PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885899

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885899

Plant-Based Seafood Ingredients Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

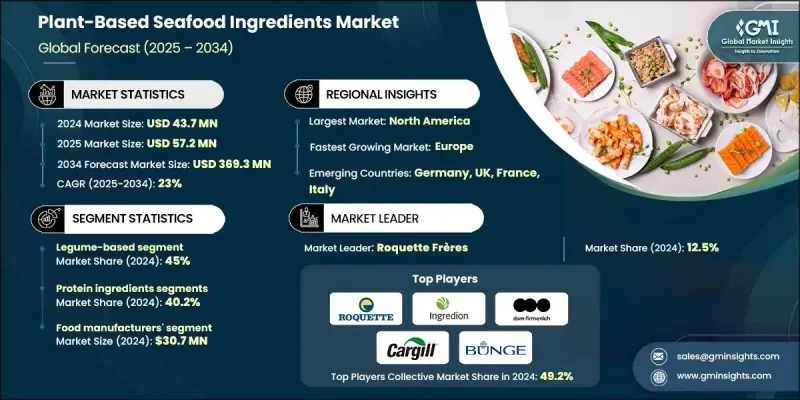

The Global Plant-Based Seafood Ingredients Market was valued at USD 43.7 million in 2024 and is estimated to grow at a CAGR of 23% to reach USD 369.3 million by 2034.

The surge in demand reflects consumers' growing preference for sustainable, ethical, and health-conscious foods. Plant-based seafood alternatives are gaining traction due to their ability to closely replicate conventional seafood in taste, texture, and appearance, while addressing concerns about overfishing, marine pollution, and climate change. Consumers are increasingly aware of the health advantages of plant-based diets, including lower cholesterol levels, improved cardiovascular health, and weight management. The primary application of these ingredients is to provide a sustainable and nutritious substitute for traditional seafood, catering to the expanding vegan, vegetarian, and flexitarian populations. These ingredients are utilized in the production of seafood analogs, ready-to-eat meals, snacks, and functional food products, enabling food manufacturers to reduce environmental impact while delivering the sensory qualities consumers desire.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $43.7 Million |

| Forecast Value | $369.3 Million |

| CAGR | 23% |

The legume-based ingredients segment held a 45% share in 2024, due to their high protein content, versatility, and environmental benefits. Soy, pea, and chickpea derivatives are increasingly used to replicate seafood textures and flavors for health-conscious and eco-aware consumers. Processing advancements are enhancing their functionality for seafood applications.

The protein ingredients segment held 40.2% share in 2024, focusing on plant-derived proteins that improve nutritional content and functional properties. Innovations in protein extraction and processing have significantly improved taste and texture, while clean-label and allergen-free trends continue to drive product development.

North America Plant-Based Seafood Ingredients Market held a 42.3% share in 2024 and is expected to grow at a 23.1% CAGR through 2034, with the U.S. market valued at USD 14.8 million in 2024. Growth in this region is driven by health-conscious consumers, sustainability concerns, and ethical considerations. Technological advancements in plant protein extraction and fermentation have enabled the creation of seafood alternatives with authentic taste and texture. Additional market momentum comes from favorable regulations and increased product launches across retail and food service sectors.

Key players in the Plant-Based Seafood Ingredients Market include Cargill, Incorporated; DSM-Firmenich; Ingredion Incorporated; Bunge Limited; CP Kelco (J.M. Huber Corporation); Roquette Freres; AGT Foods & Ingredients; Angel Yeast Co., Ltd.; Mara Renewables Corporation; Paleo (formerly Miruku); BENEO GmbH (Sudzucker Group); FMC Corporation (BioPolymer Division); Kalys (MERIDIS Group); and Algama Foods. Leading companies in the Plant-Based Seafood Ingredients Market are adopting strategies such as expanding product portfolios, investing in R&D for texture and taste improvements, forming partnerships with foodservice and retail brands, and leveraging sustainable and clean-label claims. They are also focusing on geographic expansion, strategic collaborations, and technological innovations in protein extraction and fermentation processes to strengthen market presence and appeal to environmentally conscious and health-focused consumers.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Source

- 2.2.3 Ingredient type

- 2.2.4 Functionality

- 2.2.5 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product category

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Source, 2021-2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Legume-based ingredients

- 5.3 Cereal & grain-based ingredients

- 5.4 Seaweed & algae-based ingredients

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Ingredient Type, 2021-2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Protein ingredients

- 6.2.1 Pea protein

- 6.2.2 Soy protein

- 6.2.3 Wheat gluten

- 6.3 Hydrocolloids & texturizing agents

- 6.3.1 Carrageenan

- 6.3.2 Alginate

- 6.3.3 Agar

- 6.3.4 Konjac glucomannan

- 6.3.5 Other hydrocolloids

- 6.4 Flavoring ingredients

- 6.4.1 Yeast extract

- 6.4.2 Seaweed seasoning & extracts

- 6.4.3 Vegetable umami & natural flavors

- 6.5 Oils & fats

- 6.5.1 Algal oil (omega-3)

- 6.5.2 Microbial oils (precision fermentation)

- 6.5.3 Plant oils (canola, coconut, sunflower)

- 6.6 Functional additives

- 6.6.1 Starches

- 6.6.2 Fibers (cellulose, citrus, flax, chia)

- 6.6.3 Natural colorants (phycobiliproteins, vegetable concentrates)

Chapter 7 Market Estimates and Forecast, By Functionality, 2021-2034 (USD Million & Kilo Tons)

- 7.1 Key trend

- 7.2 Protein & nutrition enhancement

- 7.3 Texture & structure formation

- 7.4 Flavor & taste enhancement

- 7.5 Binding & gelation

- 7.6 Color & appearance

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By End Use, 2021-2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 Food manufacturers (B2B)

- 8.3 Foodservice & restaurants

- 8.4 Retail brands

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 AGT Foods & Ingredients

- 10.2 Algama Foods

- 10.3 Angel Yeast Co., Ltd.

- 10.4 BENEO GmbH (Sudzucker Group)

- 10.5 Bunge Limited

- 10.6 Cargill, Incorporated

- 10.7 CP Kelco (J.M. Huber Corporation)

- 10.8 dsm-firmenich

- 10.9 FMC Corporation (BioPolymer Division)

- 10.10 Ingredion Incorporated

- 10.11 Kalys (MERIDIS Group)

- 10.12 Mara Renewables Corporation

- 10.13 MGP Ingredients, Inc.

- 10.14 Paleo (formerly Miruku)

- 10.15 Roquette Freres