PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885861

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885861

Mediterranean Atmospheric Water Generator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

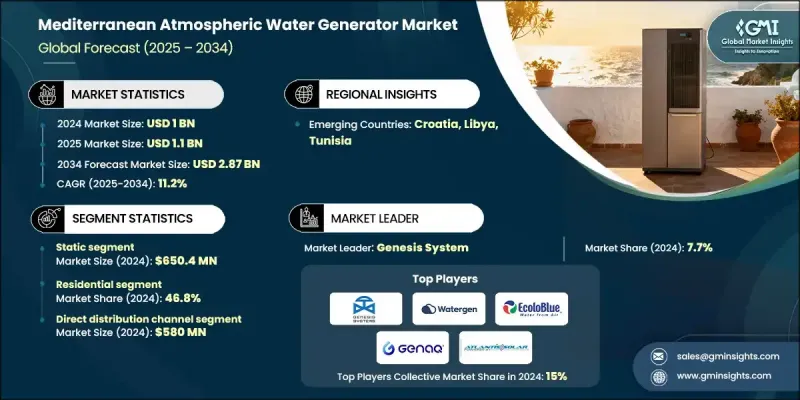

Mediterranean Atmospheric Water Generator Market was valued at USD 1 billion in 2024 and is estimated to grow at a CAGR of 11.2% to reach USD 2.87 billion by 2034.

The region faces persistent water stress due to rising temperatures, irregular rainfall, and declining aquifer levels, putting pressure on municipal water supplies and agricultural systems. Population growth and tourism intensify water demand, prompting governments, businesses, and households to explore alternative water sources. Atmospheric water generators (AWGs) offer a decentralized solution by producing potable water directly from air, helping mitigate reliance on conventional water systems. Policymakers and private stakeholders are increasingly emphasizing sustainable water management and climate resilience, driving AWG adoption in homes, hotels, and industrial facilities. Among the technologies, cooling-condensation dominates due to its consistent output and scalability. By condensing moisture from ambient air through refrigeration cycles, these systems ensure reliable water production in the moderate to high humidity conditions typical of the Mediterranean coast, making AWGs a crucial tool for regional water security.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1 Billion |

| Forecast Value | $2.87 Billion |

| CAGR | 11.2% |

In 2024, the static type segment generated USD 650.4 million. Static AWGs are permanently installed units designed to extract water from ambient air, differing from portable models in their sustained output and higher capacity. These systems are typically fixed in residential, commercial, or industrial premises and use cooling-condensation to convert air moisture into drinking water. Due to their reliability and higher output, static units are particularly suitable for Mediterranean regions with moderate humidity levels, providing continuous water availability.

The residential segment held a 46.8% share in 2024. Homeowners increasingly seek AWGs as a decentralized source of potable water, offering independence from municipal supplies, particularly in areas prone to drought or supply interruptions. Residential units are generally compact, energy-efficient, and capable of producing 20-100 liters of water daily, depending on humidity and temperature. The growing focus on sustainability and self-sufficiency is fueling demand for home-based AWG systems.

The Middle East Atmospheric Water Generator Market held a 57.2% share, generating USD 576.7 million in 2024. This growth is driven by chronic water scarcity and the demand for sustainable solutions in countries with arid climates and limited freshwater resources. AWGs provide a decentralized, cost-effective alternative to traditional desalination methods, which are energy-intensive. Governments and businesses increasingly view AWGs as a strategic component of water security planning across the region.

Key players operating in the Mediterranean Atmospheric Water Generator Market include Airwater Company, Atlantis Solar, A1RWATER, Agua De Sol, Beyond Water, EcoloBlue, Genaq Technologies, Genesis Systems, HAZAGUA, Island Sky Corp, Saba Technology, SolarDew, Source Global, Watergen, and Aquasol. To strengthen their presence, companies are focusing on product innovation, enhancing energy efficiency, and water output to meet the growing needs of residential, commercial, and industrial users. Strategic partnerships with governments and the private sectors are expanding deployment opportunities in drought-prone areas. Firms are investing in localized manufacturing and after-sales support to improve accessibility and reliability. Marketing campaigns highlight sustainability benefits, independence from municipal supplies, and emergency water security, appealing to environmentally conscious consumers.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Technology

- 2.2.4 Energy source

- 2.2.5 Capacity

- 2.2.6 Application

- 2.2.7 End use

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Acute freshwater scarcity

- 3.2.1.2 Mature cooling-condensation technology

- 3.2.1.3 Supportive regulatory environment

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital and energy requirements

- 3.2.2.2 Technical complexity and maintenance

- 3.2.3 Opportunities

- 3.2.3.1 Smart-home integration

- 3.2.3.2 Hybrid and renewable-powered systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Static

- 5.3 Mobile

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Condensation-based systems

- 6.3 Desiccant-based systems

- 6.4 Advanced technologies

- 6.5 MOF technology

- 6.6 Solar-thermal integration

- 6.7 Integrated water-agriculture systems

Chapter 7 Market Estimates and Forecast, By Energy Source, 2021 - 2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Solar-powered

- 7.3 Grid-connected

- 7.4 Hybrid renewable

- 7.5 Carbon negative systems

Chapter 8 Market Estimates and Forecast, By Capacity, 2021 - 2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 1L-500L

- 8.3 500L-1000L

- 8.4 1000L-5000L

- 8.5 Above 5000L

Chapter 9 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Standalone water generation

- 9.3 Agriculture-integrated systems

- 9.4 Food production facilities

- 9.5 Greenhouse applications

Chapter 10 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Residential

- 10.3 Commercial

- 10.4 Industrial

Chapter 11 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 Direct

- 11.3 Indirect

Chapter 12 Market Estimates and Forecast, By Countries, 2021 - 2034 (USD Million) (Thousand Units)

- 12.1 Key trends

- 12.2 Europe

- 12.2.1 Italy

- 12.2.2 Spain

- 12.2.3 France

- 12.2.4 Croatia

- 12.3 North Africa

- 12.3.1 Morocco

- 12.3.2 Algeria

- 12.3.3 Libya

- 12.3.4 Tunisia

- 12.3.5 Egypt

- 12.4 Middle East

- 12.4.1 Cyprus

- 12.4.2 Israel

- 12.4.3 Lebanon

- 12.4.4 Palestine

- 12.4.5 Syria

- 12.4.6 Turkey

Chapter 13 Company Profiles

- 13.1 A1RWATER

- 13.2 Agua De Sol

- 13.3 Airwater Company

- 13.4 Aquasol

- 13.5 Atlantis Solar

- 13.6 Beyond Water

- 13.7 EcoloBlue

- 13.8 Genaq Technologies

- 13.9 Genesis Systems

- 13.10 HAZAGUA

- 13.11 Island Sky Corp

- 13.12 Saba Technology

- 13.13 SolarDew

- 13.14 Source Global

- 13.15 Watergen