PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885903

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885903

Hollow Fiber Membrane Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

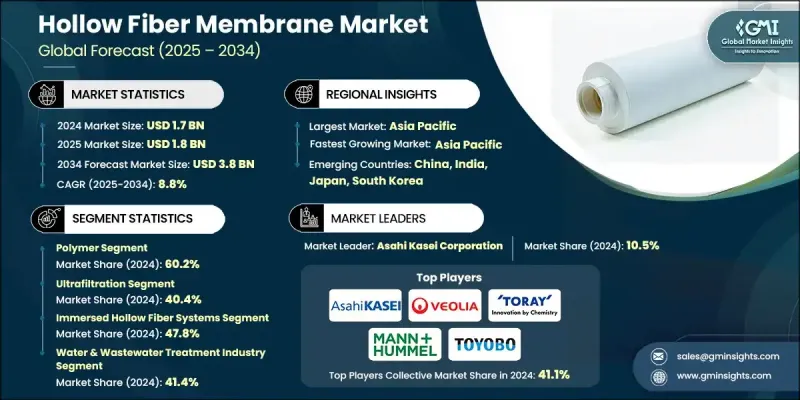

The Global Hollow Fiber Membrane Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 8.8% to reach USD 3.8 billion by 2034.

Hollow fiber membranes, initially designed for laboratory-scale applications, have become critical components in infrastructure and life-support systems, supported by growing regulatory oversight. Their adoption is driven by safety and efficacy standards for healthcare and industrial use, coupled with recognition as leading technologies for treating challenging contaminants. The industry relies on advanced polymer chemistry and highly precise manufacturing to create membranes with tightly controlled pore structures. High entry barriers, including regulatory approvals, substantial capital requirements, and specialized technical knowledge, tend to favor established, vertically integrated firms with proven track records. Market players can be broadly categorized into healthcare-focused companies emphasizing compliance, industrial providers delivering cost-efficient and durable solutions, and multi-segment players with diverse cross-application portfolios.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $3.8 Billion |

| CAGR | 8.8% |

The polymer membranes segment held 60.2% share in 2024 and is expected to grow at a CAGR of 8.5% through 2034. Their broad application across water treatment, dialysis, and industrial processes makes them the dominant material choice due to cost-effectiveness, versatility, and ease of production. Technological advancements have further improved their permeability, durability, and resistance to fouling, accelerating market growth.

The ultrafiltration technology segment held a 40.4% share in 2024 and is projected to grow at a CAGR of 9.1% during 2025-2034. The demand for ultrafiltration membranes is fueled by their efficiency in separating viruses, proteins, and other high-molecular-weight compounds from water and fluids. Growing initiatives for water recycling and reuse in industrial and municipal operations have further increased the adoption of ultrafiltration. Its lower energy requirements and operational costs make it an increasingly preferred choice for various applications.

Europe Hollow Fiber Membrane Market generated USD 302.5 million in 2024. The market in Europe combines maturity with evolving demands, driven by stringent environmental regulations and sustainability initiatives. Regulations on waste discharge and water quality standards have intensified the need for efficient membrane filtration solutions in municipal, industrial, and healthcare sectors. Key countries driving adoption include Germany, the UK, and France, where water conservation and pollution control programs support market expansion.

Major companies in the Global Hollow Fiber Membrane Market include Asahi Kasei Corporation, Kovalus Separation Solutions, Polymem France, Mitsubishi Chemical Corporation, DuPont, NX Filtration, Oxymo Technology, Mann+Hummel, Toray Industries, Inc., PHILOS Co., Ltd, Theway Membranes, Zig Sheng Industrial Co., Ltd, Jiuwu Hi-Tech Membrane Technology, Aquabrane Water Technologies Pvt. Ltd., Toyobo, LG Chem, Medica Group, Veolia, and Zena Membranes. Leading companies in the Global Hollow Fiber Membrane Market focus on strategies such as expanding their product portfolios across healthcare and industrial applications, investing in R&D to improve membrane performance and durability, and forming strategic alliances to enhance distribution networks. Many are adopting cost optimization techniques, scaling up production capacity, and leveraging regulatory certifications to strengthen credibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material type

- 2.2.3 Filtration type

- 2.2.4 Technology configuration

- 2.2.5 Application

- 2.2.6 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By material type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021-2034 (USD Million) (Thousand Square Meter)

- 5.1 Key trends

- 5.2 Polymer

- 5.2.1 Polysulfone (PS)

- 5.2.2 Polyethersulfone (PES)

- 5.2.3 Polyvinylidene Fluoride (PVDF)

- 5.2.4 Polyacrylonitrile (PAN)

- 5.2.5 Polyimide (PI)

- 5.2.6 Other Polymers

- 5.3 Ceramic

- 5.4 Composite

Chapter 6 Market Estimates and Forecast, By Filtration Type, 2021-2034 (USD Million) (Thousand Square Meter)

- 6.1 Key trends

- 6.2 Microfiltration

- 6.3 Ultrafiltration

- 6.4 Nanofiltration

- 6.5 Reverse osmosis

Chapter 7 Market Estimates and Forecast, By Technology Configuration, 2021-2034 (USD Million) (Thousand Square Meter)

- 7.1 Key trends

- 7.2 Immersed hollow fiber systems

- 7.3 Tangential flow filtration (TFF)

- 7.4 Dead-end filtration

- 7.5 Vacuum membrane distillation

Chapter 8 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Thousand Square Meter)

- 8.1 Key trends

- 8.2 Water & wastewater treatment

- 8.3 Pharmaceutical & biotechnology

- 8.4 Food & beverage processing

- 8.5 Chemical processing

- 8.6 Blood purification/hemodialysis

- 8.7 Environmental protection

- 8.8 Gas separation & recovery

- 8.9 Others

Chapter 9 Market Estimates and Forecast, By End Use, 2021-2034 (USD Million) (Thousand Square Meter)

- 9.1 Key trends

- 9.2 Municipal

- 9.3 Industrial

- 9.3.1 Manufacturing

- 9.3.2 Power generation

- 9.3.3 Oil & gas

- 9.4 Healthcare

- 9.5 Food & beverage

- 9.6 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Thousand Square Meter)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Asahi Kasei Corporation

- 11.2 Kovalus Separation Solutions

- 11.3 Polymem France

- 11.4 Mitsubishi Chemical Corporation

- 11.5 DuPont

- 11.6 NX Filtration

- 11.7 Oxymo Technology

- 11.8 Mann+Hummel

- 11.9 Toray Industries, Inc.

- 11.10 PHILOS Co., Ltd

- 11.11 Theway Membranes

- 11.12 Zig Sheng Industrial Co., Ltd

- 11.13 Jiuwu Hi-Tech Membrane Technology

- 11.14 Aquabrane Water Technologies Pvt. Ltd.

- 11.15 Toyobo

- 11.16 LG Chem

- 11.17 Medica Group

- 11.18 Veolia

- 11.19 Zena Membranes