PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885823

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885823

Carbon Fiber Recycling from Aerospace Composites Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

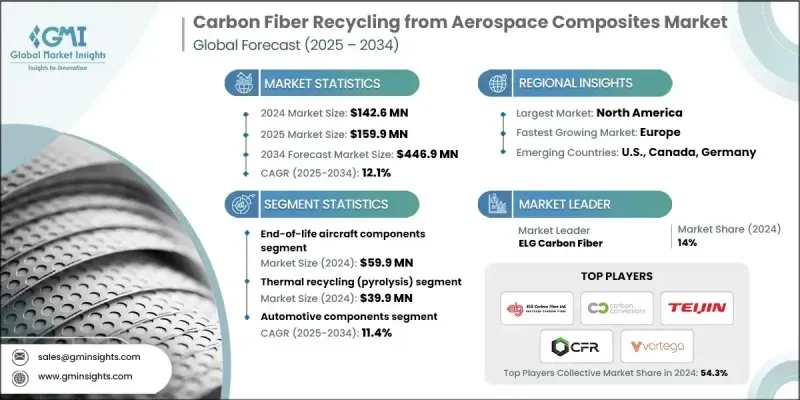

The Global Carbon Fiber Recycling from Aerospace Composites Market was valued at USD 142.6 million in 2024 and is estimated to grow at a CAGR of 12.1% to reach USD 446.9 million by 2034.

Rapid progress in recovery technologies is making recycled carbon fiber more cost-effective and higher in quality, encouraging its wider use in aerospace and related sectors. New methods that significantly reduce energy consumption while preserving mechanical strength are accelerating commercial adoption and improving process sustainability. Expanding recycling infrastructure and maturing industrial capabilities support the rising volume of composite waste generated from aircraft decommissioning. Global emphasis on circular manufacturing, stricter environmental targets, and stronger regulatory direction are also driving investments in advanced recycling systems. The increasing availability of end-of-life composite materials and the technical viability of converting them into high-value secondary fibers are creating favorable conditions for large-scale deployment. As recycling technologies evolve and supply chains integrate more efficiently, recycled carbon fiber is becoming an increasingly strategic material for aerospace, automotive, and industrial applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $142.6 Million |

| Forecast Value | $446.9 Million |

| CAGR | 12.1% |

The end-of-life aircraft components generated USD 59.9 million in 2024. Retired aircraft contain substantial quantities of carbon-fiber-based structures such as fuselage elements, wing assemblies, and tail components, making them a valuable source for recovery. The accelerating retirement cycle of older fleets worldwide continues to expand feedstock supply, reinforcing the importance of this material stream in recycling operations.

Thermal recycling, including pyrolysis, reached USD 39.9 million in 2024. This method dominates because it reliably extracts high-quality fibers without undermining their structural characteristics. Its scalability, ability to process large composite volumes, and comparatively low operational costs position it as the most commercially feasible technique. Continuous system advancements and improved energy-recovery approaches further enhance its economic performance. While alternative processes can recover fibers with high purity, their elevated costs limit broad adoption, solidifying thermal recycling as the leading industrial solution.

North America Carbon Fiber Recycling from Aerospace Composites Market captured USD 52 million in 2024, owing to strong aerospace manufacturing activity and expanding recycling capacities. The region benefits from a strong concentration of OEMs, Tier-1 suppliers, and emerging recyclers, increasing their production capabilities. Expanding commercial facilities and ongoing research initiatives strengthen domestic supply, while demand from downstream sectors reinforces regional growth.

Key companies active in the Carbon Fiber Recycling from Aerospace Composites Market include Toray Advanced Composites (Toray Group), ELG Carbon Fibre, Mitsubishi Chemical, Carbon Conversions, SGL Carbon, Carbon Fiber Recycling (CFR), Teijin Limited, Carbon Fiber Conversions GmbH, Westlake Corporation, and Vartega Inc. Companies operating in Carbon Fiber Recycling from Aerospace Composites Market enhance their competitive position by scaling production capacity, adopting advanced recovery technologies, and investing in energy-efficient processes that preserve fiber strength. Many pursue strategic partnerships with aerospace OEMs to secure consistent feedstock and integrate recycled materials into next-generation components. Efforts to improve process automation, reduce operational costs, and expand continuous recycling systems help increase output reliability. Organizations also focus on establishing certification standards, ensuring recycled fibers meet aerospace-grade performance requirements.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Feedstock Source

- 2.2.3 Technology

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing aircraft decommissioning rates

- 3.2.1.2 Sustainability regulations and circular economy goals

- 3.2.1.3 Technological advancements in recycling processes

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Inconsistent mechanical properties of recycled carbon fiber

- 3.2.2.2 Lack of standardization and certification frameworks

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for lightweight materials in aerospace

- 3.2.3.2 Government incentives and green procurement policies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 Feedstock Source

- 3.7.3 Technology

- 3.7.4 Application

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Feedstock Source, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 End-of-Life Aircraft Components

- 5.2.1 Retired fuselage sections

- 5.2.2 Wing and tail structures

- 5.2.3 Interior panels and fixtures

- 5.2.4 Engine cowls and nacelles

- 5.3 Production Scrap

- 5.3.1 Prepreg offcuts and trimmings

- 5.3.2 Defective or rejected layups

- 5.3.3 Autoclave rejects and cured waste

- 5.4 MRO (Maintenance, Repair & Overhaul) Waste

- 5.4.1 Replaced or repaired panels

- 5.4.2 Damaged composite parts from overhaul

- 5.4.3 Residual parts from retrofitting

- 5.5 Prototyping and R&D Scrap

- 5.5.1 Test parts from development batches

- 5.5.2 Non-certified experimental components

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Mechanical recycling

- 6.2.1 Shredding

- 6.2.2 Milling and grinding

- 6.2.3 Granulation

- 6.3 Thermal Recycling (Pyrolysis)

- 6.3.1 Conventional pyrolysis (inert gas)

- 6.3.2 Microwave-assisted pyrolysis

- 6.3.3 Fluidized bed pyrolysis

- 6.4 Chemical Recycling (Solvolysis / Depolymerization)

- 6.4.1 Acid/base catalyzed solvolysis

- 6.4.2 Alcoholysis and glycolysis methods

- 6.4.3 Supercritical fluid solvolysis

- 6.5 Supercritical fluid processing

- 6.5.1 Supercritical CO2

- 6.5.2 Supercritical water oxidation

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive components

- 7.2.1 Structural automotive parts

- 7.2.2 Body panels & exterior components

- 7.2.3 Interior applications

- 7.3 Electronics manufacturing

- 7.3.1 Circuit board applications

- 7.3.2 Electronic housings & enclosures

- 7.3.3 Thermal management components

- 7.4 Infrastructure applications

- 7.4.1 Electrical grid components

- 7.4.2 Construction & building materials

- 7.4.3 Transportation infrastructure

- 7.5 Sporting goods & consumer products

- 7.5.1 Recreational equipment

- 7.5.2 Consumer electronics

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Mitsubishi Chemical

- 9.2 ELG Carbon Fibre

- 9.3 Carbon Fiber Conversions GmbH

- 9.4 Carbon Fiber Recycling (CFR)

- 9.5 Carbon Conversions

- 9.6 Teijin Limited

- 9.7 SGL Carbon

- 9.8 Toray Advanced Composites(Toray Group)

- 9.9 Westlake Corporation

- 9.10 Vartega Inc