PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885911

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885911

Data Center Infrastructure Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

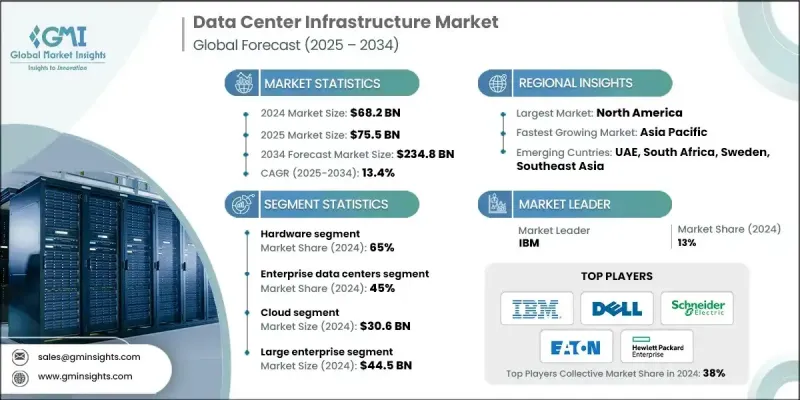

The Global Data Center Infrastructure Market was valued at USD 68.2 billion in 2024 and is estimated to grow at a CAGR of 13.4% to reach USD 234.8 billion by 2034.

The market expansion is fueled by increasing adoption of artificial intelligence workloads, hyperscale cloud growth, and enterprise digital transformation. Rising demand for high-density racks, purpose-built servers, GPUs, and accelerators is reshaping power distribution, cooling, and network interconnect requirements. Government initiatives promoting digitization, smart cities, and data-driven governance are driving the construction of more data centers to improve efficiency, safety, and innovation under heavy workload demands. The industry is shifting from traditional x86 architectures to custom silicon and specialized accelerators tailored for AI and machine learning tasks. Hyperscale operators are investing in proprietary server designs with custom processors and AI accelerators to optimize performance, power efficiency, and total cost of ownership. Edge data center economics differ significantly from hyperscale deployments, while the push for energy-efficient, low-carbon operations is forcing operators to adopt renewable power sourcing, heat-reuse strategies, and stricter energy performance standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $68.2 Billion |

| Forecast Value | $234.8 Billion |

| CAGR | 13.4% |

The hardware segment held a 65% share in 2024 and is expected to grow at a CAGR of 12.7% from 2025 to 2034. This segment includes servers, storage systems, networking equipment, power distribution units (PDUs), uninterruptible power supplies (UPS), cooling infrastructure, racks, and enclosures. Hardware requires significant capital investment and frequent technology refresh cycles to maintain efficiency and performance across evolving workloads.

The enterprise data centers segment accounted for a 45% share in 2024 and is anticipated to grow at a CAGR of 12.6% between 2025 and 2034. These facilities, operated internally by organizations to support IT operations, remain the largest segment but are gradually declining as enterprises migrate toward colocation and public cloud platforms. Many enterprise data centers operate with power usage effectiveness (PUE) values above 1.8-2.0 due to legacy infrastructure and under-optimized cooling systems, presenting opportunities for efficiency improvements.

North America Data Center Infrastructure Market held 38% share, valued at USD 26.3 billion in 2024. The region benefits from a strong presence of hyperscale operators, technology firms, financial institutions, and digital infrastructure. The U.S. market is expected to expand rapidly due to AI infrastructure investments, with demand for data center power projected to increase from around 4 GW in 2024 to 123 GW by 2035.

Key players in the Global Data Center Infrastructure Market include Eaton, Lenovo Group, Hewlett Packard Enterprise (HPE), Cisco Systems, ABB, IBM, Dell, Fujitsu, Schneider Electric, and Huawei Technologies. Companies in the Data Center Infrastructure Market are strengthening their presence by focusing on R&D for high-efficiency servers, advanced cooling solutions, and next-generation networking equipment. Strategic partnerships with cloud providers and enterprise clients help them tailor solutions to specific workload requirements. Geographic expansion into emerging markets and acquisitions of technology startups enhance market reach. Firms are also investing in energy-efficient designs, low-carbon operations, and AI-enabled monitoring systems to improve performance, reduce operating costs, and comply with regulatory standards. Offering comprehensive service and maintenance contracts alongside training programs further builds customer loyalty and reinforces competitive positioning.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast

