PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885840

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885840

Industrial Filtration System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

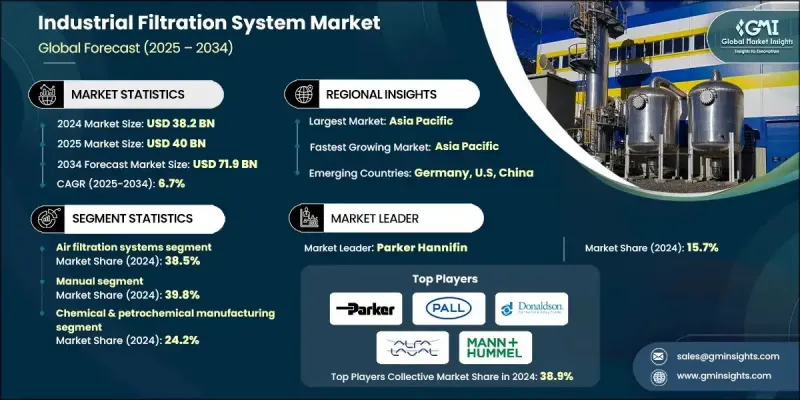

The Global Industrial Filtration System Market was valued at USD 38.2 billion in 2024 and is estimated to grow at a CAGR of 6.7% to reach USD 71.9 billion by 2034.

The market is advancing rapidly as shifting regulatory expectations, evolving customer demands, and ongoing technology upgrades reshape industrial operations. Environmental sustainability has become a central driver of innovation as manufacturers focus on eco-conscious filtration materials, reduced energy consumption, and system designs that support long-term environmental goals. Rising interest in high-performance filtration media is enabling stronger durability, greater precision, and wider applicability across industries dealing with corrosive, high-temperature, or high-pressure environments. Improvements in material science continue to extend filtration lifespan and reliability, encouraging industries to invest in systems that ensure compliance with increasingly strict environmental standards. These advancements are influencing capital allocation, modernization strategies, and infrastructure upgrades across global industrial facilities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $38.2 Billion |

| Forecast Value | $71.9 Billion |

| CAGR | 6.7% |

The air filtration category held a 38.5% share in 2024 and is anticipated to grow at a 7.4% CAGR from 2025 to 2034. This segment leads due to increasing global attention on emission controls, workplace safety requirements, and environmental guidelines that demand advanced air filtration solutions. Regulatory frameworks in major regions continue to influence investment in higher-efficiency systems designed to protect workers and reduce industrial pollutants.

The semi-automatic filtration systems generated USD 10.7 billion in 2024, accounting for a 28% share, and are expected to grow at a CAGR of 6.9% through 2034. These systems integrate automated monitoring features with operator-managed maintenance, offering a hybrid model that enhances efficiency while maintaining human oversight of essential functions. Industries that require consistent, validated performance rely heavily on these systems to support dependable filtration and compliance standards.

North America Industrial Filtration System Market reached USD 10.7 billion in 2024 with a 28% share and is expected to register a 6.9% CAGR through 2034. Growth in this region is supported by replacement demand, infrastructure upgrades, and regulatory enforcement. The United States drives most of the regional consumption due to strict environmental regulations, aging industrial assets, and increasing production activity that requires robust filtration technologies. Compliance with national and state-level guidelines continues to shape investment priorities across industrial facilities.

Leading companies in the Industrial Filtration System Market include Parker Hannifin Corporation, Pall Corporation, Donaldson Company, Inc., Ahlstrom-Munksjo, Eaton Corporation Plc, 3M Company, Lenntech B.V., Pentair Plc, W. L. Gore & Associates, Inc., Alfa Laval AB, Camfil Group, Filtration Group Corporation, MANN+HUMMEL Group, Freudenberg Filtration Technologies, and Cummins Filtration. Major industry players strengthen their competitive standing by expanding filtration portfolios, enhancing material innovation, and investing in advanced, energy-efficient designs. Many companies accelerate R&D to introduce systems with extended durability, improved efficiency, and reduced operational costs. Strategic acquisitions, global distribution partnerships, and facility expansions support broader geographic reach and faster market penetration. Firms also focus on developing filtration technologies that align with evolving environmental and workplace safety regulations, ensuring seamless compliance for end users.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.3 Data collection methods

