PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885789

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885789

Asia Pacific Metal Fabrication Fluid Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

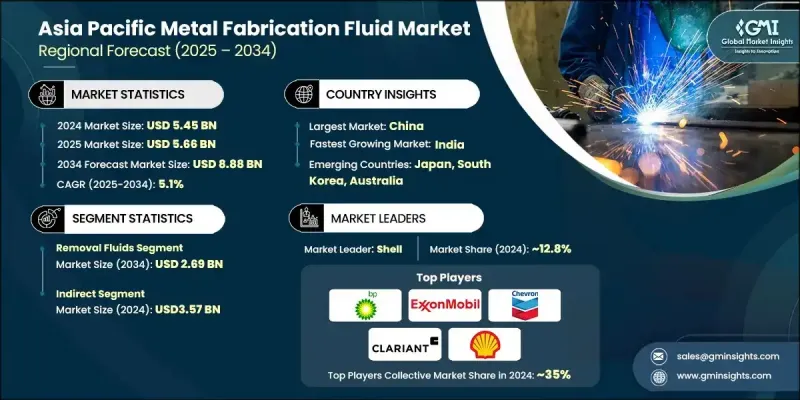

Asia Pacific Metal Fabrication Fluid Market was valued at USD 5.45 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 8.88 billion by 2034.

The market is evolving rapidly, driven by accelerated industrialization, stricter environmental regulations, and the adoption of advanced manufacturing techniques that demand high-performance and eco-friendly formulations. Initiatives aimed at modernizing the manufacturing sector in several countries are encouraging the use of synthetic and semi-synthetic fluids that enhance cooling, lubrication, and corrosion resistance. Precision-driven industries across the region, including automotive and electronics, are elevating performance expectations for metalworking fluids, while investments in automated coolant management and IoT-enabled monitoring systems are helping manufacturers reduce waste and improve efficiency. Growth in shipbuilding, automotive, and infrastructure projects is further boosting demand for high-quality fluids that improve productivity, prolong equipment life, and meet environmental compliance, reinforcing the Asia Pacific metal fabrication fluid market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.45 Billion |

| Forecast Value | $8.88 Billion |

| CAGR | 5.1% |

The removal fluids segment was valued at USD 1.59 billion in 2024 and is expected to reach USD 2.69 billion by 2034. These fluids, including coolants and lubricants, are essential for removing metal chips, swarf, and debris during machining operations. They enhance tool performance, reduce friction and heat, extend equipment lifespan, and improve precision, making them indispensable in automotive, aerospace, and general manufacturing processes.

The indirect segment generated USD 3.57 billion, accounting for a 65.4% share. Distributors, dealers, and retailers help manufacturers access wider geographic regions and fragmented customer bases across Asia Pacific. Long-standing relationships with end users, faster delivery, and efficient logistics make indirect channels cost-effective and attractive, reducing overheads while maintaining service quality.

China Metal Fabrication Fluid Market generated USD 2.26 billion in 2024 and is expected to grow at a CAGR of 5.6% through 2034. With one of the world's largest manufacturing sectors spanning automotive, electronics, aerospace, and heavy machinery, China drives strong demand for cutting, forming, and finishing fluids. Urbanization, infrastructure projects, and the country's export-oriented manufacturing landscape further strengthen the need for high-performance metalworking fluids.

Key players in the Asia Pacific Metal Fabrication Fluid Market include Chevron, FUCHS, ExxonMobil, Quaker Houghton, BP, Yushiro Chemical, Blaser Swisslube, PETRONAS Lubricants, ENEOS Corporation, Idemitsu Kosan, Indian Oil Corporation, SINOPEC, TotalEnergies, Master Fluid Solutions, and HPCL. Companies in the Asia Pacific Metal Fabrication Fluid Market are adopting multiple strategies to expand their market presence. They are investing heavily in R&D to develop advanced synthetic and semi-synthetic formulations with superior cooling, lubrication, and anti-corrosion properties. Strategic partnerships with manufacturers and distributors help increase reach in fragmented regional markets. Firms are enhancing automation, IoT monitoring systems, and coolant management solutions to improve efficiency and reduce operational waste. Investments in eco-friendly products and compliance with environmental regulations strengthen brand credibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country trends

