PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885809

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885809

Solid Carbide Tools Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

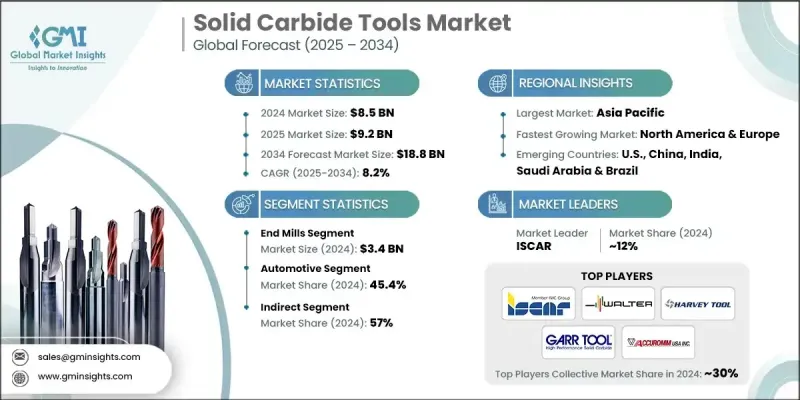

The Global Solid Carbide Tools Market was valued at USD 8.5 billion in 2024 and is estimated to grow at a CAGR of 8.2% to reach USD 18.8 billion by 2034.

The market growth is driven by increasing demand in automotive and electric vehicle (EV) manufacturing. As automakers focus on reducing vehicle weight and improving performance efficiency, there is a growing preference for high-performance materials and precision components, which in turn elevates the need for advanced cutting tools. Solid carbide tools offer unmatched hardness, heat resistance, and durability, making them ideal for machining aluminum, composites, and advanced alloys. The adoption of automation, CNC machining, and smart manufacturing technologies is further propelling market demand. High-speed machines and robotic systems require tools capable of maintaining precision under extreme conditions. Solid carbide tools, often enhanced with advanced coatings and optimized geometries, are specifically designed to sustain these demanding manufacturing environments while delivering consistent, high-quality results.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.5 Billion |

| Forecast Value | $18.8 Billion |

| CAGR | 8.2% |

The end mills segment generated USD 3.4 billion in 2024 and is expected to grow at a CAGR of 8.7% from 2025 to 2034. End mills are critical for operations such as profiling, slotting, contouring, and finishing complex surfaces. Rising EV production and lightweighting trends are driving demand for machining advanced materials such as aluminum, titanium, and composites, which require tools with superior hardness and wear resistance. Solid carbide end mills excel in meeting these demanding requirements, particularly in automotive, aerospace, and electronics manufacturing.

The automotive sector held a 45.4% share and is projected to grow at a CAGR of 8.6% through 2034. The production of electric vehicles has heightened the need for machining lightweight components like aluminum, magnesium alloys, and composites, all of which demand durability and wear resistance of solid carbide tools. Automotive manufacturers are increasingly deploying high-speed CNC machining and automation to reduce cycle times and meet stringent quality standards, further boosting demand for precision-tooling solutions.

U.S. Solid Carbide Tools Market generated USD 2 billion in 2024 and is expected to grow at a CAGR of 8.5% through 2034. The country's automotive and aerospace industries are major consumers of precision tools, driven by the machining of lightweight materials such as aluminum, titanium, and composites. Additionally, the widespread adoption of Industry 4.0 practices, including automation, CNC systems, and smart factory solutions, has increased reliance on high-precision and durable solid carbide tools.

Key players in the Global Solid Carbide Tools Market include Accuromm, Accusharp, Birla Precision Technologies, DIC Tools, Fullerton Tool, Garr Tool, Hannibal Carbide Tool, Harvey Tool, ISCAR, Johnson Carbide, Mitsubishi, Orient Tools, Samtec Tools, SwiftCARB, Tixna Tools, and Walter Tools. Companies in the Solid Carbide Tools Market are strengthening their presence by focusing on product innovation, such as advanced coatings, optimized geometries, and specialized tools for lightweight and composite materials. Many firms are investing in automation-compatible solutions and CNC-ready tools to serve the growing demand from high-speed manufacturing environments. Strategic collaborations with automotive, aerospace, and electronics manufacturers help expand market reach and ensure tailored solutions for complex machining requirements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Coating type

- 2.2.4 Application

- 2.2.5 End use industry

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand in automotive & EV manufacturing

- 3.2.1.2 Adoption of automation / CNC machining / smart manufacturing

- 3.2.1.3 Rising focus on productivity & cost efficiency

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High raw material & production costs

- 3.2.2.2 Supply chain disruptions & complexity

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Trade statistics

- 3.8.1 Major importing countries

- 3.8.2 Major exporting countries

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Consumer behavior analysis

- 3.11.1 Purchasing patterns

- 3.11.2 Preference analysis

- 3.11.3 Regional variations in consumer behavior

- 3.11.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 End mills

- 5.2.1 Ball nose end mills

- 5.2.2 Square end mills

- 5.2.3 Corner radius end mills

- 5.3 Drills

- 5.3.1 Twist drills

- 5.3.2 Step drills

- 5.3.3 Micro drills

- 5.3.4 Gun drills

- 5.4 Reamers

- 5.4.1 Straight flute reamers

- 5.4.2 Spiral flute reamers

- 5.4.3 Adjustable reamers

- 5.5 Taps

- 5.6 Inserts

- 5.7 Others (boring bars etc.)

Chapter 6 Market Estimates & Forecast, By Coating Type, 2021 - 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 TiN (Titanium nitride)

- 6.3 TiCN (Titanium carbonitride)

- 6.4 TiAlN (Titanium aluminum nitride)

- 6.5 AlCrN (Aluminum chromium nitride)

- 6.6 Diamond coatings

- 6.7 Uncoated carbide

- 6.7.1 Standard grades

- 6.7.2 Micro-grain grades

- 6.7.3 Nano-grain grades

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Milling

- 7.3 Drilling

- 7.4 Reaming

- 7.5 Threading

- 7.6 Turning

- 7.7 Others (engraving etc.)

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021 - 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Aerospace

- 8.3 Automotive

- 8.4 Medical devices

- 8.5 Electronics & semiconductors

- 8.6 General engineering

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Indonesia

- 10.4.7 Malaysia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 UAE

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Accuromm

- 11.2 Accusharp

- 11.3 Birla Precision Technologies

- 11.4 DIC Tools

- 11.5 Fullerton Tool

- 11.6 Garr Tool

- 11.7 Hannibal Carbide Tool

- 11.8 Harvey Tool

- 11.9 ISCAR

- 11.10 Johnson Carbide

- 11.11 Mitsubishi

- 11.12 Orient Tools

- 11.13 Samtec Tools

- 11.14 SwiftCARB

- 11.15 Tixna Tools

- 11.16 Walter Tools