PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885871

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885871

Bidirectional EV Charging (V2G/V2H) System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

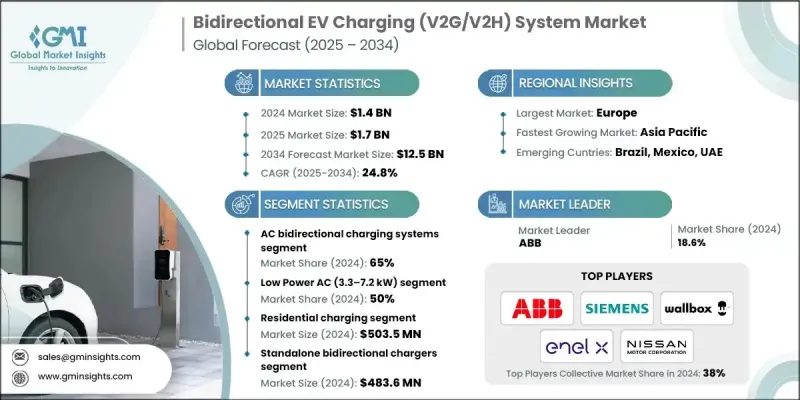

The Global Bidirectional EV Charging (V2G/V2H) System Market was valued at USD 1.4 billion in 2024 and is estimated to grow at a CAGR of 24.8% to reach USD 12.5 billion by 2034.

Market growth is fueled by the rapid adoption of electric vehicles, the expansion of commercial and private EV fleets, and rising demand for smart energy management solutions. As vehicle-to-grid and vehicle-to-home technologies advance, stakeholders are focusing on enhancing operational efficiency, grid stability, and optimized load distribution. The market is shifting toward data-driven, automated, and connected V2G/V2H networks, transforming conventional energy management approaches. Increasing use of IoT-enabled bidirectional chargers, AI-powered load balancing algorithms, and cloud-based energy platforms is revolutionizing operations, enabling predictive energy discharge, seamless coordination between utilities and fleet operators, and real-time monitoring to improve efficiency, reduce peak load, and lower operational costs. These innovations support scalable, cost-effective, and resilient bidirectional charging ecosystems across residential, commercial, and fleet applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.4 Billion |

| Forecast Value | $12.5 Billion |

| CAGR | 24.8% |

The AC bidirectional charging systems segment accounted for a 65% share in 2024 and is projected to grow at a CAGR of 25.2% between 2025 and 2034. AC bidirectional systems are integral for efficient V2G/V2H energy flow, leveraging onboard AC chargers, smart load controllers, and communication interfaces to facilitate energy discharge from EVs to homes or grids.

The low-power AC segment (3.3-7.2 kW) held a 50% share in 2024 and is expected to grow at a CAGR of 24.5% through 2034. This segment is primarily driven by residential and small commercial applications, offering cost-effective, easily installable solutions compatible with most EVs, enhanced by IoT monitoring and AI-enabled energy scheduling.

Germany Bidirectional EV Charging (V2G/V2H) System Market held a 40% share, generating USD 194.8 million in 2024. The country's leadership is supported by strong automotive manufacturing, regulatory incentives, and widespread adoption of connected, V2G-enabled infrastructure. Germany is increasingly implementing AI-based load optimization, IoT-enabled bidirectional chargers, predictive energy scheduling, and cloud-integrated energy management platforms to ensure grid reliability and operational efficiency while adhering to evolving energy regulations.

Key players driving growth in the Bidirectional EV Charging (V2G/V2H) System Market include Nuvve, Wallbox Chargers, Eaton, ABB, Siemens, Enel X, ChargePoint, The Mobility House, Schneider Electric, and Nissan Motor. Companies are strengthening their presence through strategic initiatives such as expanding regional charging networks, forming partnerships with utilities and fleet operators, and investing in AI and IoT-based bidirectional technologies. Product innovations include cost-efficient, low-power AC solutions and scalable commercial V2G systems. Firms also focus on integrating cloud platforms, predictive energy scheduling, and smart load balancing to improve performance and compliance. Marketing efforts target residential, commercial, and fleet customers to increase adoption, while mergers, acquisitions, and long-term service agreements enhance distribution, brand recognition, and market foothold globally.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Charging

- 2.2.3 Power capacity

- 2.2.4 Charging location

- 2.2.5 Integration level

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid EV adoption & fleet expansion

- 3.2.1.2 Smart grid & energy management needs

- 3.2.1.3 Technological advancements

- 3.2.1.4 Government policies & incentives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High infrastructure & implementation costs

- 3.2.2.2 Regulatory & standardization gaps

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with renewable energy & home energy systems

