PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885879

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885879

Carpet Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

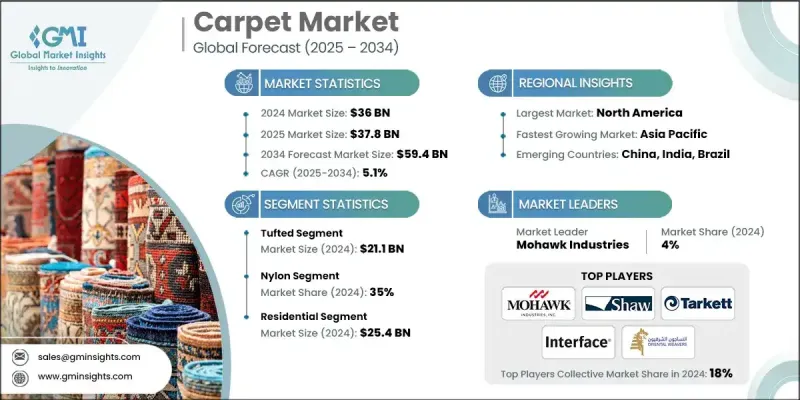

The Global Carpet Market was valued at USD 36 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 59.4 billion by 2034.

A major force behind this growth is the rising preference for environmentally responsible carpets. Producers are incorporating more recycled fibers, natural materials such as wool, jute, and sisal, and low-VOC adhesives to satisfy the growing demand for green products. Certifications like Cradle to Cradle and Green Label Plus have become stronger signals of product quality and environmental commitment. Circular-economy principles are inspiring innovations such as recyclable backings, take-back initiatives, and modular carpet systems that help reduce waste and enhance material efficiency. These sustainability-driven changes influence not just product design but also marketing, as environmentally conscious buyers, especially younger generations, favor brands that reflect their values. At the same time, digital transformation and the rapid rise of e-commerce are reshaping how carpets are promoted and sold, giving consumers broader access to diverse styles and a more convenient buying experience.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $36 Billion |

| Forecast Value | $59.4 Billion |

| CAGR | 5.1% |

In 2024, the tufted carpets segment generated USD 21.1 billion. Their dominance comes from fast production cycles, lower manufacturing costs, and wide design flexibility. The tufting process uses specialized needles to insert yarn into a backing layer, enabling rapid output with far less labor than traditional weaving. This efficient technique allows companies to supply large quantities at competitive prices while offering a wide range of textures, pile variations, and patterns suitable for residential, commercial, and hospitality environments.

The nylon segment accounted for a 35% share in 2024. Its popularity stems from its durability, structural resilience, and balanced price-to-performance profile. Nylon fibers withstand heavy foot traffic without significant wear and maintain their appearance over time. When enhanced with protective finishes, they offer strong resistance to stains, making them highly appealing for settings that require long-lasting performance.

United States Carpet Market held a 76.9% share and generated USD 8.9 billion in 2024. Continued growth in both residential and commercial spaces supports this leadership. Increasing adoption of eco-friendly carpets aligns with the region's heightened focus on sustainability. Strong construction activity, rising renovation efforts, and improvements in fiber technology, including better stain resistance and enhanced durability, reinforce the country's position in the regional market.

Key companies operating in the Global Carpet Market include Brintons, EGE Carpets, Lano, Balta, Beaulieu, Bentley Mills, Engineered Floors, Interface, Merinos Hali, Milliken & Company, Mohawk Industries, Oriental Weavers, Shaw Industries Group, Tarkett, and The Dixie Group. Companies competing in the Carpet Market strengthen their position through a mix of innovation, sustainability, and strategic expansion. Many are investing in advanced manufacturing technologies to improve efficiency and accelerate product development. Sustainability has become central, prompting firms to adopt recycled inputs, eco-friendly backings, and low-emission materials to meet evolving environmental expectations. Digital platforms and e-commerce enhancements help brands reach wider audiences and improve customer engagement. Numerous players are also expanding their distribution networks and forming strategic partnerships to improve market access.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product Type

- 2.2.3 Material

- 2.2.4 Application

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for interior aesthetics and home renovation

- 3.2.1.2 Growth in commercial and institutional construction

- 3.2.1.3 Technological advancements and product innovation

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Volatility in raw material prices and price instability

- 3.2.2.2 Labor shortages and skill gaps

- 3.2.3 Opportunities

- 3.2.3.1 Rising demand for sustainable and eco-friendly carpets

- 3.2.3.2 Customization and design personalization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Major market trends and Disruptions

- 3.5 Future market trends

- 3.6 Gap Analysis

- 3.7 Risk and mitigation Analysis

- 3.8 Trade statistics

- 3.8.1 Major importing country

- 3.8.2 Major exporting country

- 3.9 Consumer behaviour analysis

- 3.9.1 Purchasing patterns

- 3.9.2 Preference analysis

- 3.9.3 Regional variations in consumer behavior

- 3.9.4 Impact of e-commerce on buying decisions

- 3.10 Technology and innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Price trends

- 3.11.1 By region

- 3.11.2 By product type

- 3.12 Regulatory landscape

- 3.12.1 North America

- 3.12.2 Europe

- 3.12.3 Asia-Pacific

- 3.12.4 Middle East and Africa

- 3.12.5 Latin America

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

- 3.15 Market Evaluation

- 3.15.1 Global

- 3.15.2 Europe

- 3.15.3 Turkey

- 3.16 Overall assessment and growth prospects

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Million Square Feet)

- 5.1 Key trends

- 5.2 Tufted

- 5.3 Woven

- 5.4 Needle-punched

- 5.5 Knotted

- 5.6 Flat-weave

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 (USD Billion) (Million Square Feet)

- 6.1 Key trends

- 6.2 Nylon

- 6.3 Polyester

- 6.4 Polypropylene

- 6.5 Wool

- 6.6 Acrylic

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Million Square Feet)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Million Square Feet)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 E-commerce

- 8.2.2 Company website

- 8.3 Offline

- 8.3.1 Discount retail channels

- 8.3.1.1 Home Improvement Centers

- 8.3.1.2 Mass Merchandisers

- 8.3.1.3 Off-price Retailers

- 8.3.1.4 Furniture Discount/Outlet Stores

- 8.3.2 Traditional speciality channels

- 8.3.1 Discount retail channels

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Million Square Feet)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Turkey

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Balta

- 10.2 Beaulieu

- 10.3 Bentley Mills

- 10.4 Brintons

- 10.5 EGE Carpets

- 10.6 Engineered Floors

- 10.7 Interface

- 10.8 Lano

- 10.9 Merinos Hali

- 10.10 Milliken & Company

- 10.11 Mohawk Industries

- 10.12 Oriental Weavers

- 10.13 Shaw Industries Group

- 10.14 Tarkett

- 10.15 The Dixie Group