PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892676

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892676

Europe HVAC Drives Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

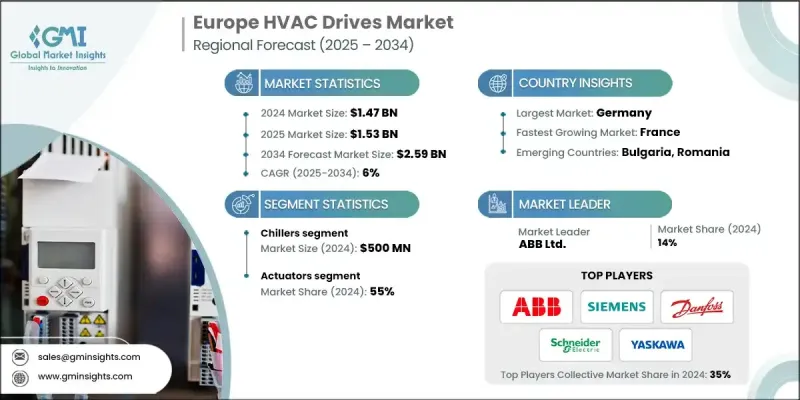

Europe HVAC Drives Market was valued at USD 1.47 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 2.59 billion by 2034.

The region is experiencing strong demand for more intelligent and energy-aware HVAC solutions as both businesses and households turn toward technologies that improve comfort and efficiency. Interest in advanced drives continues to rise as they enable HVAC systems to adjust output based on real-time needs, lowering energy consumption and extending system lifespan. Europe's varied climate conditions and older building infrastructure also influence purchasing behavior, making flexible and efficient HVAC equipment highly desirable. The tightening of environmental regulations and the region's focus on sustainability further encourage the adoption of drives that enhance heating, cooling, and ventilation performance. Product reliability, long-term efficiency, and ease of integration into existing systems are now essential expectations across the market. Manufacturers are aligning with this shift by emphasizing digital enhancements and more adaptable product designs. Smart connectivity, remote diagnostics, and seamless integration with building automation platforms are becoming standard features as end-users look for technology that simplifies management while delivering stronger performance. Customers also want equipment that installs easily and requires minimal specialized knowledge, prompting companies to develop more user-friendly solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.47 Billion |

| Forecast Value | $2.59 Billion |

| CAGR | 6% |

The chillers segment generated USD 500 million in 2024. This segment maintains a significant role in the HVAC drives market due to its importance in cooling-intensive environments across industrial facilities, commercial complexes, and technologically advanced infrastructures. Drives improve chiller operations by supporting variable speeds, reducing energy use, and lowering operating expenses under varying load conditions.

The indirect sales held a significant share in 2024. This model remains dominant thanks to the broad networks of wholesalers, dealers, and resellers that help companies reach diverse customer groups. Indirect channels play a key role in supplying small and medium-sized businesses and regional buyers, while providing local assistance and accessible distribution.

Germany HVAC Drives Market held 22% share in 2024 and is projected to grow at a CAGR of 5.5% from 2025 to 2034. The country's mature industrial landscape and strong commitment to energy efficiency support the expanding demand for high-performance HVAC equipment. Policies that emphasize reduced energy consumption and the adoption of intelligent building technologies reinforce market growth, making Germany the most influential country in the region for HVAC drive deployment.

Key companies in the Europe HVAC Drives Market include Delta Electronics (EMEA), Siemens AG, Invertek Drives Ltd. (UK), ABB Ltd., Yaskawa Europe GmbH, Eaton (Power Quality Division), Fuji Electric Europe GmbH, Danfoss A/S, Schneider Electric SE, Mitsubishi Electric Europe B.V., Ziehl-Abegg SE, Rockwell Automation (Allen-Bradley), Emerson (Control Techniques / Leroy-Somer Drives), WEG Electric Corp., and ebm-papst Group. Companies competing in the Europe HVAC Drives Market are strengthening their market presence through a combination of digital advancement, customer-centric product design, and regional expansion. Many firms are prioritizing the development of smart, connected drives that integrate smoothly with intelligent building ecosystems while enabling predictive maintenance and energy optimization. Strategic collaborations with distributors help enhance reach and ensure faster delivery across fragmented markets. Manufacturers are also tailoring solutions to meet Europe's evolving energy standards, focusing on efficiency certifications and compliance with sustainability regulations.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Country

- 2.2.2 Product Type

- 2.2.3 Power rating

- 2.2.4 Installation

- 2.2.5 End use

- 2.2.6 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Stringent energy efficiency regulations across the EU

- 3.2.1.2 Growing demand for smart and automated HVAC solutions

- 3.2.1.3 Urbanization and increased construction activities

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investment and installation complexity

- 3.2.2.2 Supply chain disruptions and raw material price volatility

- 3.2.3 Opportunities

- 3.2.3.1 Government incentives for heat pump and electrification projects

- 3.2.3.2 Integration with smart building technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By Country

- 3.6.2 By Product type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Chillers (Compressors motor drives)

- 5.3 Air handling units

- 5.4 Pumps

- 5.5 Cooling tower fans

- 5.6 Ventilation fans

Chapter 6 Market Estimates and Forecast, By Power Rating, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 less than 10kW

- 6.3 10-100kW

- 6.4 More than 100kW

Chapter 7 Market Estimates and Forecast, By Installation, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 New construction

- 7.3 Replacement/retrofit

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Commercial buildings

- 8.3 Industrial facilities

- 8.4 Data centre

- 8.5 Institutional buildings

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Market Estimates and Forecast, By Country, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Germany

- 10.2 France

- 10.3 United Kingdom

- 10.4 Italy

- 10.5 Spain

- 10.6 Netherlands

- 10.7 Sweden

- 10.8 Poland

- 10.9 Belgium

- 10.10 Austria

- 10.11 Rest of Europe

Chapter 11 Company Profiles

- 11.1 ABB Ltd.

- 11.2 Danfoss A/S

- 11.3 Delta Electronics (EMEA)

- 11.4 Eaton (Power Quality Division)

- 11.5 ebm-papst Group

- 11.6 Emerson (Control Techniques / Leroy-Somer Drives)

- 11.7 Fuji Electric Europe GmbH

- 11.8 Invertek Drives Ltd. (UK)

- 11.9 Mitsubishi Electric Europe B.V.

- 11.10 Rockwell Automation (Allen-Bradley)

- 11.11 Schneider Electric SE

- 11.12 Siemens AG

- 11.13 WEG Electric Corp.

- 11.14 Yaskawa Europe GmbH

- 11.15 Ziehl-Abegg SE