PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892675

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892675

Europe Dental Implants and Abutment Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

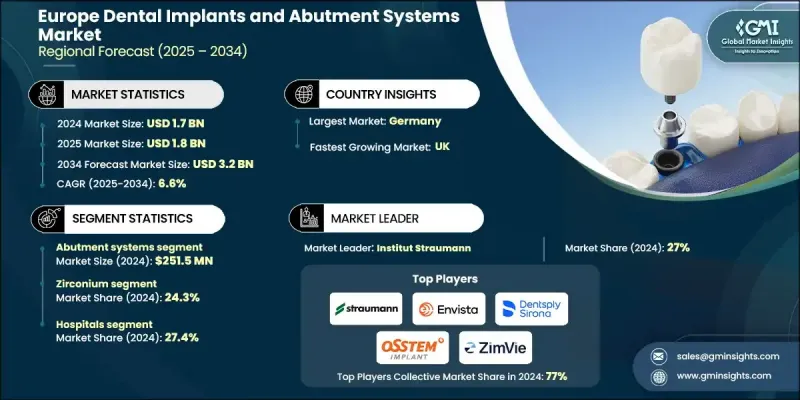

Europe Dental Implants and Abutment Systems Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 3.2 billion by 2034.

The market growth is fueled by increasing awareness and demand for aesthetic dentistry, the rising prevalence of dental disorders, expanding dental insurance coverage, and continuous advancements in implant technologies. Patients today are seeking treatments that restore oral function while also improving their smile and overall appearance, driven by higher disposable incomes. Cosmetic dental procedures, including full-mouth restorations and smile enhancements, are growing in popularity, positioning dental implants as a preferred alternative to traditional dentures. Premium implants and advanced abutment designs are witnessing higher adoption due to their ability to deliver both functional and aesthetic outcomes. Technological innovations, such as digital dentistry and surface modifications that improve osseointegration and reduce healing time, are further driving demand. Overall, the market is experiencing strong growth as clinicians increasingly rely on high-precision, patient-specific solutions to meet evolving cosmetic and restorative needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $3.2 Billion |

| CAGR | 6.6% |

The dental implants segment held a significant share in 2024, as they serve as artificial roots, typically made of titanium or zirconia, surgically placed in the jawbone to support prosthetic teeth such as crowns, bridges, or dentures. Abutments act as connectors between the implant and the prosthesis, ensuring long-term stability and a natural appearance.

The titanium segment garnered notable revenues in 2024 owing to its high biocompatibility, corrosion resistance, mechanical strength, and superior osseointegration, which guarantees durable performance in oral environments. The adoption of digital workflows, including CAD/CAM technologies, is transforming implant procedures by improving precision, reducing chair time, and enabling patient-specific restorations.

Germany Dental Implants and Abutment Systems Market was valued at USD 368 million in 2024 and expected to reach USD 700.3 million by 2034. The country's strong market growth is driven by the high prevalence of dental disorders, robust healthcare infrastructure, and government investments in dental care. The demand for advanced restorative solutions continues to rise, supported by growing awareness of oral health and aesthetic needs.

Key players in the Europe Dental Implants and Abutment Systems Market include ZimVie, BioHorizons, Keystone Dental Group, AVINENT Science and Material, Dentium USA, Dentsply Sirona, Osstem Implant, Envista Holdings Corporation, Cortex, Glidewell, Henry Schein, Institut Straumann, Ziacom, Dynamic Abutment Solutions, and Bicon. Companies in the Europe Dental Implants and Abutment Systems Market focus on continuous innovation in implant design, material science, and surface technologies to enhance osseointegration, aesthetics, and clinical outcomes. Investments in digital dentistry, including CAD/CAM integration and guided surgical solutions, help deliver patient-specific, precise restorations. Strategic partnerships with dental clinics, distributors, and healthcare networks expand market reach and adoption. Companies are also emphasizing training programs and educational initiatives for dentists to improve clinical proficiency and promote advanced procedures.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country trends

- 2.2.2 Product trends

- 2.2.3 Material trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing awareness and demand for aesthetic dentistry

- 3.2.1.2 Growing prevalence of dental disorders

- 3.2.1.3 Expansion of dental insurance coverage

- 3.2.1.4 Advancements in implant technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory compliance challenges

- 3.2.2.2 High cost of dental implant treatment

- 3.2.3 Market opportunities

- 3.2.3.1 Adoption of digital dentistry

- 3.2.3.2 Expansion of dental tourism

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Reimbursement scenario

- 3.8 Pricing analysis, 2024

- 3.9 Future market trends

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Dental implants

- 5.2.1 Tapered implants

- 5.2.2 Parallel-walled implants

- 5.3 Abutment systems

- 5.3.1 Stock abutments

- 5.3.2 Custom abutments

- 5.3.3 Abutments fixation screws

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Titanium

- 6.3 Zirconium

- 6.4 Other materials

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Dental clinics

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Country, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Germany

- 8.3 UK

- 8.4 France

- 8.5 Spain

- 8.6 Italy

- 8.7 Netherlands

Chapter 9 Company Profiles

- 9.1 AVINENT Science and Material

- 9.2 Bicon

- 9.3 BioHorizons

- 9.4 Cortex

- 9.5 Dentium USA

- 9.6 Dentsply Sirona

- 9.7 Dynamic Abutment Solutions

- 9.8 Envista Holdings Corporation

- 9.9 Glidewell

- 9.10 Henry Schein

- 9.11 Institut Straumann

- 9.12 Keystone Dental Group

- 9.13 National Dentex Labs

- 9.14 Osstem Implant

- 9.15 Ziacom

- 9.16 ZimVie