- 6.6 Drug toxicity & efficacy testing

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Pharmaceutical & biotechnology companies

- 7.3 Academic & research institutes

- 7.4 Hospitals and diagnostic centers

- 7.5 Other End Use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 ACROBiosystems

- 9.2 AMSBIO

- 9.3 ATCC

- 9.4 Corning

- 9.5 DefiniGEN

- 9.6 Lonza

- 9.7 Merck KGaA

- 9.8 Molecular Devices

- 9.9 Prellis Biologics

- 9.10 STEMCELL Technologies