PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885896

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885896

Cultivated Meat Ingredients Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

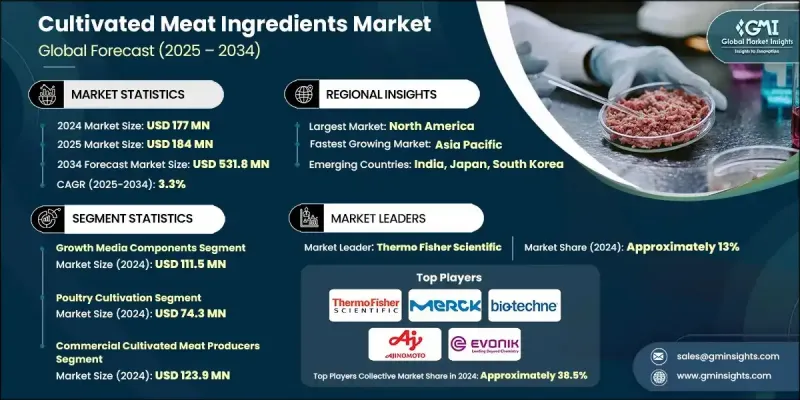

The Global Cultivated Meat Ingredients Market was valued at USD 177 million in 2024 and is estimated to grow at a CAGR of 3.3% to reach USD 531.8 million by 2034.

These ingredients form the foundation of cellular agriculture, enabling the creation of real meat from animal cells through controlled bioprocessing rather than traditional farming. They include essential components such as growth media ingredients, scaffolding materials, and processing additives that support cell expansion, maturation, and structured tissue formation. Advanced bioprocess engineering and precision fermentation are used to develop food-grade inputs that help form muscle, fat, and connective tissue within large-scale bioreactor systems. As regulations become clearer and sustainability priorities strengthen, manufacturers are emphasizing animal-free, lower-cost formulations to push the industry toward price parity with conventional meat. Commercial producers represent the largest demand base, relying heavily on high-quality media inputs including basal nutrients, recombinant growth factors like FGF2 and IGF-1, serum-free replacements, and micronutrient blends designed for high-density cell performance. This circular approach to bioprocessing aims to reduce dependence on costly pharmaceutical-grade ingredients and builds the path toward scalable production systems capable of supporting industrial-level cultivated meat operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $177 million |

| Forecast Value | $531.8 million |

| CAGR | 3.3% |

The growth media components segment generated USD 111.5 million in 2024 and is expected to grow at a CAGR of 3.2% from 2025 to 2034, accounting for a 63% share in 2024. This category plays a dominant role because these components provide the biochemical foundation necessary for robust cell growth, survival, and differentiation throughout cultivation. Basal nutrients, specialized proteins, amino acid blends, and serum-free substitutes all work together to create the optimal environment for tissue formation.

The poultry cultivation segment generated USD 74.3 million in 2024 and is expected to grow at a CAGR of 3.4% between 2025 and 2034, representing 42% of the total market in 2024. Poultry cells hold a leading position in this sector due to their favorable growth behavior, more efficient media requirements, and broad consumer acceptance of various poultry-based products. Faster cell doubling times and reduced complexity contribute to lower operating costs and shorter commercialization timelines, which are especially important for early-stage production facilities focused on scaling rapidly while managing capital demands.

North America Cultivated Meat Ingredients Market is projected to grow at a CAGR of 3.3% from 2025 to 2034. Rising corporate interest in sustainable protein production and growing recognition of cellular agriculture's role in responsible food systems are contributing to increased adoption across commercial, pilot, and research environments. Concerns surrounding environmental impact and ethical food production are motivating investment into advanced bioprocess technologies that may gradually complement traditional livestock-based systems.

Leading companies in the Global Cultivated Meat Ingredients Market include Thermo Fisher Scientific, Merck KGaA, Bio-Techne, Ajinomoto, Evonik Industries, CJ Bio, Wacker Chemie, Sartorius, ADM, Cargill, GenScript, Takara Bio, Rousselot, GELITA, and Palsgaard. Companies in the Cultivated Meat Ingredients Market are strengthening their competitive positioning by investing heavily in R&D to lower production costs, improve functional performance, and develop animal-free ingredients tailored for large-scale bioprocessing. Many firms are advancing recombinant protein technologies, optimizing nutrient blends, and building partnerships with cultivated meat manufacturers to co-develop specialized media formulations. Businesses are expanding their global footprint through new production sites, strategic collaborations, and supply-chain integration to ensure reliable ingredient availability. Sustainability initiatives, including the shift toward food-grade, non-pharmaceutical components, also support long-term market expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Ingredients trends

- 2.2.2 Application trends

- 2.2.3 End use trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Drivers

- 3.2.2 Pitfalls & Challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By ingredients

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Ingredients, 2021-2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Growth media components

- 5.2.1 Basal media

- 5.2.2 Serum & serum alternatives

- 5.2.3 Recombinant growth factors

- 5.2.4 Recombinant structural & functional proteins

- 5.2.5 Amino acids & nitrogen sources

- 5.2.6 Vitamins, minerals & energy sources

- 5.3 Growth media components

- 5.3.1 Nanofibrous scaffolds

- 5.3.2 Edible microcarriers

- 5.3.3 Edible membranes & hollow fiber systems

- 5.3.4 Extracellular matrix (ECM) proteins

- 5.3.5 Plant-derived scaffolds

- 5.3.6 Fungal & microbial scaffolds

- 5.3.7 Synthetic polymer scaffolds

- 5.3.8 3D bioinks

- 5.4 Processing aids & formulation ingredients

- 5.4.1 Crosslinking enzymes

- 5.4.2 Lipids & fatty acids

- 5.4.3 Emulsifiers & stabilizers

- 5.4.4 Fat substitutes & oleogels

- 5.4.5 Flavor systems & sensory enhancers

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Poultry cultivation

- 6.3 Seafood & fish cultivation

- 6.4 Beef & red meat cultivation

- 6.5 Pork cultivation

- 6.6 Exotic & novel meats

- 6.7 Others

Chapter 7 Market Estimates and Forecast, By End Use, 2021-2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Commercial Cultivated Meat Producers

- 7.3 Pilot & Demonstration Facilities

- 7.4 Research Institutions & Academia

- 7.5 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Thermo Fisher Scientific

- 9.2 Merck KGaA

- 9.3 Bio-Techne

- 9.4 Ajinomoto

- 9.5 Evonik Industries

- 9.6 CJ Bio

- 9.7 Wacker Chemie

- 9.8 Sartorius

- 9.9 ADM

- 9.10 Cargill

- 9.11 GenScript

- 9.12 Takara Bio

- 9.13 Rousselot

- 9.14 GELITA

- 9.15 Palsgaard