PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885927

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885927

Electric Household Appliances Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

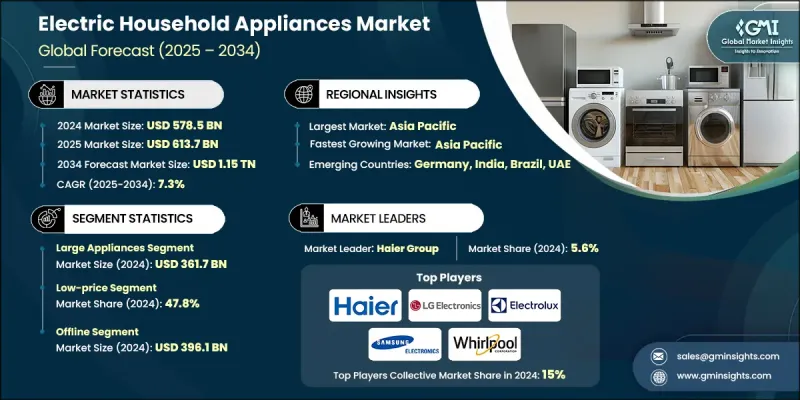

The Global Electric Household Appliances Market was valued at USD 578.5 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 1.15 trillion by 2034.

The industry is undergoing rapid transformation, driven by technological advancements that are reshaping convenience and efficiency in everyday living. Smart appliances featuring IoT connectivity, AI-driven automation, and voice control are integrating seamlessly into smart home ecosystems, enabling remote monitoring, predictive maintenance, and personalized settings. Manufacturers are increasingly prioritizing energy-efficient technologies to meet sustainability goals and comply with environmental regulations, while appealing to eco-conscious consumers. Urbanization is influencing appliance design, with smaller dwellings creating demand for compact, multi-functional devices such as washer-dryer combinations and space-saving kitchen appliances. Dual-income households and busy lifestyles are further boosting the adoption of automated and smart devices that save time and reduce manual effort. Additionally, consumer demand for modern designs, aesthetics, and premium features is shaping innovation, as urban buyers seek appliances that combine style with advanced performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $578.5 Billion |

| Forecast Value | $1.15 Trillion |

| CAGR | 7.3% |

In 2024, the large appliances segment generated USD 361.7 billion. This segment, which includes refrigerators, washing machines, ovens, and air conditioners, dominates due to its essential nature, making them a priority purchase even during economic downturns. Replacement cycles and consumer upgrades toward energy-efficient and smart models continue to drive revenue growth in this segment.

The low-price segment held a 47.8% share in 2024. This segment is primarily driven by highly price-sensitive consumers in emerging markets and rural areas, where affordability takes precedence over advanced features. Products with basic functionality and durability, such as fans, irons, and simple kitchen appliances, are considered household essentials, generating significant sales volumes.

United States Electric Household Appliances Market held a 66.8% share, generating USD 86 billion in 2024. Demand in the U.S. is fueled by the growing popularity of smart and eco-friendly appliances, advancements in IoT and AI-enabled controls, and increasing consumer focus on sustainability and energy efficiency. Lifestyle changes, such as increased home renovations and more time spent at home, are also boosting the consumption of premium appliances.

Key players in the Global Electric Household Appliances Market include Hitachi, Electrolux, LG Electronics, Midea Group, Walton Group, Samsung Electronics, Bosch, Panasonic, Sharp, Gree Electric Appliances, Whirlpool, BSH Hausgerate, Haier Group, Siemens, and Miele. Companies in the Electric Household Appliances Market are employing several strategies to strengthen their presence and expand market share. They are investing heavily in research and development to enhance energy efficiency, smart features, and AI integration. Strategic partnerships, mergers, and acquisitions help broaden distribution networks and penetrate emerging markets. Product portfolio diversification, focusing on multi-functional and space-saving appliances, caters to urban consumers. Firms emphasize sustainable manufacturing practices, eco-friendly certifications, and compliance with global energy standards to appeal to environmentally conscious buyers.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Price

- 2.2.4 End use

- 2.2.5 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancements

- 3.2.1.2 Urbanization & changing lifestyles

- 3.2.1.3 Rising disposable income

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial costs

- 3.2.2.2 Regulatory complexity

- 3.2.3 Opportunities

- 3.2.3.1 Smart & connected appliances

- 3.2.3.2 Energy-efficient & sustainable solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East and Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Million units)

- 5.1 Key trends

- 5.2 Large appliances

- 5.2.1 Refrigerators

- 5.2.2 Cooking appliances

- 5.2.3 Laundry appliances

- 5.2.4 Cleaning appliances

- 5.2.5 Climate control appliances

- 5.3 Small appliances

- 5.3.1 Toasters

- 5.3.2 Coffee makers

- 5.3.3 Blenders & mixers

- 5.3.4 Irons

- 5.3.5 Hair dryers

- 5.3.6 Water filters

- 5.3.7 Others (electric kettles, steamers, etc.)

Chapter 6 Market Estimates and Forecast, By Price, 2021 - 2034 (USD Billion) (Million units)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Million units)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Million units)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 E-commerce

- 8.2.2 Company website

- 8.3 Offline

- 8.3.1 Mega retail stores

- 8.3.2 Supermarket/hypermarket stores

- 8.3.3 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Million units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 BSH Hausgerate

- 10.2 Electrolux

- 10.3 Gree Electric Appliances

- 10.4 Haier Group

- 10.5 Hitachi

- 10.6 LG Electronics

- 10.7 Midea Group

- 10.8 Miele

- 10.9 Panasonic

- 10.10 Robert Bosch

- 10.11 Samsung Electronics

- 10.12 Sharp

- 10.13 Siemens

- 10.14 Walton Group

- 10.15 Whirlpool