PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885818

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885818

Wilsons Disease Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

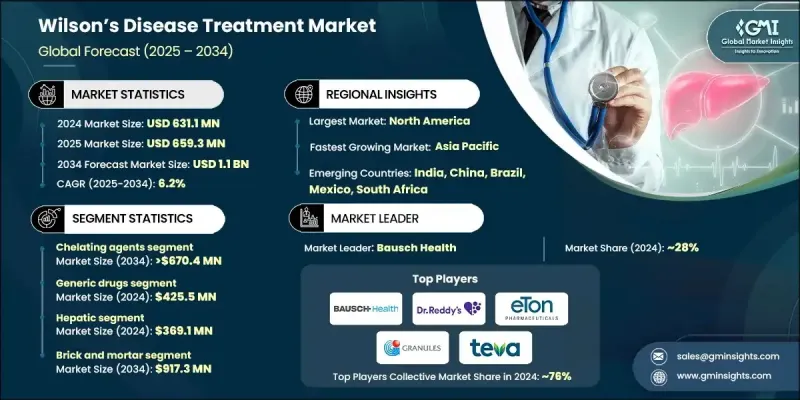

The Global Wilsons Disease Treatment Market was valued at USD 631.1 million in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 1.1 billion by 2034.

Market expansion continues to be shaped by rising disease prevalence, improved clinical awareness, broader use of chelation and zinc-based therapies, and steady advancements in drug development. Increasing access to specialty care and multidisciplinary treatment centers also supports stronger adoption of long-term therapy. Wilson's disease treatment focuses on managing excessive copper buildup caused by inherited defects in copper regulation, relying mainly on chelators and zinc formulations that enhance excretion or reduce absorption. These therapies aim to protect organs-most critically the liver and central nervous system-while sustaining healthy copper levels throughout a patient's lifetime.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $631.1 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 6.2% |

The chelating agents held a 60% share in 2024 owing to their longstanding role in guidelines and their ability to rapidly clear excess copper. Their effectiveness in addressing both neurological and hepatic complications supports ongoing physician preference worldwide. The continued reliance on agents such as trientine and penicillamine reinforces strong, consistent global demand.

The generic drugs category captured USD 425.5 million in 2024 and is expected to grow at a CAGR of 6.3% through 2034. Lower-cost versions of widely used chelators and zinc therapies provide significant affordability advantages, supporting sustained patient adherence since treatment must be maintained lifelong. Patent expirations across several therapies have enabled a broader range of manufacturers to enter the market, increasing availability within cost-sensitive healthcare systems.

U.S. Wilsons Disease Treatment Market generated USD 228.6 million in 2024. North America benefits from a strong diagnostic infrastructure, including widespread use of genetic analysis, biochemical testing, and imaging tools, enabling more timely detection of the condition. As early diagnosis rates rise, therapy initiation expands, supporting sustained market growth. Broad access to branded and generic medications across the region also ensures reliable treatment availability, supported by regulatory approvals and strong supply chains.

Prominent companies active in the Global Wilsons Disease Treatment Market include Breckenridge Pharmaceutical, Nobelpharma, TAJ PHARMA, Dr. Reddy's Laboratories, TSUMURA, Teva Pharmaceutical, Zydus Group, Bausch Health, Eton Pharmaceuticals, Optimus Pharma, Biophore, Granules, Invagen Pharmaceuticals, and Orphalan. Companies competing in the Global Wilsons Disease Treatment Market are strengthening their market foothold through multiple strategies. Many firms are expanding their portfolios of chelators and zinc-based formulations to meet increasing therapeutic demand and widen patient access. Investments in improved drug delivery systems aim to enhance tolerability and long-term adherence, especially for chronic management. Manufacturers are also emphasizing cost-efficient production to support competitive pricing in both branded and generic segments. Collaborations with clinical research groups help advance next-generation treatments and support evidence-based positioning.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Treatment type trends

- 2.2.3 Drug type trends

- 2.2.4 Indication trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising availability of chelating agents and zinc-based therapies

- 3.2.1.2 Expansion of orphan drug designations and regulatory support

- 3.2.1.3 Advancements in treatment adherence and monitoring tools

- 3.2.1.4 Improved clinical guidelines and treatment standardization

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of branded and orphan-designated drugs

- 3.2.2.2 Limited patient population and low commercial attractiveness

- 3.2.3 Market opportunities

- 3.2.3.1 Introduction of next-generation chelators and safer formulations

- 3.2.3.2 Growing focus on gene therapy and curative research

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Reimbursement scenario

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.6 Technology landscape

- 3.6.1 Current technological trends

- 3.6.2 Emerging technologies

- 3.7 Consumer insights

- 3.8 Pipeline analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Future market trends

- 3.12 Clinical trial scenario

- 3.13 Gap analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.4 Competitive positioning matrix

- 4.5 Competitive analysis of major market players

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New treatment type launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Treatment Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Chelating agents

- 5.2.1 D-penicillamine

- 5.2.2 Trientine hydrochloride

- 5.2.3 Trientine tetrahydrochloride

- 5.2.4 Dimercaprol

- 5.3 Zinc salts

- 5.3.1 Zinc acetate

- 5.3.2 Zinc sulfate

- 5.4 Combination therapy

Chapter 6 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Generic drugs

- 6.3 Branded drugs

Chapter 7 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hepatic

- 7.3 Neurological and psychiatric

- 7.4 Other indications

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Brick and mortar

- 8.3 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Bausch Health

- 10.2 Biophore

- 10.3 Breckenridge Pharmaceutical

- 10.4 Dr. Reddy’s Laboratories

- 10.5 Eton Pharmaceuticals

- 10.6 GRANULES

- 10.7 Invagen Pharmaceuticals

- 10.8 Nobelpharma

- 10.9 Optimus Pharma

- 10.10 Orphalan

- 10.11 TAJ PHARMA

- 10.12 Teva Pharmaceutical

- 10.13 TSUMURA

- 10.14 Zydus Group