PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892655

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892655

North America Grinding Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

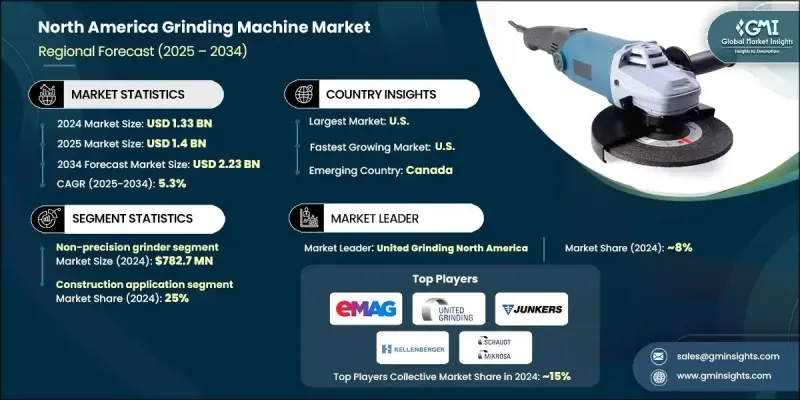

North America Grinding Machine Market was valued at USD 1.33 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 2.23 billion by 2034.

The market growth is driven by the rising demand for high-precision components and advanced manufacturing solutions across industries such as automotive, aerospace, medical devices, and semiconductors. Modern production increasingly relies on sub-micron accuracy and superior surface finishes, which older legacy systems cannot achieve. Manufacturers are shifting toward CNC-based grinding platforms that offer precision, speed, and consistency. Industry 4.0 technologies, including smart grinding solutions, IoT-enabled sensors, real-time monitoring, predictive maintenance, AI-driven processes, adaptive grinding algorithms, and digital twins, are being widely adopted. These innovations enhance operational efficiency, reduce downtime, and enable faster, more consistent production while minimizing costs, positioning North America at the forefront of precision manufacturing technology.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.33 Billion |

| Forecast Value | $2.23 Billion |

| CAGR | 5.3% |

The non-precision grinders segment generated USD 782.7 million in 2024 and is expected to grow at a CAGR of 5.5% from 2025 to 2034. These machines are widely used in construction, metal fabrication, and general automotive component production for tasks such as surface finishing, deburring, and material removal. Their lower cost compared to precision grinders makes them appealing to small and mid-sized manufacturers seeking to balance performance and operational efficiency.

The construction segment held a 25% share and is forecast to grow at a CAGR of 5.8% through 2034. Grinding machines are essential for preparing metal structures, finishing concrete surfaces, and fabricating steel components for bridges, buildings, and transportation infrastructure. Federal investments in infrastructure modernization, including programs like the Infrastructure Investment and Jobs Act, have driven the demand for durable, high-capacity grinding solutions capable of handling large-scale projects efficiently.

U.S. Grinding Machine Market generated USD 1.16 billion in 2024 and is expected to grow at a CAGR of 5.4% from 2025 to 2034. Reshoring initiatives, supported by federal programs such as the CHIPS Act and infrastructure development incentives, are driving capital investment in advanced grinding machines. U.S. manufacturers are leading the integration of Industry 4.0 technologies, including predictive maintenance, IoT-enabled monitoring, and AI-driven process optimization, which enhances productivity, reduces operational downtime, and ensures high-quality output.

Major players operating in the North America Grinding Machine Market include Amada Machine Tools, Danobat, Doimak, EMAG, Gleason, Haas Automation, JTEKT Machinery Americas, Junker, Kellenberger, Makino Milling Machine, Okamoto, Schaudt Mikrosa, Studer, Toyoda Machinery USA Corporation, and United Grinding North America. Companies in the North America Grinding Machine Market are focusing on strategies such as expanding production capacity, adopting advanced CNC and automated grinding technologies, and enhancing R&D efforts to improve precision and efficiency. Strategic collaborations and partnerships with end-user industries are being used to strengthen market penetration. Firms are also investing in digital solutions, including AI, predictive maintenance, and IoT integration, to optimize operations and reduce downtime.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Type

- 2.2.3 Application

- 2.2.4 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Precision & advanced manufacturing demand

- 3.2.1.2 Automation & industry 4.0 integration

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High capital investment & ROI uncertainty

- 3.2.2.2 Workforce & automation integration challenges

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034, (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Non-precision grinder

- 5.2.1 Bench grinder

- 5.2.2 Portable grinder

- 5.2.3 Pedestal grinder

- 5.2.4 Flexible grinder

- 5.3 Precision grinder

- 5.3.1 Cylindrical grinding machines

- 5.3.2 Surface grinding machines

- 5.3.3 Centre-less grinding machines

- 5.3.4 Tool and cutter grinding machines

- 5.3.5 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Automotive

- 6.3 Aerospace

- 6.4 Medical

- 6.5 Construction

- 6.6 Industrial manufacturing

- 6.7 Electrical and electronics

- 6.8 Marine industry

- 6.9 Other

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Direct sales

- 7.3 Indirect sales

Chapter 8 Market Estimates & Forecast, By Country, 2021 - 2034, (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 U.S.

- 8.3 Canada

Chapter 9 Company Profiles

- 9.1 Amada Machine Tools

- 9.2 Danobat

- 9.3 Doimak

- 9.4 EMAG

- 9.5 Gleason

- 9.6 Haas Automation

- 9.7 JTEKT Machinery Americas

- 9.8 Junker

- 9.9 Kellenberger

- 9.10 Makino Milling Machine

- 9.11 Okamoto

- 9.12 Schaudt Mikrosa

- 9.13 Studer

- 9.14 Toyoda Machinery USA Corporation

- 9.15 United Grinding North America