PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892659

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892659

Nordic Professional Cleaning Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

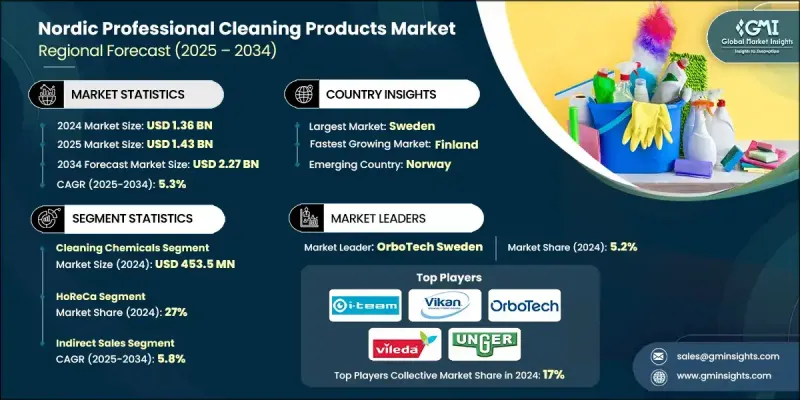

Nordic Professional Cleaning Products Market was valued at USD 1.36 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 2.27 billion by 2034.

The growth is fueled by heightened awareness of hygiene standards across the region. Increased demand for professional-grade disinfectants, sanitizers, and specialized cleaning chemicals continues even after pandemic restrictions eased. Ecolabels such as the Nordic Swan and EU Ecolabel have become essential for public tenders and corporate procurement, driving the adoption of environmentally friendly formulations. Sustainability in the Nordic region is culturally embedded, encouraging acceptance of premium pricing for green products and fostering innovations in biodegradable surfactants, plant-based ingredients, and concentrated formulations that minimize packaging and transport emissions. Outsourcing and professionalization of cleaning services further drive growth, as high labor costs encourage organizations to rely on specialized service providers with expertise in product selection, dosing, and staff training. Digitalization and technological innovation are increasingly transforming the market, creating more efficient and sustainable cleaning solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.36 Billion |

| Forecast Value | $2.27 Billion |

| CAGR | 5.3% |

The cleaning chemicals segment accounted for USD 453.5 million in 2024 and is expected to grow at a CAGR of 5.6% during 2025-2034. This segment remains central to the Nordic professional cleaning products market, driven by evolving regulations, sustainability goals, and performance-driven innovations. Microfiber technology has emerged as a key growth driver, with microfiber cloths and mops increasingly replacing traditional cotton and synthetic alternatives in professional settings across the region.

The HoReCa segment held a 27% share in 2024 and is expected to grow at a CAGR of 5.6% from 2025 to 2034. The segment's growth is supported by the resurgence of tourism, as environmentally conscious travel and high visitor numbers drive demand for professional cleaning products in hotels, restaurants, and catering establishments.

Sweden Professional Cleaning Products Market held a 38% share and generated USD 521 million in 2024. The country's large population, diversified economy, and well-established service sector make it the largest market in the region. Swedish buyers are environmentally conscious, sophisticated, and guided by comprehensive regulatory frameworks, sustaining a strong demand for professional cleaning solutions across multiple sectors.

Major players operating in the Nordic Professional Cleaning Products Market include Essity, i-team Global, Karcher, Klippans Bruk, Knack Packaging, Lagafors, Metsa, Nilfisk, OrboTech Sweden, Sofidel Sweden, Trioworld, Unger, Vajda Papir, Vikan, and Vileda. Key strategies adopted by companies in the Nordic professional cleaning products market focus on sustainability, innovation, and digital transformation. Firms are expanding eco-friendly product lines, including biodegradable and plant-based formulations, to meet stringent ecolabel standards. R&D investments enhance product efficiency, concentrate solutions, and reduce environmental impact. Companies are strengthening partnerships with facility management providers and professional service firms to expand market penetration and ensure optimal product usage. Digital tools, IoT-enabled monitoring, and training programs are implemented to enhance operational efficiency and customer experience.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country trends

