PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885800

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885800

Retail Packaging and Display Boxes for Consumer Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

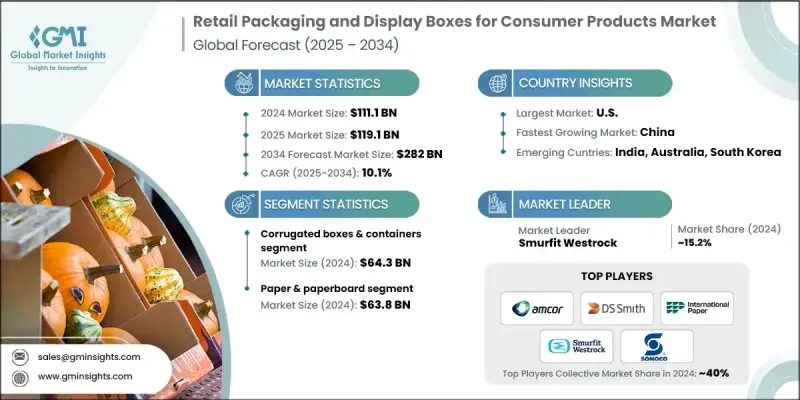

The Global Retail Packaging and Display Boxes for Consumer Products Market was valued at USD 111.1 billion in 2024 and is estimated to grow at a CAGR of 10.1% to reach USD 282 billion by 2034.

The sector is undergoing transformative changes driven by evolving environmental regulations, shifting consumer expectations, and technological innovations. Packaging companies are adapting to a complex regulatory landscape, with stricter requirements on recyclability, waste management, and chemical safety. Simultaneously, smart and connected packaging is emerging, enabled by Internet of Things (IoT) technologies, allowing packages to communicate real-time information across the supply chain. Raw material suppliers produce flexible substrates, conductive inks, and sensor-compatible materials that maintain traditional packaging functionality while integrating digital features. Brands are increasingly leveraging these innovations to deliver interactive experiences, enhance product visibility, and reinforce sustainability commitments, all while maintaining cost efficiency and scalability across global retail and e-commerce channels.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $111.1 Billion |

| Forecast Value | $282 Billion |

| CAGR | 10.1% |

In 2024, the corrugated boxes and containers segment generated USD 64.3 billion and is expected to grow at a CAGR of 9.7% through 2034. Its popularity stems from versatility, cost-effectiveness, and applicability across retail and online commerce. Corrugated materials are highly recyclable and biodegradable, supporting sustainability goals and meeting consumer preferences. Advances in printing and die-cutting technologies allow brands to create personalized, eye-catching packaging with strong shelf appeal.

The paper and paperboard segment generated USD 63.8 billion in 2024. Paper-based packaging is valued for its recyclability and biodegradability, aligning with both regulatory requirements and eco-conscious consumer behavior. Its adaptability across folding cartons, rigid boxes, and display-ready packaging makes it ideal for a wide range of products, including food, cosmetics, electronics, and apparel.

U.S. Retail Packaging and Display Boxes for Consumer Products Market reached USD 22.3 billion in 2024. Growth is driven by the country's robust retail and e-commerce infrastructure, along with consumer demand for sustainable and personalized packaging. Regulatory support combined with heightened consumer awareness is prompting manufacturers to focus on recyclable and compostable formats, enhancing both brand reputation and environmental compliance.

Key players in the Global Retail Packaging and Display Boxes for Consumer Products Market include Graphic Packaging International, Stora Enso, DS Smith, Amcor, Mondi Group, Bennett Packaging, BW Packaging Systems, Weedon Direct, Sonoco Products Company, Karl Knauer Group, Georgia-Pacific, Barry-Wehmiller Corporation, Ashtonne Packaging, Smurfit Westrock, and International Paper Company. Companies are strengthening their presence through strategies such as expanding sustainable product lines, investing in advanced printing and die-cutting technologies, and improving supply chain efficiency. Strategic partnerships and acquisitions help broaden geographic reach and customer base. Firms are also focusing on innovation in smart and interactive packaging, developing eco-friendly and cost-effective materials, and enhancing brand customization options.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type trends

