PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892670

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892670

Asia-Pacific Milling Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

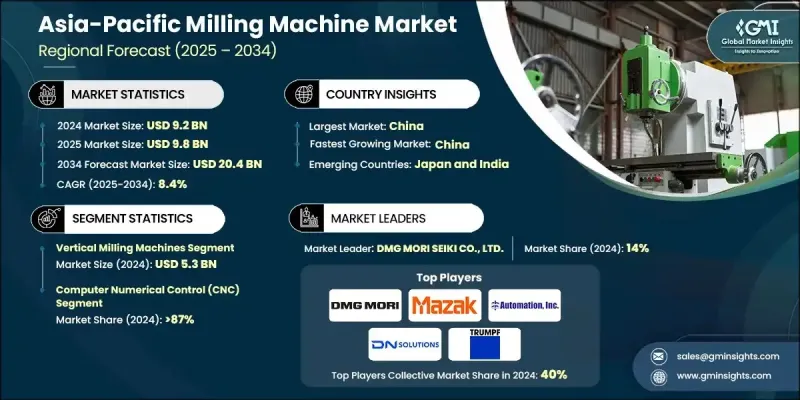

Asia-Pacific Milling Machine Market was valued at USD 9.2 billion in 2024 and is estimated to grow at a CAGR of 8.4% to reach USD 20.4 billion by 2034.

The region is witnessing strong progress as industries adopt advanced, user-friendly technologies that require minimal operator expertise, supporting broader transitions to low-carbon construction and sustainability-focused manufacturing. Regulatory requirements tied to environmental compliance continue to shape the market, particularly as global standards influence production expectations across the region. Ongoing industrialization, paired with rapid advances in automation and smart manufacturing, is accelerating demand for next-generation milling equipment. Integration of robotics, IoT connectivity, and AI-driven monitoring tools is elevating operational precision, reducing manual involvement, and improving overall production efficiency. Rising competition among global brands and regional manufacturers is motivating companies to innovate and tailor their offerings to evolving customer needs. With diverse industries from automotive to electronics boosting equipment investment, the Asia-Pacific market is undergoing a major shift toward digitalized, high-performance machining solutions that support faster output, cost optimization, and flexible manufacturing workflows.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.2 Billion |

| Forecast Value | $20.4 Billion |

| CAGR | 8.4% |

The vertical milling machines segment generated USD 5.3 billion in 2024. Their popularity stems from their compact design, wide operational range, and cost efficiency. These systems deliver accurate cutting and drilling capabilities while helping facilities maximize workspace, making them suitable for both small-scale and large industrial environments.

The computer numerical control (CNC) segment held an 87% share in 2024. CNC systems maintain their lead due to their precision, reliability, and ability to produce intricate components that require stringent accuracy. Automation significantly reduces human error and supports continuous, high-volume production cycles.

China Milling Machine Market held a 36% share in 2024 and is forecast to grow at a 10.3% CAGR through 2034. Its strong manufacturing sector, rising investment in automation, and emphasis on digitally enabled production environments continue to strengthen demand for advanced CNC milling equipment. The country's focus on smart factory development further reinforces the need for efficient and powerful machining technologies.

Major players in the Asia-Pacific Milling Machine Market include DMG MORI SEIKI CO., LTD., Brother Industries Ltd., Shenyang Machine Tool Co., Ltd. (SMTCL), Makino Milling Machine Co., Ltd., Yamazaki Mazak Corporation, Dalian Machine Tool Group Corporation (DMTG), TRUMPF GmbH + Co. KG, Qinchuan Machine Tool & Tool Group Share Co., Ltd., Jinan First Machine Tool Co., Ltd., United Machining Solutions AG, DN Solutions, Hyundai WIA Corporation, Okuma Corporation, Haas Automation, Inc., and Ace Micromatic Group. Companies operating in the Asia-Pacific milling machine sector are strengthening their market position by accelerating investments in automation, enhancing CNC capabilities, and integrating smart technologies into their product lines. Many manufacturers are focusing on developing high-precision systems with improved energy efficiency to align with sustainability expectations and regulatory standards. Strategic collaborations with industrial automation firms and localized production expansions are helping companies reduce costs and improve service responsiveness. Firms are also prioritizing customization to meet varied sector requirements, from automotive to aerospace.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Type

- 2.2.3 Operating Technology

- 2.2.4 Axis Configuration

- 2.2.5 End Use

- 2.2.6 Distribution Channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid industrialization and infrastructure development

- 3.2.1.2 Government initiatives supporting manufacturing

- 3.2.1.3 Growing adoption of automation and smart manufacturing

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and maintenance costs

- 3.2.2.2 Shortage of skilled workforce

- 3.2.3 Opportunities

- 3.2.3.1 Expansion of aerospace and defense manufacturing

- 3.2.3.2 Growth of e-commerce and indirect sales channels

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By Region

- 3.6.2 By Type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Vertical Milling Machine

- 5.3 Horizontal Milling Machine

Chapter 6 Market Estimates and Forecast, By Operating Technology, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Computer Numerical Control (CNC)

- 6.3 Conventional

Chapter 7 Market Estimates and Forecast, By Axis Configuration, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 2-Axis Milling Machine

- 7.3 3-Axis Milling Machine

- 7.4 4-Axis Milling Machine

- 7.5 5-Axis Milling Machine

- 7.6 Others (6-axis, 7-axis. Etc.)

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Aerospace & Defense

- 8.3 Automotive

- 8.4 Energy & Power

- 8.5 Building & Construction

- 8.6 Others (Healthcare, marine, etc.)

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates and Forecast, By Country, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 China

- 10.3 Japan

- 10.4 India

- 10.5 South Korea

- 10.6 Australia

- 10.7 Malaysia

- 10.8 Indonesia

Chapter 11 Company Profiles

- 11.1 DMG MORI SEIKI CO., LTD.

- 11.2 Yamazaki Mazak Corporation

- 11.3 Haas Automation, Inc.

- 11.4 TRUMPF GmbH + Co. KG

- 11.5 Makino Milling Machine Co., Ltd.

- 11.6 United Machining Solutions AG

- 11.7 Dalian Machine Tool Group Corporation (DMTG)

- 11.8 Shenyang Machine Tool Co., Ltd. (SMTCL)

- 11.9 Qinchuan Machine Tool & Tool Group Share Co., Ltd.

- 11.10 Jinan First Machine Tool Co., Ltd.

- 11.11 Okuma Corporation

- 11.12 Brother Industries, Ltd.

- 11.13 DN Solutions

- 11.14 Hyundai WIA Corporation

- 11.15 Ace Micromatic Group