PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892681

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1892681

Predictive Maintenance for Vehicles Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

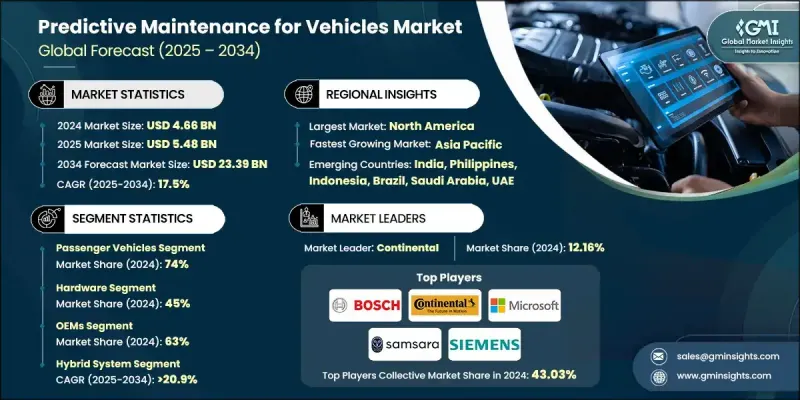

The Global Predictive Maintenance for Vehicles Market was valued at USD 4.66 billion in 2024 and is estimated to grow at a CAGR of 17.5% to reach USD 23.39 billion by 2034.

The rapid digitalization of the automotive and fleet ecosystem is transforming how vehicles are monitored, maintained, and serviced. Predictive maintenance solutions leverage telematics, IoT sensors, onboard diagnostics, AI/ML analytics, and cloud computing to enable real-time vehicle health monitoring, early fault detection, and remaining-useful-life (RUL) predictions for engines, batteries, brakes, tires, and power electronics. As vehicles evolve toward software-defined architectures, data-driven maintenance is replacing traditional reactive and scheduled servicing across commercial fleets, passenger vehicles, and EVs. The COVID-19 pandemic accelerated the adoption of remote diagnostics, over-the-air updates, and digital fleet-health platforms. Supply chain disruptions and the need to maximize uptime and vehicle lifespan further increased demand. AI models analyze telematics, fault codes, vibration, temperature, and historical repair data to forecast failures before they occur, allowing fleet operators and OEMs to reduce downtime, optimize maintenance schedules, and ensure safety.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.66 Billion |

| Forecast Value | $23.39 Billion |

| CAGR | 17.5% |

The passenger vehicle segment held a 74% share in 2024 and is expected to grow at a CAGR of 17% through 2034. This segment leads due to the sheer size of the global passenger vehicle fleet, widespread adoption of connected-car technologies, and growing consumer demand for reliability, safety, and lower maintenance costs. Modern passenger vehicles are increasingly equipped with telematics control units, AI-powered diagnostic tools, and onboard sensors to monitor engine, battery, and braking system health, boosting the adoption of predictive maintenance.

The hardware segment held a 45% share in 2024 and is projected to grow at a CAGR of 16.8% through 2034. Hardware, including sensors, telematics devices, OBD-II gateways, and IoT modules, is essential for collecting real-time data on engine performance, braking systems, battery health, vibration, and temperature. These inputs form the foundation for AI and machine learning models to forecast failures accurately. Both passenger and commercial vehicles rely heavily on robust hardware to ensure continuous monitoring and prevent unplanned downtime.

U.S. Predictive Maintenance for Vehicles Market held 86% share, generating USD 1.46 billion in 2024. The U.S. market benefits from advanced connected-fleet ecosystems, widespread telematics adoption, and AI-driven analytics. Commercial fleets, including logistics, last-mile delivery, ride-hailing, and rental operators, rely heavily on predictive maintenance platforms. Companies investing in cloud analytics, real-time diagnostics, and AI-based maintenance solutions have made predictive maintenance a central operational tool in the transportation industry.

