PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885822

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885822

Hardware-in-the-Loop (HIL) Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

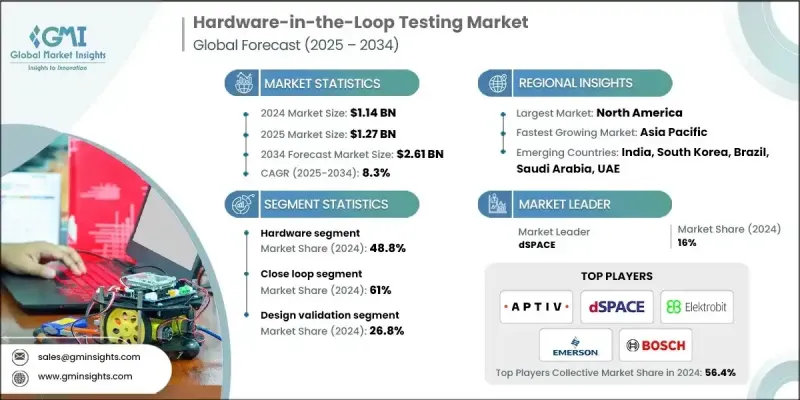

The Global Hardware-in-the-Loop (HIL) Testing Market was valued at USD 1.14 billion in 2024 and is estimated to grow at a CAGR of 8.3% to reach USD 2.61 billion by 2034.

The rapid shift toward advanced control architectures and the push for faster product validation have amplified the need for real-time simulation environments that can mirror highly complex system behaviors. HIL platforms support continuous software verification, broad multi-domain testing, and earlier detection of operational faults, making them an essential part of modern engineering workflows. With development cycles accelerating, solution providers are broadening their technical capabilities, scaling real-time computing resources, adding higher-density I/O boards, and deepening cooperation with software toolchains. These enhancements cater to rising demand in electric mobility, aviation research, and next-generation energy systems. Companies are increasingly relying on HIL testing to evaluate high-voltage architectures, propulsion units, and grid-connected equipment under thermal, aging, and fluctuating load conditions without placing actual devices at risk. This evolution positions HIL technology as a core enabler for advanced verification practices across multiple industrial sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.14 Billion |

| Forecast Value | $2.61 Billion |

| CAGR | 8.3% |

The hardware segment held 48.8% share in 2024 and is projected to grow at a 7.1% CAGR through 2034. Its prominence stems from the need for high-performance physical components, including real-time computing units, channel-rich interface modules, programmable processors, specialized load units, and power-focused rigs. These systems deliver precise, microsecond-level performance needed to validate controllers and embedded logic used in critical operational environments. Industries such as transportation, defense, and energy rely on these hardware platforms to examine real-world behavior of electric propulsion systems, safety-driven controllers, and advanced protection technologies.

The closed-loop category held a 61% share in 2024 and is projected to grow at 8% from 2025 to 2034. This approach remains dominant because it enables seamless interaction between physical components and virtual models, creating a dynamic test cycle that mirrors operational behavior. Engineers use closed-loop setups to safely examine the performance of control units, electrified systems, and intelligent functions under highly realistic conditions without exposing physical prototypes to operational hazards.

North America Hardware-in-the-Loop (HIL) Testing Market generated USD 355.3 million in 2024. The country's growth is supported by continued progress in automated technologies, electric mobility development, and the wider adoption of highly modular vehicle architectures. Companies in the US are expanding validation programs to meet evolving standards in safety, compliance, and digital system integrity. Significant advancements in battery development, electrified platforms, and next-generation drivetrain systems are helping accelerate the adoption of HIL environments to reduce costs tied to physical prototyping and to shorten engineering timelines.

