PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885842

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885842

Grant Management Software Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

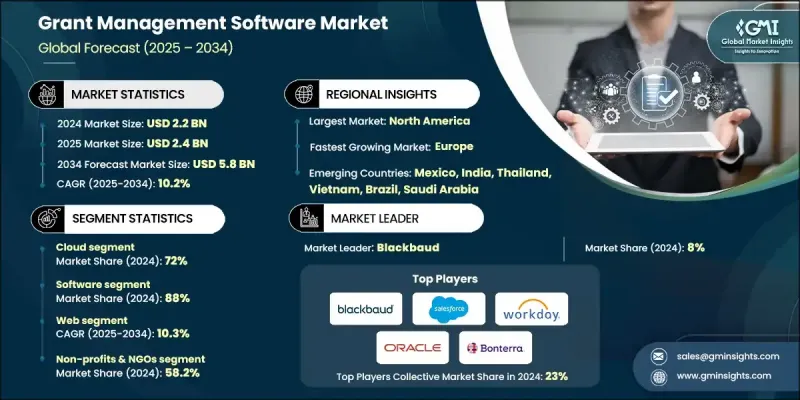

The Global Grant Management Software Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 10.2% to reach USD 5.8 billion by 2034.

Many public, private, and nonprofit institutions are adopting advanced platforms to manage the full lifecycle of grants, including application intake, evaluation, awards, fund allocation, and compliance reporting. Cloud-based systems are gaining strong traction due to their scalability, cost efficiency, and remote accessibility, allowing teams across various sectors to manage large grant portfolios with greater accuracy. Digital transformation efforts are also intensifying, leading organizations to rely on data-driven workflows to maintain accountability, track financial performance, and ensure regulatory alignment. As funding volumes rise and program complexity grows, integrated solutions that connect seamlessly with enterprise financial tools are becoming essential to support comprehensive oversight in government entities, research organizations, higher education institutions, and philanthropic groups.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $5.8 Billion |

| CAGR | 10.2% |

The on-premises segment is projected to grow at a CAGR of 9.5% from 2025 to 2034. Many institutions continue to choose on-premises systems when requirements include strict data governance, extensive legacy workflows, or controlled internal IT environments. Organizations managing highly sensitive information or relying on long-standing procurement frameworks often prefer on-premises platforms due to predictable operational costs and compliance stability. However, challenges associated with updates, expansion, and long-term maintenance are prompting some users to explore hybrid alternatives that reduce technical strain.

The software segment accounted for an 88% share in 2024, reinforcing its dominance within the grant management ecosystem. Organizations increasingly seek platforms that automate core grant processes, consolidate application reviews, support monitoring activities, and provide real-time reporting. Strong integration capabilities with CRM, ERP, and financial systems continue to elevate demand for flexible, configurable solutions that simplify internal workflows and enhance compliance management as funding programs expand.

U.S. Grant Management Software Market reached USD 809.3 million in 2024. The country holds a leading position in North America due to its advanced digital ecosystem, established adoption across nonprofits and government bodies, and wide availability of enterprise-grade cloud solutions. Deployment success is further supported by strong collaboration between software providers, consulting partners, and public agencies, which helps streamline implementation, strengthen governance practices, and standardize processes across federal and state grant programs.

Major companies active in the Grant Management Software Market include Blackbaud, Salesforce, Workday, Oracle, Bonterra, Submittable, and Euna Solutions. Companies in the Grant Management Software Market rely on multiple strategies to strengthen their competitive position. Many are expanding cloud-native capabilities to improve scalability, enhance security, and simplify multi-agency collaboration. Vendors are also investing heavily in AI-driven automation to streamline application screening, detect anomalies, and optimize award distribution. Integration with financial, CRM, and analytics platforms remains a key priority, enabling seamless data exchange and reducing administrative workloads. Strategic partnerships with consulting firms and public-sector organizations allow vendors to support large-scale digital transformation projects and secure long-term contracts.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Deployment model

- 2.2.3 Component

- 2.2.4 Platform

- 2.2.5 Enterprise size

- 2.2.6 End use

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing regulatory compliance requirements

- 3.2.1.2 Digital transformation acceleration in government & nonprofits

- 3.2.1.3 Growing grant funding volumes globally

- 3.2.1.4 AI & automation adoption for efficiency gains

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial implementation costs & TCO concerns

- 3.2.2.2 Data security & privacy compliance burden

- 3.2.3 Market opportunities

- 3.2.3.1 FedRAMP high authorization market gap

- 3.2.3.2 International development aid digitization

- 3.2.3.3 AI-powered grant matching & predictive analytics

- 3.2.3.4 Mobile-first solutions for field operations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.7.3 Technology roadmaps & evolution

- 3.7.4 Technology adoption lifecycle analysis

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Patent analysis

- 3.10 Cost breakdown analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Carbon footprint considerations

- 3.13 Cybersecurity & data governance landscape

- 3.14 Use Case & Workflow Analysis

- 3.15 Integration & API Ecosystem

- 3.16 TCO & ROI Analysis Framework

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

- 4.7 Vendor selection criteria

Chapter 5 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Cloud

- 5.3 On-premises

- 5.4 Hybrid

Chapter 6 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Software

- 6.3 Services

- 6.3.1 Professional services

- 6.3.2 Managed services

Chapter 7 Market Estimates & Forecast, By Platform, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Web

- 7.3 Mobile app

Chapter 8 Market Estimates & Forecast, By Enterprise Size, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Large enterprises

- 8.3 SMEs

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 Government and public sector

- 9.3 Non-Profits & NGOs

- 9.4 Corporate

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Benelux

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Singapore

- 10.4.7 Malaysia

- 10.4.8 Indonesia

- 10.4.9 Vietnam

- 10.4.10 Thailand

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Colombia

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Turkey

Chapter 11 Company Profiles

- 11.1 Global companies

- 11.1.1 Salesforce

- 11.1.2 Blackbaud

- 11.1.3 Workday

- 11.1.4 Oracle

- 11.1.5 Microsoft

- 11.1.6 Sage

- 11.1.7 Benevity

- 11.1.8 Bonterra

- 11.2 Regional companies

- 11.2.1 Fluxx Labs

- 11.2.2 Optimy

- 11.2.3 AmpliFund

- 11.2.4 eCivis

- 11.2.5 CyberGrants

- 11.2.6 SmartSimple Cloud

- 11.2.7 HTC Global Services

- 11.2.8 REI Systems

- 11.3 Emerging companies

- 11.3.1 Submittable

- 11.3.2 WizeHive

- 11.3.3 Foundant Technologies

- 11.3.4 Instrumentl

- 11.3.5 SurveyMonkey Apply

- 11.3.6 Award Force

- 11.3.7 FluidReview

- 11.3.8 ZoomGrants

- 11.3.9 Good Grants

- 11.3.10 Grantseeker