PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892669

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892669

Whey Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

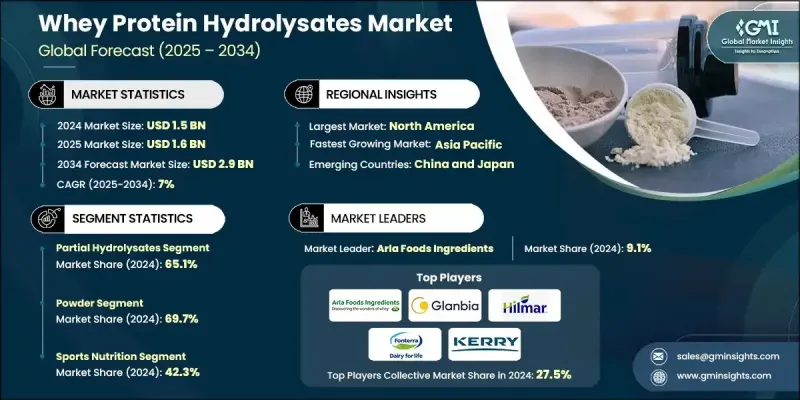

The Global Whey Protein Hydrolysates Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 7% to reach USD 2.9 billion by 2034.

Demand continues to expand as consumers shift toward protein ingredients that offer rapid absorption, high digestibility, and reduced allergenic potential. Whey protein hydrolysates are produced through controlled enzymatic hydrolysis of whey protein concentrate or isolate, breaking down the proteins into smaller peptides and free amino acids that deliver improved physiological benefits. Their adoption has accelerated across infant formulas, sports nutrition, medical nutrition, and functional food applications. Growing global awareness of lactose intolerance, which affects a large portion of the adult population, further supports the shift toward hydrolyzed dairy proteins. This segment of the protein ingredients industry relies on specialized processing systems and strict quality criteria, as manufacturers design highly consistent peptide compositions and molecular weight profiles tailored to specific performance needs. Hydrolysis levels typically range from mild to extensive, depending on intended characteristics such as solubility, heat tolerance, emulsification behavior, and overall bioavailability. Advancements in processing methods and rising consumer interest in high-performance nutritional ingredients continue to shape the evolution of the market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $2.9 Billion |

| CAGR | 7% |

The partial hydrolysates segment held 65.1% share in 2024 and is projected to grow at a CAGR of 6.9% through 2034. These ingredients maintain a balanced structure, offering improved digestibility and reduced allergenicity while preserving desirable functional traits that support widespread use in food and beverage formulations. Their lower bitterness compared to extensively hydrolyzed products increases formulation flexibility and reduces the need for added flavor solutions.

The sports nutrition segment accounted for a 42.3% share in 2024 and is anticipated to grow at a CAGR of 7.3% through 2034. Hydrolyzed whey proteins are widely preferred in this category due to their faster uptake rate, strong impact on muscle protein synthesis, and role in post-exercise recovery. High consumer recognition of protein quality and established sales channels across retail and e-commerce contribute to sustained segment momentum.

North America Whey Protein Hydrolysates Market held a 36.9% share in 2024, supported by a well-developed nutrition industry, strong processing capabilities, and high adoption of premium protein ingredients.

Major companies active in the Whey Protein Hydrolysates Market include Arla Foods Ingredients, Glanbia Nutritionals, Kerry Group, Hilmar Ingredients, Saputo Dairy Ingredients, Fonterra Co-operative Group, FrieslandCampina Ingredients, Nestle Health Science, Agropur Ingredients, Ingredia, Lactalis Ingredients, and Carbery Group. Companies competing in the Whey Protein Hydrolysates Market are prioritizing advanced enzymatic technologies to create differentiated peptide profiles with enhanced functional and nutritional performance. Many manufacturers are scaling production capacity and upgrading process controls to maintain consistent hydrolysis levels and meet rising demand from sports, infant, and clinical nutrition sectors. Strategic product diversification, including formulations with improved sensory characteristics, supports broader commercial adoption. Firms are also strengthening long-term partnerships with food, beverage, and supplement brands to secure stable supply channels.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Form

- 2.2.3 Degree of hydrolysis

- 2.2.4 Application

- 2.2.5 Distribution Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing sports nutrition market & protein supplementation

- 3.2.1.2 Increasing clinical nutrition demand

- 3.2.1.3 Consumer preference for clean label & functional ingredients

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs & price sensitivity

- 3.2.2.2 Bitterness & sensory challenges limiting consumer acceptance

- 3.2.3 Market opportunities

- 3.2.3.1 Bioactive peptide-enriched hydrolysates for cardiovascular health

- 3.2.3.2 MFGM-enriched hydrolysates for cognitive & muscle health

- 3.2.3.3 Hybrid dairy-plant protein hydrolysate blends

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By form

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Degree of Hydrolysis, 2021-2034 (USD Billion & Tons)

- 5.1 Key trends

- 5.2 Partial hydrolysates

- 5.3 Highly hydrolyzed

Chapter 6 Market Estimates and Forecast, By Form, 2021-2034 (USD Billion & Tons)

- 6.1 Key trends

- 6.2 Powder

- 6.3 Liquid

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion & Tons)

- 7.1 Key trends

- 7.2 Infant nutrition

- 7.3 Sports nutrition

- 7.3.1 Protein Powders

- 7.3.2 Ready to drink shakes

- 7.4 Clinical nutrition

- 7.5 Functional foods & beverages

- 7.5.1 High-Protein Beverages

- 7.5.2 Bakery & Confectionery

- 7.5.3 Dairy Products

- 7.5.4 Ready-to-Mix Powders

- 7.6 Animal nutrition

- 7.6.1 Livestock

- 7.6.2 Pet food

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021-2034 (USD Billion & Tons)

- 8.1 Key trends

- 8.2 Retail channels

- 8.2.1 Supermarkets and hypermarkets

- 8.2.2 Specialty kosher stores

- 8.2.3 Convenience stores

- 8.3 Online and E-commerce

- 8.3.1 Direct-to-consumer sales

- 8.3.2 Brand website sales

- 8.3.3 Subscription services

- 8.3.4 E-commerce platforms

- 8.4 Foodservice channels

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion & Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Arla Foods Ingredients

- 10.2 Glanbia Nutritionals

- 10.3 Hilmar Ingredients

- 10.4 Fonterra Co-operative Group

- 10.5 Kerry Group

- 10.6 FrieslandCampina Ingredients

- 10.7 Nestle Health Science

- 10.8 Carbery Group

- 10.9 Agropur Ingredients

- 10.10 Lactalis Ingredients

- 10.11 Saputo Dairy Ingredients

- 10.12 Ingredia