PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892658

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892658

Asia Pacific Copper Tube Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

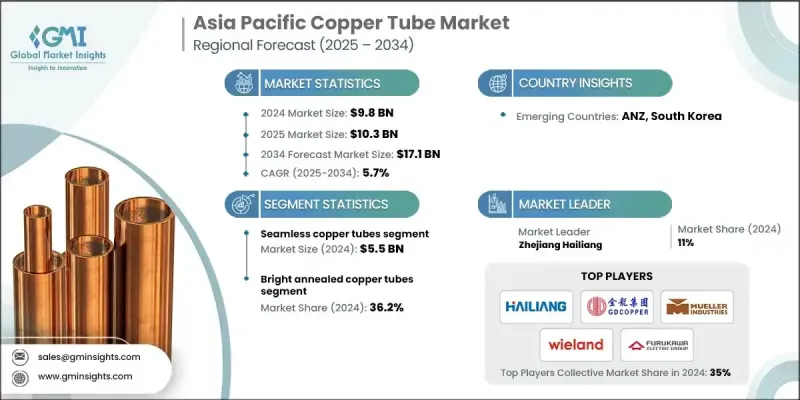

Asia Pacific Copper Tube Market was valued at USD 9.8 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 17.1 billion by 2034.

The region is witnessing rapid urbanization, expansion of megacities, and the development of smart cities across China, India, and Southeast Asia, which is driving demand for durable and reliable materials for plumbing, water distribution, and HVAC systems. Copper tubes are highly preferred due to their corrosion resistance, recyclability, and long service life, making them suitable for both premium and mid-tier construction projects. Government-backed housing initiatives and infrastructure development are also fueling the need for sustainable materials that comply with modern safety and building standards. Rising urban populations and increasingly complex utility networks, such as central water and district cooling systems, further reinforce the reliance on copper tubes. As infrastructure grows more advanced, demand for copper tubing across residential, commercial, and public projects continues to rise, positioning the Asia Pacific market as a key growth hub for the global copper industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.8 Billion |

| Forecast Value | $17.1 Billion |

| CAGR | 5.7% |

The seamless copper tubes generated USD 5.5 billion in 2024. These tubes offer superior strength and reliability compared to welded tubes because they are manufactured without joints or seams, allowing them to withstand extreme pressure and high temperatures while minimizing the risk of leaks and failures. Their durability makes them suitable for demanding applications across construction, industrial, and utility projects.

The bright annealed copper tubes segment held a 36.2% share in 2024. These tubes are produced through a controlled annealing process in a protected atmosphere, yielding polished, smooth, and oxide-free surfaces. This finish enhances both aesthetics and hygiene, making bright annealed tubes suitable for applications requiring visual appeal and cleanliness, such as exposed plumbing, luxury interiors, and medical installations.

China Copper Tube Market generated USD 3.4 billion in 2024. Strong manufacturing capabilities, availability of raw materials, and advanced production technologies allow China to lead in both production and consumption of copper tubes in the region. Chinese manufacturers are investing in automation and state-of-the-art technology to consistently produce high-quality, seamless, and bright annealed tubes at competitive prices, supporting sustained growth and meeting rising demand across electrical, HVAC, plumbing, and refrigeration sectors.

Major players operating in the Asia Pacific Copper Tube Market include Furukawa Electric, Golden Dragon Precise Copper Tube Group, KMCT, Luvata, Mehta Tubes, MetTube Berhad, Mitsubishi Materials, Mueller Industries, Ningbo Jintian Copper, Poongsan, Qingdao Hongtai Copper Tube, Shanghai Metal, Steel Tubes, Wieland Group, and Zhejiang Hailiang. Companies in the Asia Pacific Copper Tube Market are pursuing strategies such as expanding production capacity, investing in automated and high-precision manufacturing technologies, and improving quality control to strengthen market presence. Strategic partnerships with construction and industrial players help secure long-term supply contracts. Firms are also focusing on sustainability initiatives, including recycling programs and energy-efficient production methods, to meet growing environmental regulations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Countries

- 2.2.2 Product type

- 2.2.3 Finish type

- 2.2.4 Price

- 2.2.5 Application

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Urbanization & infrastructure expansion

- 3.2.1.2 HVAC & refrigeration expansion

- 3.2.1.3 Energy-efficient building codes

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 Volatile copper prices

- 3.2.2.2 Competition from substitutes

- 3.2.3 Opportunities

- 3.2.3.1 Smart cities & district cooling projects

- 3.2.3.2 Premium & sustainable solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By countries

- 3.6.2 By product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Seamless copper tubes

- 5.3 Welded copper tubes

- 5.4 Capillary tubes

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Finish Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Bright annealed copper tubes

- 6.3 Dark annealed copper tubes

- 6.4 Lacquered copper tubes

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Price, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Low

- 7.3 Medium

- 7.4 High

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Plumbing

- 8.3 HVAC

- 8.4 Industrial

- 8.5 Electrical

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates and Forecast, By Countries, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 China

- 10.3 India

- 10.4 Japan

- 10.5 South Korea

- 10.6 ANZ

- 10.7 SEA

- 10.8 Rest of APAC

Chapter 11 Company Profiles

- 11.1 Furukawa Electric

- 11.2 Golden Dragon Precise Copper Tube Group

- 11.3 KMCT

- 11.4 Luvata

- 11.5 Mehta Tubes

- 11.6 MetTube Berhad

- 11.7 Mitsubishi Materials

- 11.8 Mueller Industries

- 11.9 Ningbo Jintian Copper

- 11.10 Poongsan

- 11.11 Qingdao Hongtai Copper Tube

- 11.12 Shanghai Metal

- 11.13 Steel Tubes

- 11.14 Wieland Group

- 11.15 Zhejiang Hailiang