PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885836

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885836

Automotive Telematics Services Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

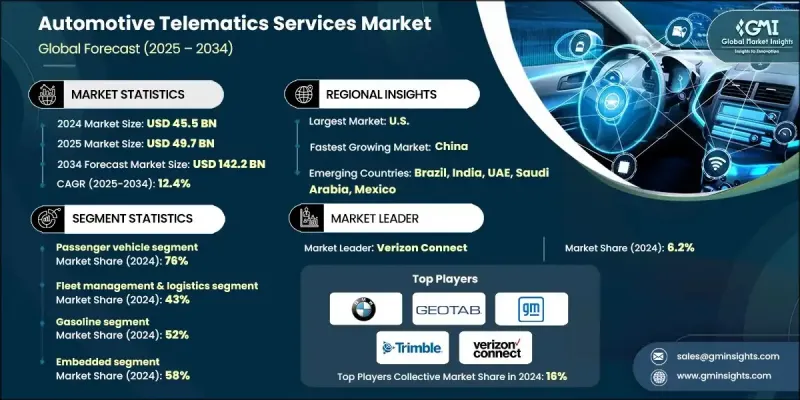

The Global Automotive Telematics Services Market was valued at USD 45.5 billion in 2024 and is estimated to grow at a CAGR of 12.4% to reach USD 142.2 billion by 2034.

Adoption continues to accelerate as commercial fleets, mobility operators, and transportation providers rely on telematics to reduce downtime, optimize routes, manage maintenance, and control fuel spending. Advanced diagnostics, predictive fault detection, automated service alerts, and behavioral insights are increasingly used to boost operational efficiency and unlock strong returns on investment, which strengthens demand for recurring service subscriptions. Automakers are embedding telematics capabilities into new vehicle platforms to meet safety, compliance, and connectivity requirements driven by regulations, remote monitoring needs, and over-the-air updates. With more vehicles equipped at the factory, subscription-based services are expanding rapidly. Insurers are also relying heavily on telematics data to support usage-based insurance models, with real-time insights on risk patterns, mileage, and driving behavior creating steady demand for connected devices and data platforms. As both commercial clients and individual policyholders shift to behavior-driven coverage, the telematics ecosystem continues to expand and reinforce its long-term revenue base.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $45.5 Billion |

| Forecast Value | $142.2 Billion |

| CAGR | 12.4% |

The passenger vehicle segment held a 76% share in 2024 and is forecast to grow at a CAGR of 12.7% through 2034. Embedded safety features supported by telematics, including crash alerts, emergency response communication, theft tracking, and continuous monitoring, have become key purchase incentives for consumers. Automakers are standardizing connected systems across a wide range of passenger models as part of broader efforts to meet regulatory expectations and enhance user confidence.

The fleet management and logistics segment held a 43% share in 2024 and is projected to grow at a CAGR of 12% between 2025 and 2034. Rising fuel expenses and higher operational overheads are pushing logistics operators to adopt telematics tools that track fuel efficiency, measure idle durations, and optimize routing. Data-driven insights enable fleets to lower operating costs, streamline utilization, and improve productivity, establishing telematics as a critical technology within competitive transportation operations.

US Automotive Telematics Services Market held an 86% share and generated USD 15.5 billion in 2024. Adoption is advancing quickly due to regulatory requirements related to safety systems, emissions oversight, electronic logging, and vehicle diagnostics. Federal and state compliance pressures continue to accelerate the rollout of advanced connected platforms among manufacturers and fleet operators across the country.

Major companies in the Global Automotive Telematics Services Market include BMW, GM, Bosch, Continental, Geotab, Verizon Connect, Ituran, ZF, Trimble, and Samsara. Companies in the Automotive Telematics Services Market are strengthening their competitive positions by expanding cloud-based platforms, improving AI-driven analytics, and building unified dashboards for fleets and consumers. They are also forming strategic partnerships with automakers, insurers, and mobility service providers to integrate data-rich telematics functions into broader ecosystems. Investments in cybersecurity, predictive maintenance capabilities, and real-time monitoring tools support stronger value propositions for end users. Firms are scaling subscription models, enhancing over-the-air update systems, and developing modular telematics units that fit diverse vehicle segments. These strategies help companies boost recurring revenue streams, improve customer retention, and maintain long-term relevance in the connected vehicle landscape.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Service

- 2.2.3 Propulsion

- 2.2.4 Technology

- 2.2.5 Connectivity

- 2.2.6 Vehicle

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook

- 2.6 Strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of connected and software-defined vehicles

- 3.2.1.2 Expansion of usage-based insurance (UBI) and data-driven risk models

- 3.2.1.3 Rapid growth of commercial fleets and logistics digitization

- 3.2.1.4 Advancements in 4G/5G connectivity and cloud platforms

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Data privacy, cybersecurity risks & regulatory compliance

- 3.2.2.2 Fragmented standards & interoperability issues

- 3.2.2.3 High installation and subscription costs in emerging markets

- 3.2.2.4 Inconsistent network availability in rural and remote areas

- 3.2.3 Market opportunities

- 3.2.3.1 Growth of electric vehicles and smart charging ecosystems

- 3.2.3.2 Expansion of video telematics and AI-driven safety analytics

- 3.2.3.3 Emergence of mobility-as-a-service (MaaS) platforms

- 3.2.3.4 Aftermarket telematics, retrofits & customization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Major market trends and disruptions

