PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885811

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885811

Green Hydrogen Production Chemicals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

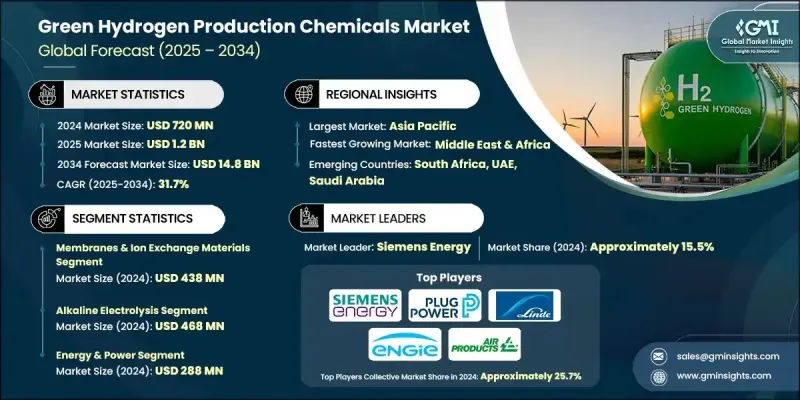

The Green Hydrogen Production Chemicals Market was valued at USD 720 million in 2024 and is estimated to grow at a CAGR of 31.7% to reach USD 14.8 billion by 2034.

Industry momentum continues to accelerate as governments intensify decarbonization mandates and roll out subsidy frameworks that directly support chemical inputs used in green hydrogen production. These measures have improved project financing, increased investor assurance, and motivated industries to transition toward low-carbon chemical processes. Rapid declines in the cost of wind and solar power have also strengthened the market outlook, enabling producers to operate electrolysers with more affordable renewable electricity, which remains the primary cost driver. As renewable pricing continues to fall, large-scale green hydrogen and derivative chemical production has become increasingly viable, expanding the market's commercial attractiveness. Meanwhile, lower capital costs and improved efficiencies in electrolyser technology have reduced overall production expenses. This shift is pushing manufacturers to scale up, develop new and advanced process chemicals, and adopt high-performance catalysts and membranes, strengthening value creation across the supply chain.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $720 Million |

| Forecast Value | $14.8 Billion |

| CAGR | 31.7% |

The membranes and ion-exchange materials segment was valued at USD 438 million in 2024 and is forecast to grow at a CAGR of 41.2% from 2025 to 2034. These materials are being integrated more widely into electrolyser systems as producers aim to enhance operational performance. Higher-grade catalysts and purer electrolytes are being deployed to maximize conversion efficiency and reduce energy losses, while durable membranes are becoming essential to support the reliability of PEM and AEM units. Their role in enabling continuous operation and stable system performance is driving long-term demand in this segment.

The alkaline electrolysis segment reached USD 468 million in 2024 and is expected to grow at a CAGR of 28.4% from 2025 to 2034. Demand is rising as alkaline and PEM electrolysis technologies gain traction in commercial settings. Alkaline systems require robust catalysts and stable electrolytes to maintain steady output, while PEM technologies depend on high-efficiency membranes, ion-exchange materials, and advanced catalysts. Their growing deployment across industrial hubs and hydrogen-driven facilities is increasing the need for reliable, high-quality chemical inputs that support performance and long operating lifespans.

North America Green Hydrogen Production Chemicals Market was valued at USD 50.4 million in 2024. Expanding renewable energy adoption and federal incentive programs are boosting hydrogen manufacturing activities and chemical consumption across the region. Rising investments in electrolyser development, clean-energy infrastructures, and hydrogen transport networks are further increasing the use of catalysts, membranes, purification chemicals, and water-treatment agents across new projects. Key companies active in this space include ENGIE, Siemens Energy AG, Linde plc, Plug Power Inc., Air Products and Chemicals, Inc., and other participants.

Leading companies in the Global Green Hydrogen Production Chemicals Market are strengthening their competitive position through several focused strategies. Many are investing heavily in R&D to design higher-efficiency catalysts, membranes, and electrolytes that enhance electrolyser performance and reduce overall production costs. Strategic partnerships with renewable energy developers, electrolyser manufacturers, and industrial end users are increasingly common, ensuring long-term supply agreements and integrated project development. Companies are also expanding manufacturing capacity to meet rising demand and are localizing production to reduce logistics costs and qualify for regional incentives. Sustainability commitments and portfolio diversification into advanced materials, specialized chemical inputs, and next-generation hydrogen technologies are further reinforcing their market foothold.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Chemical Type

- 2.2.3 Production Technology

- 2.2.4 End Use Industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Chemical Type, 2021- 2034 (USD Million, Kilo Tons)

- 5.1 Key trends

- 5.2 Catalysts

- 5.2.1 Electrolysis catalysts (PEM, alkaline, solid oxide)

- 5.2.2 Photocatalysts

- 5.3 Electrolytes

- 5.3.1 Acidic electrolytes

- 5.3.2 Alkaline electrolytes

- 5.4 Membranes & ion exchange materials

- 5.4.1 Proton exchange membranes

- 5.4.2 Anion exchange membranes

- 5.5 Water treatment chemicals

- 5.5.1 Deionization agents

- 5.5.2 Anti-scaling agents

- 5.5.3 Corrosion inhibitors

- 5.6 Gas purification chemicals

- 5.6.1 Oxygen removal agents

- 5.6.2 Moisture absorbers

Chapter 6 Market Estimates and Forecast, By Production Technology, 2021 - 2034 (USD Million, Kilo Tons)

- 6.1 Key trends

- 6.2 Alkaline electrolysis

- 6.3 Proton exchange membrane (PEM) electrolysis

- 6.4 Solid oxide electrolysis

- 6.5 Photoelectrochemical water splitting

- 6.6 Thermochemical processes

Chapter 7 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Million, Kilo Tons)

- 7.1 Key trends

- 7.2 Energy & power

- 7.3 Transportation

- 7.4 Industrial processing

- 7.5 Chemical manufacturing

- 7.6 Electronics

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Air Liquide S.A.

- 9.2 Air Products and Chemicals, Inc.

- 9.3 Linde plc

- 9.4 Siemens Energy AG

- 9.5 ENGIE

- 9.6 Plug Power Inc.

- 9.7 Bloom Energy Corporation

- 9.8 Nel Hydrogen

- 9.9 Cummins Inc.

- 9.10 McPhy Energy S.A.

- 9.11 thyssenkrupp AG

- 9.12 Ballard Power Systems Inc.

- 9.13 Reliance Industries Ltd.

- 9.14 Adani Green Energy Ltd.

- 9.15 Sinopec