PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885877

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885877

Power Semiconductors for EVs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

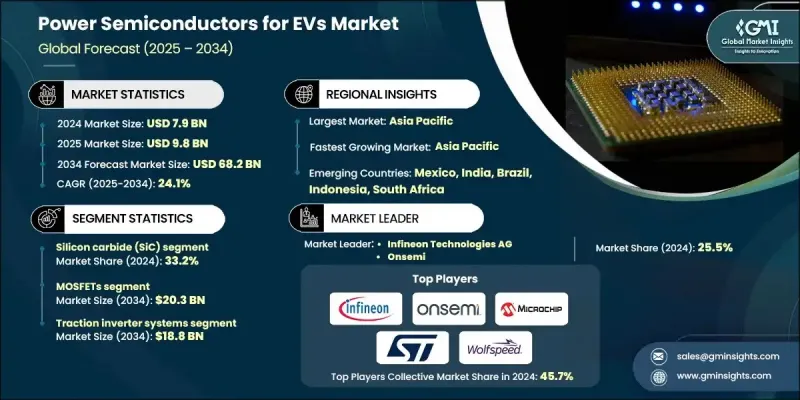

The Global Power Semiconductors for EVs Market was valued at USD 7.9 billion in 2024 and is estimated to grow at a CAGR of 24.1% to reach USD 68.2 billion by 2034.

The rapid acceleration of electric vehicle adoption is driving substantial demand for advanced power electronics capable of supporting battery systems, high-speed charging, and optimized vehicle performance. Rising global EV sales, which grew 35% year over year in the first quarter of 2025, reflect the momentum behind the electrification movement and reinforce the essential role of power semiconductors in ensuring efficient power conversion, reduced thermal losses, and enhanced system reliability. As EV platforms evolve, manufacturers require components that can withstand high temperatures, support faster charging, and maintain stable efficiency across demanding conditions. This shift continues to influence investments, technology roadmaps, and product upgrades within the semiconductor ecosystem. Collaborative efforts between automotive brands and semiconductor developers are accelerating the deployment of next-generation materials, while creating stronger supply chain frameworks to meet the rising volume and performance expectations of the global EV sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.9 Billion |

| Forecast Value | $68.2 Billion |

| CAGR | 24.1% |

The silicon carbide segment held a 33.2% share in 2024 as SiC devices gain traction due to their superior switching behavior, heat resistance, and charging performance. OEMs are increasingly integrating SiC MOSFETs into traction inverters and fast-charging architectures to improve energy efficiency and extend vehicle range. Manufacturers continue to scale SiC wafer capacity and pursue vertical integration, along with engineering tailored modules that align with the performance requirements of individual EV platforms.

The MOSFET segment is expected to reach USD 20.3 billion by 2034, supported by strong demand across onboard chargers, auxiliary circuits, and DC-DC converters. Producers are working to enhance voltage ratings and thermal durability to accommodate the growing electrical loads and higher power densities of modern EV designs.

United States Power Semiconductors for EVs Market generated USD 1.9 billion in 2024. Recent funding initiatives, including federal support for power module development, highlight ongoing national efforts to strengthen charging infrastructure. This environment encourages semiconductor suppliers to prioritize high-performance SiC and GaN technologies and to collaborate closely with domestic automotive companies to address fast-charging demands and high-voltage system challenges.

Key participants in the Power Semiconductors for EVs Market include Infineon Technologies AG, ROHM Co., Ltd., Onsemi, Mitsubishi Electric Corp., Renesas Electronics Corp., Microchip Technology Inc., STMicroelectronics N.V., Wolfspeed, Inc., Littelfuse, Inc., and Fuji Electric Co., Ltd. To reinforce their market position, companies in the power semiconductors for EVs sector are implementing strategies centered on scaling production capacity and accelerating material innovation. Many are expanding SiC and GaN manufacturing lines to meet long-term EV demand while investing in vertically integrated supply chains that stabilize wafer availability and reduce production costs. Firms are also designing application-specific modules tailored to OEM performance targets, enabling stronger technical partnerships. R&D efforts focus on reducing switching losses, improving thermal management, and supporting higher power densities.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Component type trends

- 2.2.2 Material type trends

- 2.2.3 Application trends

- 2.2.4 End Use trends

- 2.2.5 Sales channel trends

- 2.2.6 Regional trends

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of electric vehicles globally

- 3.2.1.2 Rising demand for high-efficiency and low-loss power electronics

- 3.2.1.3 Growth in renewable energy integration with EV charging infrastructure

- 3.2.1.4 Strategic collaborations to accelerate EV semiconductor innovation

- 3.2.1.5 Expansion of EV charging networks and fast-charging technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced power semiconductors (SiC, GaN)

- 3.2.2.2 Supply chain constraints and raw material shortages

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for next-generation EVs with higher efficiency

- 3.2.3.2 Expansion of fast-charging infrastructure and smart grids

- 3.2.3.3 Emergence of electric commercial vehicles and buses

- 3.2.3.4 Strategic partnerships and collaborations in semiconductor industry

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Pricing strategies

- 3.10 Emerging business models

- 3.11 Compliance requirements

- 3.12 Patent and IP analysis

- 3.13 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Component Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 MOSFETs

- 5.3 IGBTs

- 5.4 Diodes

- 5.5 Power ICs

- 5.6 Thyristor

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Material Type, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Silicon (Si)

- 6.3 Silicon Carbide (SiC)

- 6.4 Gallium Nitride (GaN)

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Traction inverter systems

- 7.3 Onboard Chargers (OBC)

- 7.4 DC-DC converters

- 7.5 Electric drive motors

- 7.6 Battery Management Systems (BMS)

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Battery Electric Vehicles (BEVs)

- 8.3 Plug-in Hybrid Electric Vehicles (PHEVs)

- 8.4 Hybrid Electric Vehicles (HEVs)

Chapter 9 Market Estimates and Forecast, By Sales Channel, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 OEMs (Original Equipment Manufacturers)

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Key Players

- 11.1.1 Infineon Technologies AG

- 11.1.2 Onsemi

- 11.1.3 Microchip Technology Inc.

- 11.1.4 STMicroelectronics N.V.

- 11.1.5 Wolfspeed, Inc.

- 11.2 Regional Key Players

- 11.2.1 North America

- 11.2.1.1 Vishay Intertechnology, Inc.

- 11.2.1.2 Littelfuse, Inc.

- 11.2.1.3 Diodes Incorporated

- 11.2.2 Europe

- 11.2.2.1 Semikron-Danfoss Group

- 11.2.2.2 Hitachi

- 11.2.2.3 SanRex Corporation

- 11.2.3 APAC

- 11.2.3.1 Mitsubishi Electric Corp.

- 11.2.3.2 ROHM Co., Ltd.

- 11.2.3.3 Renesas Electronics Corp.

- 11.2.1 North America

- 11.3 Niche Players / Disruptors

- 11.3.1 Toshiba Electronic Devices & Storage Corporation

- 11.3.2 Fuji Electric Co., Ltd.

- 11.3.3 Starpower Semiconductor Ltd.

- 11.3.4 Navitas Semiconductor Corporation