- 3.5 Future market trends

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 MEA

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Technology and innovation landscape

- 3.9.1 Current Technologies

- 3.9.1.1 Advanced telematics control units (TCUs) with integrated connectivity

- 3.9.1.2 Real-time vehicle tracking & GPS/GNSS positioning systems

- 3.9.1.3 Cloud-based fleet management platforms

- 3.9.1.4 Embedded SIM/eSIM-enabled in-vehicle connectivity

- 3.9.2 Emerging Technologies

- 3.9.2.1 AI-powered predictive analytics for driver behavior & vehicle health

- 3.9.2.2 Edge computing for low-latency telematics data processing

- 3.9.2.3 5G-enabled V2X (Vehicle-to-Everything) communication architectures

- 3.9.2.4 Digital twin models for fleet optimization & remote diagnostics

- 3.9.1 Current Technologies

- 3.10 Patent analysis

- 3.11 Production statistics

- 3.11.1 Production hubs

- 3.11.2 Consumption hubs

- 3.11.3 Export and import

- 3.12 Price trends

- 3.12.1 By region

- 3.12.2 By propulsion

- 3.13 Cost breakdown analysis

- 3.13.1 Software & platform development costs

- 3.13.2 Hardware, integration & processing costs

- 3.13.3 Quality control, testing & compliance costs

- 3.14 Sustainability and environmental aspects

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco-friendly initiatives

- 3.14.5 Carbon footprint considerations

- 3.15 Macro & micro economic analysis

- 3.15.1 Macro-economic analysis

- 3.15.1.1 Global economic factors impacting telematics adoption

- 3.15.1.2 Industry-specific economic drivers

- 3.15.1.3 Regional economic analysis

- 3.15.1.4 Trade policy & tariff impact

- 3.15.2 Micro-economic analysis

- 3.15.2.1 Component-level cost structure

- 3.15.2.2 Software & platform cost analysis

- 3.15.2.3 Connectivity & subscription cost structure

- 3.15.2.4 Installation & integration costs

- 3.15.2.5 Pricing models & revenue structures

- 3.15.2.6 Total cost of ownership analysis

- 3.15.1 Macro-economic analysis

- 3.16 Product lifecycle analysis

- 3.16.1 Technology lifecycle stages

- 3.16.2 Average product lifecycle duration

- 3.16.3 Technology refresh & upgrade cycles

- 3.16.4 End-of-life management

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Service, 2021 - 2034 ($Bn, Fleet Size)

- 5.1 Key trends

- 5.2 Fleet management & logistics

- 5.3 Usage-based insurance

- 5.4 Vehicle tracking & monitoring

- 5.5 Remote diagnostics & maintenance

- 5.6 Safety & emergency

- 5.7 Infotainment & navigation

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Fleet Size)

- 6.1 Gasoline

- 6.2 Diesel

- 6.3 BEV

- 6.4 PHEV

- 6.5 HEV

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Fleet Size)

- 7.1 Key trends

- 7.2 Vehicle connectivity systems

- 7.3 On-board diagnostics

- 7.4 Electronic onboard recorders

- 7.5 Cooperative ITS

- 7.6 Smartphone-based telematics

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Connectivity, 2021 - 2034 ($Bn, Fleet Size)

- 8.1 Key trends

- 8.2 Embedded

- 8.3 Integrated

- 8.4 Tethered

Chapter 9 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Fleet Size)

- 9.1 Key trends

- 9.2 Passenger cars

- 9.2.1 Hatchback

- 9.2.2 Sedan

- 9.2.3 SUV

- 9.3 Commercial vehicles

- 9.3.1 Light duty

- 9.3.2 Medium duty

- 9.3.3 Heavy duty

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 ($Bn, Fleet Size)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Singapore

- 10.4.7 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global players

- 11.1.1 CalAmp

- 11.1.2 Geotab

- 11.1.3 Masternaut

- 11.1.4 Microlise

- 11.1.5 Omnitracs

- 11.1.6 Spireon

- 11.1.7 Teletrac Navman

- 11.1.8 Trimble

- 11.1.9 Verizon Connect

- 11.1.10 Webfleet Solutions

- 11.1.11 BMW

- 11.1.12 Bosch

- 11.1.13 Continental

- 11.1.14 GM

- 11.1.15 Ituran

- 11.1.16 ZF

- 11.2 Regional players

- 11.2.1 Azuga

- 11.2.2 Cartrack

- 11.2.3 Ctrack

- 11.2.4 MiX Telematics

- 11.2.5 Octo Telematics

- 11.2.6 Platform Science

- 11.2.7 Quartix Technologies

- 11.2.8 Trakm8

- 11.3 Emerging Players

- 11.3.1 Bouncie

- 11.3.2 Fleetio

- 11.3.3 Lytx

- 11.3.4 Mojio

- 11.3.5 Motive

- 11.3.6 Nauto

- 11.3.7 Netradyne

- 11.3.8 Samsara

- 11.3.9 SmartDrive Systems

- 11.3.10 Zubie