PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885824

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885824

Protein Hydrolysates in Aquaculture Feed Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

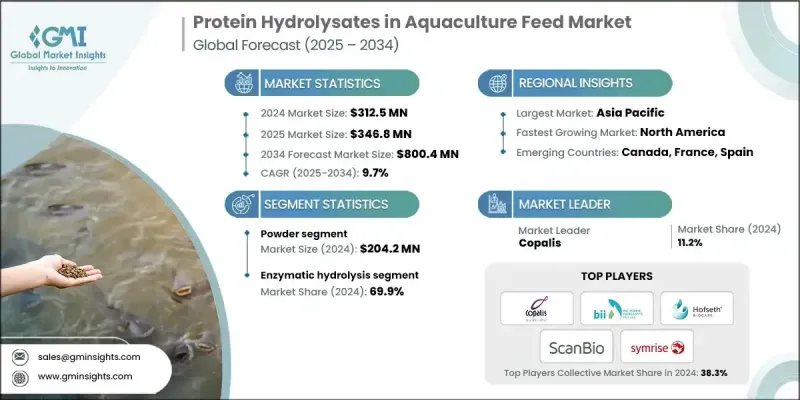

The Global Protein Hydrolysates in Aquaculture Feed Market was valued at USD 312.5 million in 2024 and is estimated to grow at a CAGR of 9.7% to reach USD 800.4 million by 2034.

The ingredients are produced through controlled enzymatic or chemical breakdown of protein-rich marine and terrestrial sources into smaller, highly digestible peptides and amino acids. Their use enhances nutrient absorption, boosts growth performance, and strengthens disease resistance in farmed aquatic species, making them essential for modern, sustainable aquaculture systems. Market expansion is strongly influenced by growing emphasis on responsible farming practices, supported by regulatory frameworks that encourage circular resource use. North America is emerging as the fastest-growing region as policies encourage transforming fishery waste into high-value hydrolysates, reducing environmental impact, and supporting compliance with sustainability standards. Rising demand for eco-friendly feed inputs and the shift toward natural, high-performance additives are driving increased adoption. The global aquaculture sector's heightened focus on health, immunity, and efficient feed utilization further accelerates the need for bioactive protein hydrolysates.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $312.5 Million |

| Forecast Value | $800.4 Million |

| CAGR | 9.7% |

The powder-based hydrolysates generated USD 204.2 million in 2024. The powdered form maintains stability and nutritional integrity over long storage periods and is easier to transport due to its concentrated nature. Feed manufacturers prefer powder formulations because they integrate smoothly into advanced mixing operations, supporting consistent quality control and enabling steady market growth across regions.

The enzymatic hydrolysis accounted for a 69.9% share in 2024. This method produces highly functional hydrolysates with controlled peptide profiles and superior digestibility and bioavailability. The process preserves key bioactive components and allows the creation of targeted peptide fractions that support optimal health and performance in aquaculture species.

North America Protein Hydrolysates in Aquaculture Feed Market is projected to grow at a CAGR of 10% from 2025 to 2034. Rising awareness of sustainable aquaculture practices and the increasing preference for natural, biodegradable feed ingredients are contributing to strong demand. Regional producers and feed manufacturers are prioritizing environmentally responsible inputs that enhance feed quality while lowering ecological impact.

Key companies in the Protein Hydrolysates in Aquaculture Feed Market include Scanbio, Symrise, Kemin Industries, Copalis, SAMPI, Alfa Laval AB, Hofseth Biocare, Bio-Marine Ingredients Ireland Ltd, Sopropeche, and Janatha Fish Meal. Companies in the protein hydrolysates in aquaculture feed market enhance their competitiveness through investments in advanced enzymatic processing, expansion of production capacity, and optimization of raw material utilization. Many emphasize sustainable sourcing by converting fishery by-products into high-value hydrolysates, aligning with circular economy goals. Strategic collaborations with aquaculture producers help tailor hydrolysate profiles for specific species and life stages, improving performance outcomes. Firms adopt strict quality certification systems to meet global regulatory expectations and build customer confidence. Product diversification aimed at functional, nutrient-dense peptide solutions strengthens their presence across premium feed categories.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Form trends

- 2.2.2 Process trends

- 2.2.3 Application trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing aquaculture production & feed demand

- 3.2.1.2 Disease prevention & immune system enhancement

- 3.2.1.3 Sustainable utilization of fish processing by-products

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs & complex processing requirements

- 3.2.2.2 Raw material supply constraints & seasonal availability

- 3.2.3 Market opportunities

- 3.2.3.1 Species-specific hydrolysate development

- 3.2.3.2 Bioactive peptide fraction applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By form

- 3.9 Future market trends

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Form, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Powder

- 5.3 Liquid

- 5.4 Paste

Chapter 6 Market Estimates and Forecast, By Process, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Enzymatic hydrolysis

- 6.3 Chemical hydrolysis

- 6.3.1 Acid hydrolysis

- 6.3.2 Alkaline hydrolysis

- 6.4 Autolytic hydrolysis

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Larval feeds

- 7.3 Starter feeds

- 7.4 Grow-out feeds

- 7.5 Functional feeds

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Alfa Laval AB

- 9.2 Bio-Marine Ingredients Ireland Ltd

- 9.3 Copalis

- 9.4 Hofseth Biocare

- 9.5 Janatha Fish Meal

- 9.6 Kemin Industries

- 9.7 SAMPI

- 9.8 Scanbio

- 9.9 Sopropeche

- 9.10 Symrise