- 3.2.3.2 Fleet & commercial applications

- 3.2.3.3 Regulatory incentives and supportive policies

- 3.2.3.4 Smart city and fleet electrification projects

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America regulatory environment

- 3.4.2 European union directives & mandates

- 3.4.3 Asia pacific policy frameworks

- 3.4.4 Interconnection standards & utility requirements

- 3.4.5 Vehicle safety & certification requirements

- 3.4.6 Building code & electrical code updates

- 3.4.7 Insurance & liability regulatory framework

- 3.4.8 Data privacy & consumer protection regulations

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation Landscape

- 3.7.1 AC bidirectional charging technology evolution

- 3.7.2 DC bidirectional charging advancements

- 3.7.3 Onboard vs offboard architecture trade-offs

- 3.7.4 Power electronics & inverted technology trends

- 3.7.5 Battery management system integration

- 3.7.6 Smart inverter functions & grid support capabilities

- 3.7.7 Wireless/inductive bidirectional charging research

- 3.7.8 Technology readiness assessment by component

- 3.7.9 Next-generation technology pipeline

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Best case scenarios

- 3.14 Pilot programs & deployment case studies

- 3.14.1. Utility v2 g pilot programs overview

- 3.14.2 Pg&e BMW chargeforward program

- 3.14.3 Con Edison smart charge

- 3.14.4. Opg v2 g pilot

- 3.14.5. Uk v2 g trials

- 3.14.6. Japanese v2 h deployment programs

- 3.15 Consumer Behavior & Adoption Analysis

- 3.15.1 Consumer awareness levels by region

- 3.15.2 Purchase decision factors & priorities

- 3.15.3 Willingness to pay analysis

- 3.15.4 Participation rates in utility programs

- 3.15.5 Churn rates & retention analysis

- 3.15.6 Customer satisfaction metrics

- 3.16 Macroeconomic Factors & Market Impact

- 3.16.1 Energy price volatility impact

- 3.16.2 Electricity rate structures & time-of-use pricing

- 3.16.3 Wholesale energy market price trends

- 3.16.4 Interest rate environment & financing costs

- 3.16.5 Inflation impact on equipment costs

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Charging, 2021 - 2034 ($ Bn, Units)

- 5.1 Key trends

- 5.2 AC bidirectional charging systems

- 5.3 DC bidirectional charging systems

Chapter 6 Market Estimates & Forecast, By Power Capacity, 2021 - 2034 ($ Bn, Units)

- 6.1 Key trends

- 6.2 Low power AC (3.3-7.2 kW)

- 6.3 Medium power AC (11-22 kW)

- 6.4 DC fast charging (50-150 kW)

- 6.5 High power DC (150+ kW)

Chapter 7 Market Estimates & Forecast, By Charging Location, 2021 - 2034 ($ Bn, Units)

- 7.1 Key trends

- 7.2 Residential charging

- 7.3 Workplace charging

- 7.4 Fleet depot charging

- 7.5 Public charging

Chapter 8 Market Estimates & Forecast, By Integration Level, 2021 - 2034 ($ Bn, Units)

- 8.1 Key trends

- 8.2 Standalone bidirectional chargers

- 8.3 Integrated with solar PV

- 8.4 Integrated with stationary battery storage

- 8.5 Fully integrated home energy systems

- 8.6 Microgrid-integrated systems

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($ Bn, Units)

- 9.1 Key trends

- 9.2 Residential users

- 9.3 Commercial & fleet operators

- 9.4 Electric utilities & grid operators

- 9.5 Industrial facilities

- 9.6 Public sector & emergency services

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($ Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Belgium

- 10.3.7 Netherlands

- 10.3.8 Sweden

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 Singapore

- 10.4.6 South Korea

- 10.4.7 Vietnam

- 10.4.8 Indonesia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Global Player

- 11.1.1 ABB

- 11.1.2 ChargePoint

- 11.1.3 Eaton

- 11.1.4 Enel X

- 11.1.5 Nissan Motor

- 11.1.6 Nuvve

- 11.1.7 Schneider Electric

- 11.1.8 Shell Recharge Solutions

- 11.1.9 Siemens

- 11.1.10 Wallbox Chargers

- 11.2 Regional Player

- 11.2.1 Blink charging

- 11.2.2 Engie EV solutions

- 11.2.3 Evbox

- 11.2.4 Pod point

- 11.2.5 Star charge

- 11.2.6 Tesla energy

- 11.2.7 TGOOD

- 11.2.8 The mobility house

- 11.2.9 Tritium

- 11.2.10 Virta

- 11.3 Emerging Players

- 11.3.1 Freewire technologies

- 11.3.2 Greenlots

- 11.3.3 Incharge energy

- 11.3.4 Ohme

- 11.3.5. Ovo energy V2 G solutions