- 2.2.2 Material Type trends

- 2.2.3 Price trends

- 2.2.4 End Use trends

- 2.2.5 Distribution channel trends

- 2.2.6 Regional trends

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

- 2.5 Strategic recommendations

- 2.5.1 Supply chain diversification strategy

- 2.5.2 Product portfolio enhancement

- 2.5.3 Partnership and alliance opportunities

- 2.5.4 Cost management and pricing strategy

- 2.6 Decision framework

- 2.6.1 Investment priority matrix

- 2.6.2 Risk-adjusted ROI analysis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Pricing analysis, 2024

- 3.4.1 By region and product type

- 3.4.2 Raw material cost

- 3.5 Future market trends

- 3.6 Risk assessment and mitigation

- 3.6.1 Regulatory compliance risks

- 3.6.2 Capacity constraint impact analysis

- 3.6.3 Technology transition risks

- 3.6.4 Pricing volatility and cost escalation risks

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Corrugated boxes & container

- 5.2.1 Single-wall corrugated boxes

- 5.2.2 Double-wall corrugated boxes

- 5.2.3 Triple-wall heavy-duty containers

- 5.2.4 Specialty flute configurations (E, F, micro-flute)

- 5.3 Folding paperboard boxes

- 5.3.1 Tuck-end cartons

- 5.3.2 Auto-bottom cartons

- 5.3.3 Reverse-tuck configurations

- 5.3.4 Specialty closure systems

- 5.4 Rigid set-up boxes

- 5.4.1 Telescopic boxes

- 5.4.2 Magnetic closure systems

- 5.4.3 Drawer-style boxes

- 5.4.4 Book-style & clamshell boxes

- 5.5 Display-ready packaging

- 5.5.1 Shelf-ready packaging (SRP)

- 5.5.2 Retail-ready packaging (RRP)

- 5.5.3 Point-of-purchase displays

- 5.5.4 Free-standing display units (FSDU)

- 5.6 Die-cut display containers

- 5.6.1 Counter displays

- 5.6.2 Floor displays

- 5.6.3 Promotional fixtures

- 5.6.4 Seasonal display solutions

Chapter 6 Market Estimates & Forecast, By Material Type, 2021 - 2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Paper & paperboard

- 6.4 Glass

- 6.5 Metal

- 6.6 Others (sustainable alternatives, etc.)

Chapter 7 Market Estimates & Forecast, By Price, 2021 - 2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Economy

- 7.3 Mid-range

- 7.4 Premium

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Food & beverages

- 8.2.1 Fresh produce & perishables

- 8.2.2 Processed foods & snacks

- 8.2.3 Beverages & liquid products

- 8.2.4 Dairy & refrigerated products

- 8.3 Cosmetics & personal care

- 8.3.1 Beauty & skincare products

- 8.3.2 Fragrances & luxury cosmetics

- 8.3.3 Personal hygiene products

- 8.3.4 Professional beauty tools

- 8.4 Pharmaceuticals & healthcare

- 8.4.1 Over-the-counter medications

- 8.4.2 Medical devices & equipment

- 8.4.3 Health supplements & nutraceuticals

- 8.4.4 Diagnostic & testing kits

- 8.5 Electronics & consumer goods

- 8.5.1 Small appliances & gadgets

- 8.5.2 Consumer electronics accessories

- 8.5.3 Technology products & components

- 8.5.4 Gaming & entertainment products

- 8.6 Others (apparel and fashion, tools and hardware, etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 U.K.

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Amcor

- 11.2 Ashtonne Packaging

- 11.3 Barry-Wehmiller Corporation

- 11.4 Bennett Packaging

- 11.5 BW Packaging Systems

- 11.6 DS Smith

- 11.7 Georgia-Pacific

- 11.8 Graphic Packaging International

- 11.9 International Paper Company

- 11.10 Karl Knauer Group

- 11.11 Mondi Group

- 11.12 Smurfit Westrock

- 11.13 Sonoco Products Company

- 11.14 Stora Enso

- 11.15 Weedon Direct