Prominent participants in the Hardware-in-the-Loop (HIL) Testing Market include Aptiv, dSPACE, Elektrobit, Emerson, IPG Automotive, Lynx Software Technologies, MathWorks, Robert Bosch, Typhoon HIL, and Vector Informatik. Key strategies used by companies in the hardware-in-the-loop testing market focus on expanding technological depth and strengthening collaborative development. Providers are investing in enhanced real-time computing clusters, higher-capacity interface boards, and advanced processing architectures to support increasingly complex simulations. Many organizations are forming alliances with software platforms to ensure seamless integration across modeling, testing, and automation workflows. Firms are also scaling production capabilities, broadening service portfolios, and introducing modular HIL systems that accommodate evolving design demands.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Offering

- 2.2.4 Testing phase

- 2.2.5 End use

- 2.3 TAM Analysis, 2026-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Silicon & Core Technology Providers

- 3.1.1.2 Platform & System Suppliers

- 3.1.1.3 Software & Model Providers

- 3.1.1.4 System Integrators & Professional Services

- 3.1.2 Profit margin analysis

- 3.1.2.1 Silicon & Core Technology Providers

- 3.1.2.2 Platform & System Suppliers

- 3.1.2.3 Software & Model Providers

- 3.1.2.4 System Integrators & Services

- 3.1.3 Cost Structure

- 3.1.4 Value Addition at Each Stage

- 3.1.5 Factors Affecting the Value Chain

- 3.1.6 Ecosystem Disruptions

- 3.1.1 Supplier landscape

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 electric vehicle proliferation and battery system validation requirements analysis

- 3.2.1.2 ADAS/autonomous vehicle complexity and software-defined vehicle architecture

- 3.2.1.3 regulatory mandates and functional safety standards (ISO 26262, IEC 61508, DO-178C)

- 3.2.1.4 power electronics and renewable energy grid integration

- 3.2.1.5 cost reduction imperative and demonstrated ROI from virtual validation

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital investment and extended payback periods for SMEs

- 3.2.2.2 Skilled workforce shortage and knowledge transfer challenges

- 3.2.2.3 Model fidelity and validation challenges

- 3.2.3 Market Opportunities

- 3.2.3.1 Cloud-based HIL and hardware-in-the-loop-as-a-service (HILaaS)

- 3.2.3.2 AI/ML-driven test automation and scenario generation

- 3.2.3.3 Digital twin integration and lifecycle validation

- 3.2.3.4 Asia-pacific market expansion and localization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America Regulatory Landscape

- 3.4.1.1 United States: Federal and State-Level Requirements

- 3.4.1.2 Canada: Harmonization with U.S. Standards

- 3.4.2 Europe Regulatory Landscape

- 3.4.2.1 European Union: comprehensive type approval and cybersecurity mandates

- 3.4.2.2 United Kingdom: post-brexit regulatory divergence

- 3.4.3 Asia Pacific Regulatory Landscape

- 3.4.3.1 China: domestic standards and data localization

- 3.4.3.2 Japan: quality standards and automotive excellence

- 3.4.3.3 India: emerging market with rapid regulatory evolution

- 3.4.3.4 South korea: advanced technology and export focus

- 3.4.4 Latin America Regulatory Landscape

- 3.4.4.1 Brazil: regional leader with localization requirements

- 3.4.4.2 Mexico: USMCA integration and automotive manufacturing hub

- 3.4.5 Middle East & Africa Regulatory Landscape

- 3.4.5.1 UAE & Saudi Arabia: ambitious technology adoption

- 3.4.5.2 South Africa: regional manufacturing hub

- 3.4.6 Cross-regional regulatory trends and strategic implications

- 3.4.1 North America Regulatory Landscape

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 FPGA-accelerated real-time simulation platforms

- 3.7.1.2 Model-based design (MBD) & simulation toolchains

- 3.7.1.3 Modular PXI/EtherCAT-based HIL architectures

- 3.7.1.4 Certified safety & compliance toolchains

- 3.7.2 Emerging technologies

- 3.7.2.1 Cloud-native HIL platforms & hil-as-a-service (HILaaS)