Major players in the Global Predictive Maintenance for Vehicles Market include Bosch, Continental, GE, Geotab, IBM, Microsoft, PTC, Samsara, Siemens, and Trimble. Companies in the Predictive Maintenance for Vehicles Market are expanding their footprint by investing in advanced AI and machine learning models to enhance predictive accuracy for vehicle components. Strategic partnerships with OEMs, fleet operators, and telematics providers help increase solution adoption and long-term service contracts. Cloud integration and real-time analytics platforms are being developed to improve remote diagnostics and over-the-air updates. Firms are also focusing on robust hardware development, including IoT sensors, telematics modules, and OBD-II devices, to ensure reliable data capture in harsh automotive environments.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Technology

- 2.2.4 Component

- 2.2.5 Maintenance

- 2.2.6 Deployment mode

- 2.2.7 End Use

- 2.3 TAM Analysis, 2026-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing vehicle complexity & sensorization

- 3.2.1.2 Regulatory pressure for safety & emissions compliance

- 3.2.1.3 Rising maintenance & repair costs

- 3.2.1.4 Expansion of telematics & 5G connectivity

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High integration costs & legacy fleet limitations

- 3.2.2.2 Restricted access to OEM diagnostic data

- 3.2.3 Market opportunities

- 3.2.3.1 Predictive maintenance for EV batteries

- 3.2.3.2 Fleet-centric AI diagnostic platforms

- 3.2.3.3 Digital twin modeling for vehicle components

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LA

- 3.4.5 MEA

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By component

- 3.10 Cost breakdown analysis

- 3.11 Sustainability and environmental impact analysis

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.12 Carbon footprint considerations

- 3.13 Digital transformation economics & TCO analysis

- 3.13.1 Total cost of ownership (TCO) framework

- 3.13.2 ROI calculation methodologies

- 3.13.3 Digital transformation maturity model

- 3.14 Technology integration & platform interoperability standards

- 3.14.1 Data exchange standards & protocols

- 3.14.2 API & integration frameworks

- 3.14.3 Cloud platform integration

- 3.14.4 Enterprise system integration

- 3.14.5 Interoperability challenges & solutions

- 3.15 Emerging use cases

- 3.15.1 Predictive maintenance for flying vehicles

- 3.15.2 Autonomous vehicle fleet management

- 3.15.3 Shared mobility & micromobility

- 3.15.4 Last-mile delivery robots

- 3.16 Regulatory evolution

- 3.16.1 NHTSA AV step program impact

- 3.16.2 Global harmonization of standards

- 3.16.3 Cybersecurity regulation tightening

- 3.16.4 Data sovereignty requirements

- 3.17 Business model innovation

- 3.17.1 Predictive maintenance-as-a-service

- 3.17.2 Pay-per-use & outcome-based pricing

- 3.17.3 Data monetization strategies

- 3.17.4 Ecosystem platform models

- 3.18 Investment hotspots

- 3.18.1 Ev battery health monitoring

- 3.18.2 Autonomous vehicle sensor diagnostics

- 3.18.3 Off-highway & construction equipment

- 3.18.4 Emerging markets infrastructure

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchbacks

- 5.2.2 Sedans

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light commercial vehicles (LCV)

- 5.3.2 Medium commercial vehicles (MCV)

- 5.3.3 Heavy commercial vehicles (HCV)

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 IoT & telematics

- 6.3 Artificial intelligence (AI)

- 6.4 Machine learning (ML)

- 6.5 Edge computing

- 6.6 Cloud computing

- 6.7 Big data analytics

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Hardware

- 7.3 Software

- 7.4 Services

Chapter 8 Market Estimates & Forecast, By Maintenance, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Condition-based maintenance

- 8.3 Predictive diagnostics

- 8.4 Remote monitoring

- 8.5 Real-time fault detection

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEMs

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Deployment mode, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 On-Premise

- 10.3 Cloud-Based

- 10.4 Hybrid

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 US

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Philippines

- 11.4.7 Indonesia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 OEMs & Tier-1 Suppliers

- 12.1.1 BMW

- 12.1.2 Bosch

- 12.1.3 Continental

- 12.1.4 Mercedes-Benz

- 12.1.5 Volkswagen

- 12.1.6 Volvo

- 12.1.7 ZF Friedrichshafen

- 12.2 Telematics & Technology Leaders

- 12.2.1 Geotab

- 12.2.2 IBM

- 12.2.3 Microsoft

- 12.2.4 PTC

- 12.2.5 Samsara

- 12.2.6 Siemens

- 12.2.7 Solera

- 12.2.8 Thermo King

- 12.2.9 Trimble

- 12.2.10 Verizon Connect

- 12.3 Regional Players

- 12.3.1 Amerit Fleet Solutions

- 12.3.2 Bendix Commercial Vehicle Systems

- 12.3.3 Fleetworthy Solutions

- 12.3.4 PrePass Safety Alliance

- 12.4 Emerging Players

- 12.4.1 Adesso

- 12.4.2 CDK Global

- 12.4.3 Simply Fleet