PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885841

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885841

North America Soundbars Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

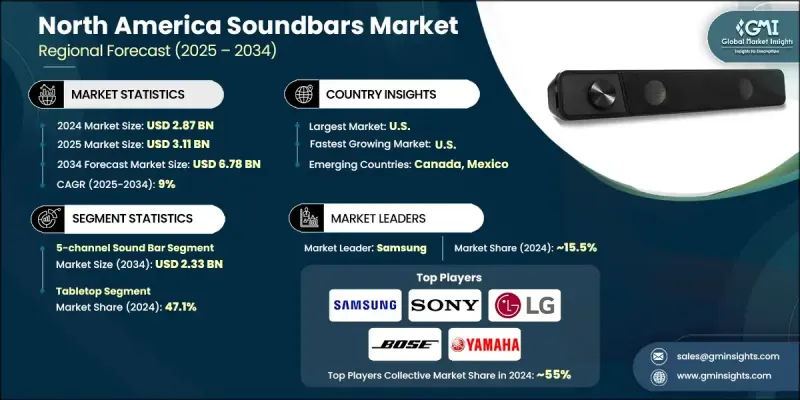

North America Soundbars Market was valued at USD 2.87 billion in 2024 and is estimated to grow at a CAGR of 9% to reach USD 6.78 billion by 2034.

The market is reshaped by immersive audio technologies, the surge in streaming video, and the integration of artificial intelligence into soundbar systems. Object-based audio formats such as Dolby Atmos and DTS X create three-dimensional soundscapes that surpass traditional surrounding sound experiences. Affordable options for Dolby Atmos soundbars, priced under USD 250, are making high-quality audio more accessible, prompting manufacturers to balance affordability with differentiation strategies. Advanced AI-driven audio processing can isolate dialogue, music, and sound effects on a scene-by-scene basis in real time. With HDMI 2.2 enabling higher bandwidth and Enhanced Audio Return Channel (eARC) supporting high-bitrate audio, consumers can enjoy pristine sound with minimal latency. Next-generation audio frameworks, including Dolby AC-4, MPEG-H, and DTS-UHD, allow metadata-driven rendering for greater playback flexibility. Market research indicates that over 60% of soundbar owners also use their devices to listen to music, highlighting the growing multifunctionality of these products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.87 Billion |

| Forecast Value | $6.78 Billion |

| CAGR | 9% |

The 5-channel soundbar segment accounted for USD 950 million in 2024 and is projected to reach USD 2.33 billion by 2034. These systems deliver true surround sound using left, right, center, and two rear channels, providing superior spatial audio for movies, gaming, and music. As consumers increasingly prioritize immersive audio experiences at home, 5-channel setups are gaining preference over 2- and 3-channel systems.

The tabletop segment generated USD 1.35 billion, capturing a 47.1% share in 2024. Tabletop soundbars are easy to install without tools or drilling, appealing to users who frequently rearrange rooms or live in rented spaces. Their convenience and user-friendly design make them particularly popular with mainstream consumers seeking quick, hassle-free solutions.

U.S. Soundbars Market was valued at USD 2.44 billion in 2024 and is expected to grow at a CAGR of 9.1% from 2025 to 2034. Rising disposable incomes and evolving lifestyles are driving home entertainment spending. Consumer expenditure surveys indicate steady year-over-year growth in spending on entertainment products, reflecting a willingness to invest in premium audio devices for enhanced streaming and gaming experiences.

Key players in the North America Soundbars Market include Denon, LG, Samsung, Polk Audio, Yamaha, Bowers & Wilkins, Bose, Klipsch, JBL, VIZIO, Sonos, Sony, Southern Audio Services, Definitive Technology, and Harman Kardon. Companies are strengthening their positions by developing AI-integrated and object-based audio soundbars, expanding retail and e-commerce distribution channels, and launching cost-effective models for mainstream adoption. Partnerships with streaming platforms and home entertainment brands enhance brand visibility, while continuous innovation in Dolby Atmos, DTS: X, and eARC-enabled products improves product differentiation. Firms also invest in marketing campaigns targeting music and gaming enthusiasts, and in R&D for compact, tabletop solutions to meet urban consumer needs. Strategic pricing, extended warranties, and bundled offerings further increase market share and customer loyalty.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country wise trends

- 2.2.2 Product type trends

- 2.2.3 Connectivity trends

- 2.2.4 Installation type trends

- 2.2.5 Price trends

- 2.2.6 Distribution channel trends

- 2.3 CXO perspective: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

- 2.5 Strategic recommendations

- 2.5.1 Supply chain diversification strategy

- 2.5.2 Product portfolio enhancement

- 2.5.3 Partnership and alliance opportunities

- 2.5.4 Cost management and pricing strategy

- 2.6 Decision framework

- 2.6.1 Investment priority matrix

- 2.6.2 ROI analysis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.6 Current technological trends

- 3.6.1 Emerging technologies

- 3.7 Price trends

- 3.7.1 By country and product type

- 3.7.2 Raw material cost

- 3.7.3 Real vs. perceived capacity constraints in supply of raw materials

- 3.7.4 Supplier price increase validation

- 3.8 Regulatory framework

- 3.8.1 By country

- 3.9 Trade statistics

- 3.9.1 Major importing countries

- 3.9.2 Major exporting countries

- 3.10 Porter's five forces analysis

- 3.11 PESTEL analysis

- 3.12 Consumer behavior analysis

- 3.12.1 Purchasing patterns

- 3.12.2 Preference analysis

- 3.12.3 Regional variations in consumer behavior

- 3.12.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Country

- 4.2.1.1 U.S.

- 4.2.1.2 Canada

- 4.2.1.3 Mexico

- 4.2.1 By Country

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Product portfolio benchmarking

- 4.7 Key developments

- 4.7.1 Mergers & acquisitions

- 4.7.2 Partnerships & collaborations

- 4.7.3 New Product Launches

- 4.7.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 2-channel sound bar

- 5.3 3-channel sound bar

- 5.4 5-channel sound bar

- 5.5 7-channel sound bar

Chapter 6 Market Estimates & Forecast, By Connectivity, 2021 - 2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Bluetooth

- 6.3 Auxiliary

- 6.4 Wi-Fi

- 6.5 Others (HDMI, optical, etc.)

Chapter 7 Market Estimates & Forecast, By Installation Type, 2021 - 2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Wall-Mounted

- 7.3 Tabletop

- 7.4 Floor Standing

Chapter 8 Market Estimates & Forecast, By Price, 2021 - 2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Low

- 8.3 Medium

- 8.4 High

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Online

- 9.3 Offline

Chapter 10 Market Estimates & Forecast, By Country, 2021 - 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 U.S.

- 10.3 Canada

- 10.4 Mexico

Chapter 11 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 11.1 Bose

- 11.2 Bowers & Wilkins

- 11.3 Definitive Technology

- 11.4 Denon

- 11.5 Harman Kardon

- 11.6 JBL

- 11.7 Klipsch

- 11.8 LG

- 11.9 Polk Audio

- 11.10 Samsung

- 11.11 Sonos

- 11.12 Sony

- 11.13 Southern Audio Services

- 11.14 VIZIO

- 11.15 Yamaha