PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892664

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892664

Lithium Metal Battery Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

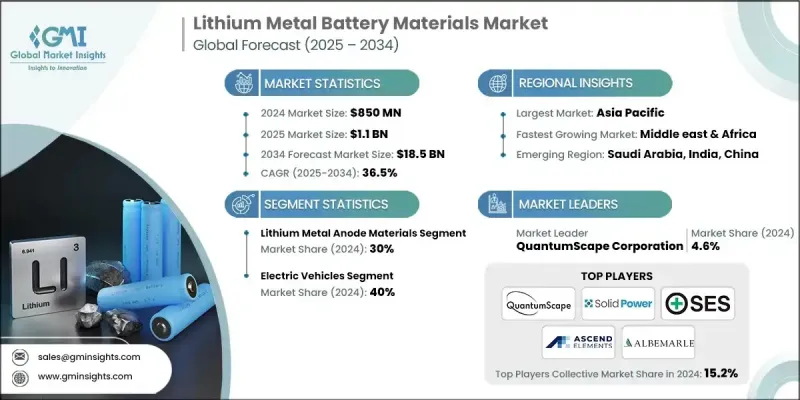

The Global Lithium Metal Battery Materials Market was valued at USD 850 million in 2024 and is estimated to grow at a CAGR of 36.5% to reach USD 18.5 billion by 2034.

The rapid growth of electric vehicles worldwide is fueling demand for advanced battery materials that offer higher energy densities, longer driving ranges, and faster charging capabilities. Adoption of renewable energy and energy storage solutions is further increasing the need for efficient, high-performance battery materials. Environmental awareness, coupled with rising expectations for faster charging and higher-capacity batteries across industries, is accelerating the shift toward lithium-based solutions. Massive investments in solid-state lithium metal battery (SS-LMB) technologies are transforming the market, as automakers and battery manufacturers are dedicating billions to R&D. SS-LMBs address safety and durability issues associated with conventional lithium-ion batteries, offering theoretical energy densities above 500 Wh/kg compared to ~350 Wh/kg for liquid-electrolyte cells. Advances in lithium-metal anode production, particularly through thermal evaporation, are driving down costs and enabling large-scale commercial adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $850 Million |

| Forecast Value | $18.5 Billion |

| CAGR | 36.5% |

The solid-state electrolytes segment held a 25% share in 2024. These materials are central to next-generation lithium metal batteries, providing enhanced stability, higher energy density, and improved safety over traditional liquid electrolytes. Their superior properties make them ideal for advanced applications in energy storage and electric mobility.

The electric vehicle segment held a 40% share in 2024. Growing consumer demand for extended driving range, rapid charging, enhanced safety, and long cycle life is driving the adoption of lithium metal battery materials. EV manufacturers increasingly prefer lithium-based solutions to meet these performance standards and regulatory requirements.

North America Lithium Metal Battery Materials Market held a 25% share in 2024. Policy initiatives, including the Inflation Reduction Act, provide substantial incentives for domestic battery manufacturing and EV adoption, while private sector investments in lithium battery production have surged. Battery manufacturing capacity in the U.S. reached nearly 70 GWh in 2023, growing rapidly from negligible production a few years earlier.

Key players in the Global Lithium Metal Battery Materials Market include Albemarle, Cuberg, QuantumScape Corporation, SES AI Corporation, Ascend Elements, Group14 Technologies, Saft, Solid Power, and Pure Lithium Corporation. Companies in the Lithium Metal Battery Materials Market are strengthening their positions through aggressive investment in research and development to enhance energy density, safety, and production efficiency. Strategic partnerships with automakers, technology developers, and supply chain partners are helping to accelerate the commercialization of solid-state batteries. Firms are also expanding production facilities in regions with strong policy support, ensuring proximity to key customers and reducing logistics costs. Intellectual property acquisition, joint ventures, and licensing agreements are employed to secure access to critical materials and technologies. In addition, many companies are emphasizing sustainable practices and recycling initiatives to appeal to environmentally conscious stakeholders while highlighting the superior performance and rapid charging capabilities of their lithium metal battery solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Material

- 2.2.2 Application

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Material, 2021-2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Lithium metal anode materials

- 5.2.1 Pure lithium metal foils

- 5.2.2 Lithium alloy anodes

- 5.2.3 Composite lithium anodes

- 5.3 Solid-state electrolyte materials

- 5.3.1 Sulfide-based electrolytes

- 5.3.2 Oxide/garnet electrolytes

- 5.3.3 Polymer electrolytes

- 5.3.4 Halide-based electrolytes

- 5.4 Liquid electrolyte materials

- 5.4.1 Advanced liquid electrolytes

- 5.4.2 Electrolyte additives

- 5.5 Protective coatings & artificial SEI materials

- 5.6 Separator materials

- 5.7 Others

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Electric vehicles

- 6.2.1 Battery electric vehicles (BEV)

- 6.2.2 Plug-in hybrid electric vehicles (PHEV)

- 6.3 Aerospace & aviation

- 6.3.1 Commercial aircraft systems

- 6.3.2 Drones & UAVs

- 6.3.3 Space applications

- 6.4 Consumer electronics

- 6.5 Grid & stationary energy storage

- 6.6 Medical devices

- 6.7 Marine & maritime

- 6.8 Others

Chapter 7 Market Size and Forecast, By Region, 2021-2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.4.6 Rest of Asia Pacific

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Rest of Latin America

- 7.6 Middle East & Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

- 7.6.4 Rest of Middle East & Africa

Chapter 8 Company Profiles

- 8.1 QuantumScape Corporation

- 8.2 Solid Power, Inc.

- 8.3 SES AI Corporation

- 8.4 Ascend Elements

- 8.5 Saft

- 8.6 Albemarle

- 8.7 Pure Lithium Corporation

- 8.8 Cuberg

- 8.9 Group14 Technologies