PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885859

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885859

Medical Equipment Maintenance Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

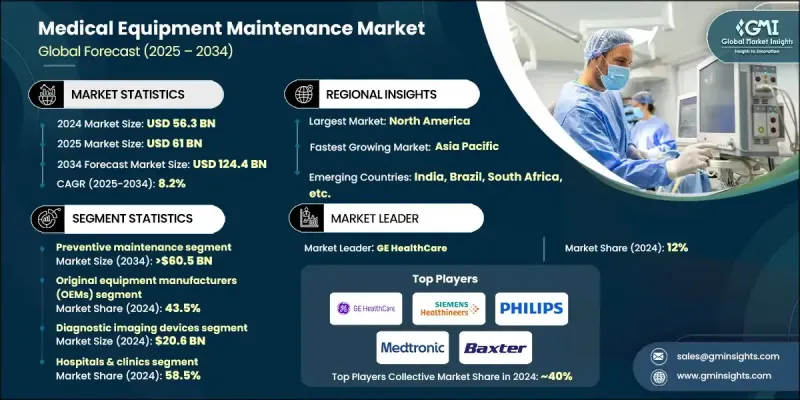

The Global Medical Equipment Maintenance Market was valued at USD 56.3 billion in 2024 and is estimated to grow at a CAGR of 8.2 % to reach USD 124.4 billion by 2034.

Market growth is driven by increasing emphasis on patient safety, rising adoption of refurbished and advanced medical devices, growing prevalence of chronic diseases, and stringent regulatory requirements for medical device upkeep. Hospitals and clinics are focusing on minimizing the risks posed by equipment failure, which can compromise patient care and safety. Preventive maintenance programs are being widely adopted to ensure devices operate within safe parameters, reduce errors, and maintain compliance with regulations. The need for reliability, operational efficiency, and oversight is pushing healthcare providers to opt for planned maintenance strategies, thereby fueling market expansion. Maintenance in this sector includes regular inspection, servicing, repair, and calibration of medical devices, ensuring optimal performance, safety, and longer equipment lifespan across healthcare facilities.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $56.3 Billion |

| Forecast Value | $124.4 Billion |

| CAGR | 8.2% |

The preventive maintenance segment held a 47.2% share in 2024. Growth in this segment is supported by cost-effective maintenance solutions designed for smaller healthcare facilities. Preventive maintenance involves routine inspections, calibration, and servicing to reduce unplanned device failures and maintain peak performance. By identifying and resolving potential issues early, it minimizes downtime, extends equipment life, and enhances patient safety. Hospitals increasingly adopt these programs to comply with regulations and reduce the costs associated with emergency repairs.

The original equipment manufacturers (OEMs) segment held a 43.5% share in 2024. OEMs maintain control by offering tailored service, specification-based parts, and technical expertise. Their strategies include long-term service agreements, predictive maintenance, and remote monitoring, often supported by digital platforms. OEM maintenance guarantees compliance with regulations and high-quality service, making them preferred providers for critical and high-value medical equipment.

North America Medical Equipment Maintenance Market captured 40.7% share in 2024. The region's advanced healthcare systems, high adoption of new medical technologies, and stringent regulatory standards drive demand for preventive and predictive maintenance. Major OEMs in the region provide integrated service contracts and digital solutions, while independent service organizations (ISOs) are increasingly offering cost-effective outsourced maintenance options.

Key players in the Global Medical Equipment Maintenance Market include FUJIFILM, Alliance Medical CORPORATION, Drive DeVilbiss HEALTHCARE, Baxter, Hitachi High-Tech, ALTHEA, STERIS HEALTHCARE, Philips, Aramark, Medtronic, GE Healthcare, Probo MEDICAL, ResMed, and GETINGE, SIEMENS Healthineers. Companies are strengthening their presence by investing in advanced digital maintenance platforms, predictive maintenance technologies, and remote monitoring solutions. Strategic partnerships, mergers, and acquisitions allow expansion into new regions and healthcare segments. Offering customized service contracts, including preventive and emergency maintenance packages, enhances customer loyalty. Firms focus on regulatory compliance, certifications, and training programs to build credibility and trust. Additionally, outsourcing solutions via ISOs provides cost-effective alternatives to hospitals, while innovation in maintenance solutions ensures reduced downtime, improved efficiency, and higher patient safety, reinforcing long-term market positioning.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Service type trends

- 2.2.3 Service provider trends

- 2.2.4 Equipment trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising adoption of advanced medical devices

- 3.2.1.2 Surging prevalence of chronic diseases

- 3.2.1.3 Growing focus on patient safety and equipment uptime

- 3.2.1.4 Regulatory compliance requirements for medical device maintenance

- 3.2.1.5 High adoption of refurbished medical equipment

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of maintenance services and contracts

- 3.2.2.2 Shortage of skilled technicians for complex devices

- 3.2.3 Opportunities

- 3.2.3.1 Predictive maintenance using AI and IoT

- 3.2.3.2 Remote monitoring solutions for cost efficiency

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Service contract models outlook

- 3.7 Sustainability and green maintenance initiatives

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Gap analysis

- 3.11 Integration of remote monitoring and tele-maintenance

- 3.12 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.3.1 Global

- 4.3.2 North America

- 4.3.3 Europe

- 4.3.4 Asia Pacific

- 4.3.5 LAMEA

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New service launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Service Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Preventive maintenance

- 5.3 Corrective maintenance

- 5.4 Operational maintenance

Chapter 6 Market Estimates and Forecast, By Service Provider, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Original equipment manufacturers (OEMs)

- 6.3 In-house maintenance

- 6.4 Independent service organizations (ISOs)

Chapter 7 Market Estimates and Forecast, By Equipment, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Diagnostic imaging devices

- 7.3 Electromedical devices

- 7.4 Surgical instruments

- 7.5 Patient monitoring and life support devices

- 7.6 Dental equipment

- 7.7 Endoscopic devices

- 7.8 Laboratory equipment

- 7.9 Other equipment

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals & clinics

- 8.3 Diagnostic imaging centers

- 8.4 Ambulatory surgical centers (ASCs)

- 8.5 Dental clinics

- 8.6 Dialysis centers

- 8.7 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Alliance Medical CORPORATION

- 10.2 ALTHEA

- 10.3 Aramark

- 10.4 Baxter

- 10.5 Drive DeVilbiss HEALTHCARE

- 10.6 FUJIFILM

- 10.7 GE HealthCare

- 10.8 GETINGE

- 10.9 Hitachi High-Tech

- 10.10 Medtronic

- 10.11 PHILIPS

- 10.12 Probo MEDICAL

- 10.13 Resmed

- 10.14 SIEMENS Healthineers

- 10.15 STERIS HEALTHCARE