- 1.4 Primary research and validation

- 1.5 Some of the primary sources

- 1.6 Data mining sources

- 1.6.1 Secondary

- 1.6.1.1 Paid Sources

- 1.6.1.2 Public Sources

- 1.6.1.3 Sources, by region

- 1.6.1 Secondary

- 1.7 Inclusion & Exclusion

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Data Center

- 2.2.4 Deployment

- 2.2.5 Organization Size

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Component manufacturers

- 3.1.1.2 System integrators & distributors

- 3.1.1.3 Facility operators & service providers

- 3.1.1.4 End use & enterprises

- 3.1.2 Cost structure

- 3.1.3 Profit margin

- 3.1.4 Value addition at each stage

- 3.1.5 Vertical integration trends

- 3.1.6 Disruptors

- 3.1.1 Supplier landscape

- 3.2 Impact on forces

- 3.2.1 Growth drivers

- 3.2.1.1 AI & Hyperscale compute demand

- 3.2.1.2 Cloud migration & continued hyperscaler/edge rollouts

- 3.2.1.3 Modernization for energy efficiency & power resiliency

- 3.2.1.4 Greater focus on sustainability & alternative energy sourcing

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Power & grid constraints

- 3.2.2.2 Supply-chain, cost inflation and skills shortages

- 3.2.3 Market opportunities

- 3.2.3.1 Custom silicon & architecture shift

- 3.2.3.2 Edge densification & distributed footprint

- 3.2.1 Growth drivers

- 3.3 Technology trends & innovation ecosystem

- 3.3.1 Current technologies

- 3.3.1.1 AI-optimized infrastructure

- 3.3.1.2 Liquid cooling technologies

- 3.3.1.3 Rear-door heat exchangers

- 3.3.1.4 Direct-to-chip cooling

- 3.3.2 Emerging technologies

- 3.3.2.1 Silicon photonics & high-speed interconnects

- 3.3.2.2 Quantum computing infrastructure requirements

- 3.3.2.3 Neuromorphic computing infrastructure

- 3.3.2.4 Modular & prefabricated data centers

- 3.3.3 Technology readiness level (TRL) assessment

- 3.3.3.1 TRL framework overview

- 3.3.3.2 Liquid cooling technologies

- 3.3.3.3 AI-specific infrastructure

- 3.3.3.4 Quantum computing infrastructure

- 3.3.1 Current technologies

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 Data sovereignty & localization requirements

- 3.5.2 Environmental & sustainability regulations

- 3.5.3 Building codes & safety standards

- 3.5.4 Regional regulatory comparison

- 3.5.4.1 North America

- 3.5.4.2 Europe

- 3.5.4.3 Asia-Pacific

- 3.5.4.4 Latin America

- 3.5.4.5 Middle East & Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Patent analysis

- 3.9 Cost breakdown analysis

- 3.10 Price trends

- 3.10.1 Hardware component pricing trends

- 3.10.2 Retail vs wholesale pricing

- 3.10.3 Cooling technology cost comparison

- 3.10.4 Total cost of ownership (TCO) model framework

- 3.11 Power & energy infrastructure

- 3.11.1 Renewable energy power purchase agreements

- 3.11.2 Grid capacity constraints by region

- 3.11.3 Power procurement strategy framework

- 3.11.4 Regional power availability assessment

- 3.12 Patent analysis

- 3.12.1 Patent filing trends by technology area

- 3.12.2 Software-defined infrastructure patents

- 3.12.3 Open-source vs proprietary technology analysis

- 3.12.4 Geographic patent distribution

- 3.13 Sustainability and environmental aspects

- 3.13.1 Circular economy & e-waste management

- 3.13.2 Renewable energy investment returns

- 3.13.3 Scope 1, 2, 3 emissions tracking

- 3.13.4 Sustainability reporting standards

- 3.14 Investment & funding analysis

- 3.14.1 Venture capital investment trends

- 3.14.2 Hyperscale capital expenditure trends

- 3.14.3 Colocation provider expansion investment

- 3.14.4 Investment by technology category

- 3.14.5 Sustainability-linked financing

- 3.15 Use case analysis & application scenarios

- 3.15.1 AI training infrastructure use cases

- 3.15.2 Reinforcement of learning infrastructure

- 3.15.3 High-performance computing use cases

- 3.15.4. 5 G edge applications

- 3.15.5 Carbon-neutral data center operations

- 3.16 Customer & End use insights

- 3.16.1 CIO/CTO profile & priorities

- 3.16.2 Customer journey mapping

- 3.16.3 Customer satisfaction & net promoter score

- 3.16.4 Customer pain points & unmet needs

- 3.17 Market adoption & penetration analysis

- 3.17.1 Adoption curve by technology

- 3.17.2 Hyperconverged infrastructure penetration

- 3.17.3 Penetration rate by industry vertical

- 3.17.4 Geographic adoption variance

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia-Pacific

- 4.2.4 Latin America

- 4.2.5 Middle East & Africa

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New product launches

- 4.5.4 Expansion plans and funding

- 4.6 Premium positioning strategies

- 4.7 Strategic OEM partnership opportunities

- 4.8 Competitive analysis and USPs

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Physical infrastructure hardware