- 2.2.2 Product type trends

- 2.2.3 Price trends

- 2.2.4 End use trends

- 2.2.5 Distribution channel trends

- 2.3 CXO perspectives: strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product type

- 3.7 Regulatory framework

- 3.7.1 Standards and certifications

- 3.7.2 Environmental regulations

- 3.7.3 Import export regulations

- 3.8 Porter's five forces analysis

- 3.9 PESTEL analysis

- 3.10 Consumer behavior analysis

- 3.10.1 Purchasing patterns

- 3.10.2 Preference analysis

- 3.10.3 Regional variations in consumer behavior

- 3.10.4 Impact of e-commerce on buying decisions

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Billion, Million Units)

- 5.1 Key trends

- 5.2 Paper & tissue products

- 5.2.1 Toilet paper

- 5.2.2 Paper towels (hand towels)

- 5.2.3 Napkins

- 5.2.4 Industrial wipers

- 5.2.5 Industrial Paper

- 5.2.6 Centre feed paper

- 5.2.7 Others (kitchen paper etc.)

- 5.3 Cleaning chemicals

- 5.3.1 Detergents

- 5.3.2 Disinfectants

- 5.3.3 Floor care

- 5.3.4 Specialty cleaners

- 5.3.5 All-purpose cleaner

- 5.3.6 Heavy duty cleaner

- 5.3.7 Window cleaner

- 5.3.8 Machine dish wash

- 5.3.9 Dish soap

- 5.3.10 Others (sanitary cleaner etc.)

- 5.4 Cleaning tools & equipment

- 5.4.1 Mops

- 5.4.2 Cloths

- 5.4.3 Cleaning trolleys

- 5.4.4 Brushes

- 5.4.5 Scrapers

- 5.4.6 Sponges

- 5.4.7 Others (window clean equipment etc.)

- 5.5 Cleaning machines

- 5.5.1 Polishing machine

- 5.5.2 Vacuum cleaners

- 5.5.3 Floor machines

- 5.5.4 Others (carpet cleaner etc.)

- 5.6 Dispensing systems

- 5.6.1 Soap dispensers

- 5.6.2 Paper dispensers

- 5.6.3 Others (sanitizer stations etc.)

- 5.7 Waste management solutions

- 5.7.1 Bags

- 5.7.2 Sacks

- 5.7.3 Others (containers etc.)

- 5.8 Others (hygiene etc.)

Chapter 6 Market Estimates & Forecast, By Price, 2021 - 2034 ($Billion, Million Units)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Billion, Million Units)

- 7.1 Key trends

- 7.2 HoReCa

- 7.3 Manufacturing industry

- 7.4 Food industry

- 7.5 Transport/logistics

- 7.6 Healthcare & medical facilities

- 7.7 Others (educational institutions etc.)

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Billion, Million Units)

- 8.1 Key trends

- 8.2 Direct sales

- 8.3 Indirect sales

Chapter 9 Market Estimates & Forecast, By Country, 2021 - 2034 ($Billion, Million Units)

- 9.1 Key trends

- 9.2 Sweden

- 9.3 Norway

- 9.4 Denmark

- 9.5 Iceland

- 9.6 Finland

Chapter 10 Company Profiles

- 10.1 Essity

- 10.2 i-team Global

- 10.3 Karcher

- 10.4 Klippans Bruk

- 10.5 Knack Packaging

- 10.6 Lagafors

- 10.7 Metsa

- 10.8 Nilfisk

- 10.9 OrboTech Sweden

- 10.10 Sofidel Sweden

- 10.11 Trioworld

- 10.12 Unger

- 10.13 Vajda Papir

- 10.14 Vikan

- 10.15 Vileda