- 2.2.2 Product type trends

- 2.2.3 Fluid type trends

- 2.2.4 Usage trends

- 2.2.5 End Use industry trends

- 2.2.6 Distribution channel trends

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

- 2.5 Strategic recommendations

- 2.5.1 Supply chain diversification strategy

- 2.5.2 Product portfolio enhancement

- 2.5.3 Partnership and alliance opportunities

- 2.5.4 Cost management and pricing strategy

- 2.6 Decision framework

- 2.6.1 Investment priority matrix

- 2.6.2 ROI analysis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing industrialization and manufacturing growth

- 3.2.1.2 Technological advancements in metalworking processes

- 3.2.1.3 Rising demand from automotive and aerospace industries

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Volatility in raw material prices

- 3.2.2.2 High maintenance costs

- 3.2.3 Opportunities

- 3.2.3.1 Rising demand from automotive and EV manufacturing

- 3.2.3.2 Expansion of infrastructure and construction projects

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.6 Current technological trends

- 3.6.1 Emerging technologies

- 3.6.1.1 Nano-Enhanced Formulations and Advanced Additives

- 3.6.1.2 IoT and Smart Fluid Management Systems

- 3.6.1.3 Minimum Quantity Lubrication (MQL) Technology

- 3.6.1.4 Circular Economy and Fluid Recycling

- 3.6.1.5 Digital Twin and Predictive Maintenance Integration

- 3.6.1 Emerging technologies

- 3.7 Price trends

- 3.7.1 By country and product type

- 3.7.2 Raw material cost

- 3.7.3 Real vs. perceived capacity constraints in supply of raw materials

- 3.7.4 Supplier price increase validation

- 3.8 Regulatory framework

- 3.8.1 By country

- 3.9 Market entry framework

- 3.9.1 Market entry strategy options and evaluation

- 3.9.2 Partnership and joint venture opportunities

- 3.9.3 Acquisition targets and consolidation opportunities

- 3.9.4 Regulatory compliance and certification requirements

- 3.9.5 Investment requirements and ROI analysis

- 3.9.6 Risk assessment and mitigation strategies

- 3.10 Porter's five forces analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Country

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Product portfolio benchmarking

- 4.7 Key developments

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New Product Launches

- 4.7.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Billion) (Thousand Liters)

- 5.1 Key trends

- 5.2 Removal fluids

- 5.3 Forming fluids

- 5.4 Protective fluids

- 5.5 Treating fluids

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Fluid Type, 2021 - 2034 (USD Billion) (Thousand Liters)

- 6.1 Key trends

- 6.2 Water-Based fluids

- 6.3 Oil-Based fluids

- 6.4 Solvent-Based fluids

Chapter 7 Market Estimates & Forecast, By Usage, 2021 - 2034 (USD Billion) (Thousand Liters)

- 7.1 Key trends

- 7.2 Machining

- 7.3 Metal forming

- 7.4 Heat treatment

- 7.5 Corrosion protection

- 7.6 Bending

- 7.7 Welding

- 7.8 Finishing

- 7.9 Others

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Thousand Liters)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Aerospace

- 8.4 Heavy machinery

- 8.5 Metal fabrication

- 8.6 Oil & gas

- 8.7 Construction

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Thousand Liters)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Country, 2021 - 2034, (USD Billion) (Thousand Liters)

- 10.1 Key trends

- 10.2 China

- 10.3 India

- 10.4 Japan

- 10.5 South Korea

- 10.6 Australia

- 10.7 Indonesia

- 10.8 Thailand

- 10.9 Vietnam

- 10.10 Malaysia

- 10.11 Philippines

- 10.12 Rest of APAC

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Blaser Swisslube

- 11.2 BP

- 11.3 Chevron

- 11.4 ENEOS Corporation

- 11.5 ExxonMobil

- 11.6 FUCHS

- 11.7 HPCL

- 11.8 Idemitsu Kosan

- 11.9 Indian Oil Corporation

- 11.10 Master Fluid Solutions

- 11.11 PETRONAS Lubricants

- 11.12 Quaker Houghton

- 11.13 SINOPEC

- 11.14 TotalEnergies

- 11.15 Yushiro Chemical