- 3.7.2.2 AI/ML-driven test automation & scenario generation

- 3.7.2.3 Digital twin integration for lifecycle validation

- 3.7.2.4 Cybersecurity validation & secure OTA update testing

- 3.7.1 Current technological trends

- 3.8 Patent analysis

- 3.9 Cost breakdown analysis

- 3.10 Trade flow analysis

- 3.10.1 Import market dynamics

- 3.10.1.1 Global import patterns

- 3.10.1.2 Trade barriers and localization

- 3.10.2 Export market structure

- 3.10.3 Export barriers and incentives

- 3.10.4 Trade flow trends & strategic implications

- 3.10.1 Import market dynamics

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practice adoption

- 3.11.2 Waste reduction innovation

- 3.11.3 Energy efficiency optimization

- 3.11.4 Environmental initiative impact

- 3.12 Use cases

- 3.12.1 Iron bird testing

- 3.12.2 Missile development

- 3.12.3 Autonomous drone testing

- 3.12.4 ADAS and autonomous driving

- 3.12.5 Electromobility and electric drives

- 3.12.6 Power grids

- 3.12.7 Vehicle dynamics

- 3.12.8 Virtual vehicle

- 3.12.9 Test benches

- 3.12.10 Real driving emissions (RDE)

- 3.13 Best case scenarios

- 3.13.1 Full lifecycle digital twin-HIL integration

- 3.13.2 Cloud-native HILaaS for global collaboration

- 3.13.3 AI/ML-driven autonomous validation

- 3.13.4 PHIL for renewable grid integration

- 3.13.5 Modular, upgradable, circular HIL architectures

- 3.14 FPGA systems used by major competitors in HIL market

- 3.14.1 Performance & application fit

- 3.14.2 Scalability, modularity & lifecycle cost

- 3.14.3 Regulatory & certification advantage

- 3.14.4 Ecosystem & integration

- 3.14.5 Regional & regulatory differentiation

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 I/O interfaces

- 5.2.1.1 PCIe-based I/O interfaces

- 5.2.1.1.1 Standard PCIe cards

- 5.2.1.1.2 High-speed DAQ modules

- 5.2.1.1.3 Custom FPGA-integrated PCIe solutions

- 5.2.1.2 FPGA-based I/O solutions

- 5.2.1.2.1 Intel (Altera) Arria-based interface modules

- 5.2.1.2.2 Xilinx Zynq-based interface modules

- 5.2.1.2.3 FPGA I/O expansion boards

- 5.2.1.2.4 Real-time logic control & signal conditioning interfaces

- 5.2.1.3 Ethernet-based and EtherCAT interfaces

- 5.2.1.3.1 Industrial ethernet (GigE, 10GigE, TSN-enabled)

- 5.2.1.3.2 EtherCAT master/slave modules

- 5.2.1.3.3 Distributed I/O nodes with EtherCAT

- 5.2.1.3.4 Time-synchronized communication modules

- 5.2.1.1 PCIe-based I/O interfaces

- 5.2.2 Processors

- 5.2.3 Real-time simulators

- 5.2.4 Data acquisition systems

- 5.2.5 Others

- 5.2.1 I/O interfaces

- 5.3 Software

- 5.4 Services

- 5.4.1 Professional services

- 5.4.2 Managed services

Chapter 6 Market Estimates & Forecast, By Offering, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.1.1 Open loop

- 6.1.2 Close loop

Chapter 7 Market Estimates & Forecast, By Testing phase, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Design validation

- 7.3 Integration testing

- 7.4 Acceptance testing

- 7.5 Manufacturing testing

- 7.6 Performance testing

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Aerospace

- 8.3 Defence

- 8.4 Railway

- 8.5 Power electronics

- 8.6 Automotive

- 8.7 Medical devices

- 8.8 Renewable energy systems

- 8.9 Telecom and networking

- 8.10 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Global Players

- 10.1.1 MathWorks

- 10.1.2 National Instruments

- 10.1.3 dSPACE

- 10.1.4 Vector Informatik

- 10.1.5 Spirent Communications

- 10.1.6 Wind River

- 10.1.7 Robert Bosch

- 10.1.8 Emerson

- 10.2 Regional players

- 10.2.1 ADVANTECH

- 10.2.2 APTIV

- 10.2.3 Wabtec

- 10.2.4 ETAS

- 10.2.5 Hinduja Tech

- 10.2.6 Elektrobit

- 10.3 Niche/emerging players

- 10.3.1 ADD2

- 10.3.2 Concurrent Real-Time

- 10.3.3 IPG Automotive

- 10.3.4 Lynx Software Technologies

- 10.3.5 Opal-RT Technologies

- 10.3.6 Plexim

- 10.3.7 RealTime Wave

- 10.3.8 Speedgoat

- 10.3.9 Typhoon HIL