- 1.4 Data mining sources

- 1.4.1 Global

- 1.4.2 Regional/Country

- 1.5 Base estimates and calculations

- 1.5.1 Base year calculation

- 1.5.2 Key trends for market estimation

- 1.6 Primary research and validation

- 1.6.1 Primary sources

- 1.7 Forecast model

- 1.8 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Automation level

- 2.2.4 Pressure range

- 2.2.5 Particle size range

- 2.2.6 Application

- 2.2.7 End Use

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factors affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Regulatory compliance and environmental standards

- 3.2.1.2 Industrial growth and process intensification

- 3.2.1.3 Technological advancement integration

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Capital investment and operational costs

- 3.2.2.2 Integration of complexity and workforce requirements

- 3.2.2.3 Supply chain and end-of-life management

- 3.2.3 Opportunities

- 3.2.3.1 Sustainable and energy-efficient solutions

- 3.2.3.2 Advanced application expansion

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By Product

- 3.7 Regulatory landscape

- 3.7.1 standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Thousand Units)

- 5.1 Key trends

- 5.2 Air filtration systems

- 5.2.1 Hepa & Ulpa filters

- 5.2.2 Electrostatic precipitators

- 5.2.3 Baghouse & dust collectors

- 5.2.4 Cartridge & panel filters

- 5.3 Membrane filtration systems

- 5.3.1 Microfiltration (MF)

- 5.3.2 Ultrafiltration (UF)

- 5.3.3 Nanofiltration (NF)

- 5.3.4 Reverse osmosis (RO)

- 5.4 Ceramic membrane filters

- 5.4.1 Silicon carbide (SIC) membranes

- 5.4.2 Alumina-based membranes

- 5.4.3 Zirconia & titania membranes

- 5.5 Pressure-driven filtration

- 5.5.1 Filter presses

- 5.5.2 Cartridge & bag filters

- 5.5.3 Vacuum filtration systems

- 5.6 Ion exchange & adsorption systems

- 5.6.1 Activated carbon systems

- 5.6.2 Ion exchange resins

- 5.6.3 Molecular sieves & specialty adsorbents

Chapter 6 Market Estimates & Forecast, By Automation Level, 2021 - 2034 ($Bn, Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automatic

- 6.4 Automatic

- 6.5 IoT enables smart system

Chapter 7 Market Estimates & Forecast, By Pressure Range, 2021 - 2034 ($Bn, Thousand Units)

- 7.1 Key trends

- 7.2 Low-pressure (<50 psi)

- 7.3 medium pressure (50-500 psi)

- 7.4 high-pressure (>500 psi)

Chapter 8 Market Estimates & Forecast, By Particle Size Range, 2021 - 2034 ($Bn, Thousand Units)

- 8.1 Key trends

- 8.2 Coarse filtration (>10 im)

- 8.3 Fine filtration (1-10 μm)

- 8.4 Ultrafine (<1 μm)

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Thousand Units)

- 9.1 Key trends

- 9.2 Air pollution control

- 9.3 Water & wastewater treatment

- 9.4 Process filtration

- 9.5 Mining & tailings management

- 9.6 Cleanroom & sterile applications

- 9.7 Hydraulic & lubricant filtration

- 9.8 Compressed air treatment

- 9.9 Gas purification

- 9.10 Solvent & catalyst recovery

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Thousand Units)

- 10.1 Key trends

- 10.2 Chemical & petrochemical manufacturing

- 10.3 Pharmaceutical & biotechnology

- 10.4 Food & beverage processing

- 10.5 Mining & metals

- 10.6 Power generation

- 10.7 Pulp & paper

- 10.8 Automotive manufacturing

- 10.9 Aerospace & defense

- 10.10 Oil & gas

- 10.11 Steel & primary metals

- 10.12 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 3M Company

- 12.2 Ahlstrom-Munksjo

- 12.3 Alfa Laval AB

- 12.4 Camfil Group

- 12.5 Cummins Filtration

- 12.6 Donaldson Company, Inc.

- 12.7 Eaton Corporation Plc

- 12.8 Filtration Group Corporation

- 12.9 Freudenberg Filtration Technologies

- 12.10 Lenntech B.V.

- 12.11 MANN+HUMMEL Group

- 12.12 Pall Corporation

- 12.13 Parker Hannifin Corporation

- 12.14 Pentair Plc

- 12.15 W. L. Gore & Associates, Inc.