- 5.2.2 IT equipment and servers

- 5.2.3 Storage systems and arrays

- 5.2.4 Networking hardware components

- 5.2.5 Power and cooling hardware

- 5.3 Software

- 5.3.1 Infrastructure management software

- 5.3.2 Virtualization and hypervisor software

- 5.3.3 Security and compliance software

- 5.3.4 Monitoring and analytics platforms

- 5.3.5 Automation and orchestration tools

- 5.4 Services

- 5.4.1 Professional services

- 5.4.2 Managed services

Chapter 6 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Cooling

- 6.2.1 Air-based cooling systems

- 6.2.1.1 Computer room air conditioning (CRAC)

- 6.2.1.2 Computer room air handling (CRAH)

- 6.2.1.3 In-row cooling units

- 6.2.1.4 Overhead cooling systems

- 6.2.2 Liquid cooling solutions

- 6.2.2.1 Direct-to-chip cooling

- 6.2.2.2 Immersion cooling systems

- 6.2.2.3 Rear door heat exchangers

- 6.2.2.4 Liquid distribution units

- 6.2.3 Hybrid cooling architectures

- 6.2.4 Cooling accessories and components

- 6.2.1 Air-based cooling systems

- 6.3 Power

- 6.3.1 UPS

- 6.3.2 Power Distribution Units (PDUs)

- 6.3.3 Generators and backup power

- 6.3.4 Power monitoring and management system

- 6.4 IT racks & enclosures

- 6.4.1 Server racks and cabinets

- 6.4.2 Network equipment enclosures

- 6.4.3 Blade server chassis

- 6.5 LV/MV distribution

- 6.5.1 Switchgear and distribution panels

- 6.5.2 Transformers and power conditioning

- 6.5.3 Busway system

- 6.5.4 Electrical protection devices

- 6.6 Networking equipment

- 6.6.1 Ethernet switches

- 6.6.2 InfiniBand switches

- 6.6.3 Routers and gateways

- 6.6.4 Load balancers and ADCs

- 6.7 DCIM

Chapter 7 Market Estimates & Forecast, By Data Center, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Enterprise data centers

- 7.3 colocation data centers

- 7.4 hyperscale data centers

- 7.5 edge data centers

Chapter 8 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Cloud

- 8.3 Hybrid

- 8.4 On-premises

Chapter 9 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Large Enterprise

- 9.3 SME

Chapter 10 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 BFSI

- 10.3 Colocation

- 10.4 Energy

- 10.5 Government

- 10.6 Healthcare

- 10.7 Manufacturing

- 10.8 IT & telecom

- 10.9 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 11.1 North America

- 11.1.1 US

- 11.1.2 Canada

- 11.2 Europe

- 11.2.1 UK

- 11.2.2 Germany

- 11.2.3 France

- 11.2.4 Italy

- 11.2.5 Spain

- 11.2.6 Belgium

- 11.2.7 Netherlands

- 11.2.8 Sweden

- 11.2.9 Russia

- 11.3 Asia Pacific

- 11.3.1 China

- 11.3.2 India

- 11.3.3 Japan

- 11.3.4 Australia

- 11.3.5 Singapore

- 11.3.6 South Korea

- 11.3.7 Vietnam

- 11.3.8 Indonesia

- 11.4 Latin America

- 11.4.1 Brazil

- 11.4.2 Mexico

- 11.4.3 Argentina

- 11.5 MEA

- 11.5.1 South Africa

- 11.5.2 Saudi Arabia

- 11.5.3 UAE

Chapter 12 Company Profiles

- 12.1 Global players

- 12.1.1 ABB

- 12.1.2 Cisco Systems

- 12.1.3 Dell Technologies

- 12.1.4 Eaton

- 12.1.5 Hewlett Packard Enterprise (HPE)

- 12.1.6 IBM

- 12.1.7 Lenovo

- 12.1.8 NetApp

- 12.1.9 Schneider Electric

- 12.1.10 Vertiv

- 12.2 Regional champions

- 12.2.1 Fujitsu

- 12.2.2 Huawei

- 12.2.3 Inspur

- 12.2.4 Legrand

- 12.2.5 Rittal

- 12.3 Emerging players & innovators

- 12.3.1 AMD

- 12.3.2 Arista Networks

- 12.3.3 Liquidstack

- 12.3.4 Micron

- 12.3.5 Pure Storage

- 12.3.6 Samsung Electronics

- 12.3.7 Seagate Technology

- 12.3.8 Super Micro Computer

- 12.3.9 Western Digital Corporation (WDC)

- 12.3.10 Wiwynn